IAG shares are ticking higher today after receiving a couple of positive recommendations from analysts, despite the firm posting one of the worst annual results in its history.

So far today, the price of IAG shares – owner of British Airways – is climbing 6.2% at 203.9p in early stock trading action in London after Credit Suisse said the company could become “even more competitive” once its pandemic woes are in the rearview mirror.

As a result of this optimistic forecast for the air carrier, the Swiss bank maintained its ‘outperform’ recommendation while setting a 12-month price target of 228p per share for the stock. This represents a 12% potential upside based on today’s price.

The bank further emphasised that the company’s ongoing restructuring effort should result in cost savings for the business and this should translate into higher operating margins in the near future as Europe heads out of the health crisis.

Alongside Credit Suisse, British investment bank Peel Hunt also hiked its recommendation for International Airlines Group (IAG) from ‘hold’ to ‘buy’ today while boosting its price target for the stock to 215p – up from a previous forecast of 145p per share.

Peel Hunt justified its recommendation by stating that leisure booking should continue to recover over the next few quarters as more and more people receive one of the vaccines that the British government has already signed off on.

Are IAG shares heading for a full-blown trend reversal?

Last week, IAG announced that it managed to secure a £2.45 billion cash injection from the combination of a deferred pension contribution and a loan that was partially guaranteed by UK Export Finance in a move that sought to keep strengthening the firm’s cash reserves to survive the virus downturn for as long as it lasts.

The markets reacted positively to the news, since, at this point, it is just a matter of time before the world starts to emerge from the virus crisis, with vaccinations offering a quick way out – possibly by the second half of the year.

That said, IAG cautioned investors that the company does not expect a full-blown recovery in the demand for air travel at least until 2023 – yet those forecasts could just be part of a conservative scenario for the business as virus-related uncertainty persists.

On the other hand, if vaccines were to be a true ‘end-game’ solution for the health emergency, the recovery could end up being way faster than anticipated, especially if pent-up demand exceeds the market’s expectations.

For now, a plausible scenario would be that the worst for airlines stocks is already behind them and things could progressively get better moving forward, with both share prices and underlying fundamentals showing signs of recovering in the following quarters.

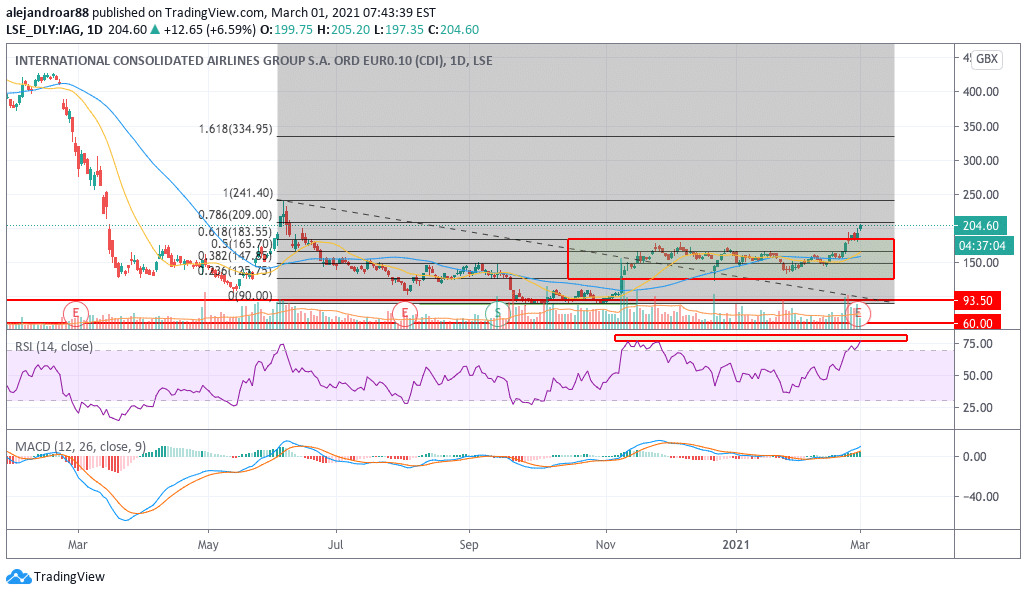

From a technical standpoint, both the RSI and the MACD are showing that the momentum is fairly positive for IAG and this could lead to a strong uptrend in the following weeks, with a first target set at 241.4p per share – the stock’s post-pandemic high.

Further reinforcing this thesis, volumes are ticking higher lately while the stock’s short-term moving averages have just posted a golden cross – a setup that usually results in short-term bullish movements for the stock price.

Question & Answers (0)