IAG shares jumped today after the company announced a £2.45 billion cash injection, coming from a pension contribution deferral and a loan that was partially guaranteed by Britain’s UK Export Finance.

This extra liquidity will help the struggling air carrier in dealing with the prolonged disruption of its business caused by the pandemic, as the United Kingdom and other European countries moved to impose travel restrictions in the past few months after a new, and seemingly more rapidly transmissible, strain of COVID was identified in the region.

The £2.45 billion obtained by British Airways’ holding company includes £450 million from a deferment in monthly pension contributions that were due in October 2020 and September as part of an agreement reached with the Trustee of New Airways Pension Scheme (NAPS) that includes a halt in dividend payments before March 2023 – the date in which IAG will fully pay the outstanding pension debt along with the interests accrued during the two-year period.

Meanwhile, the owner of Iberia also secured a £2 billion 5-year term loan from a syndicate of financial institutions that was partially guaranteed by UK Export Finance (UKEF), with this facility being fully accessible to the firm by the end of February this year.

IAG Group (IAG) shares are jumping 2.4% amid the news at €1.95, potentially eyeing the €2 resistance – a threshold that the stock price has failed to overcome in the past three months.

By the end of the nine months ended on September 2020, IAG had a total of €5 billion in cash including €2.7 billion that were raised through a share offering.

During that period, the company lost €5.5 billion as passenger revenues dropped 71% from €17 billion during such period in 2019 to €4.8 billion last year.

Meanwhile, the firm’s net debt climbed to €11 billion, up €4 billion from 2019’s balance, as the company has been forced to shore up its finances to deal with the fallout caused by the health crisis.

This extra £2.45 billion (€2.8 billion) cash injection could help the company in surviving the remaining months as Europe progressively heads out of the virus situation through en-masse vaccinations.

How have IAG shares performed so far this year?

IAG shares are recovering some lost territory this year as they have advanced roughly 6% since 2021 started after posting one of their worst years in 2020.

Last year, IAG shares plunged by 63% as a result of the pandemic and since Europe has continued to struggle to emerge from the crisis, the situation cannot be considered too promising for air carriers just yet, at least not until vaccines are rolled out among a large percentage of the region’s population.

Today’s uptick is pushing the share price near a multi-month high, with the latest uptrend possibly facing a boom-or-bust moment.

What’s next for IAG shares?

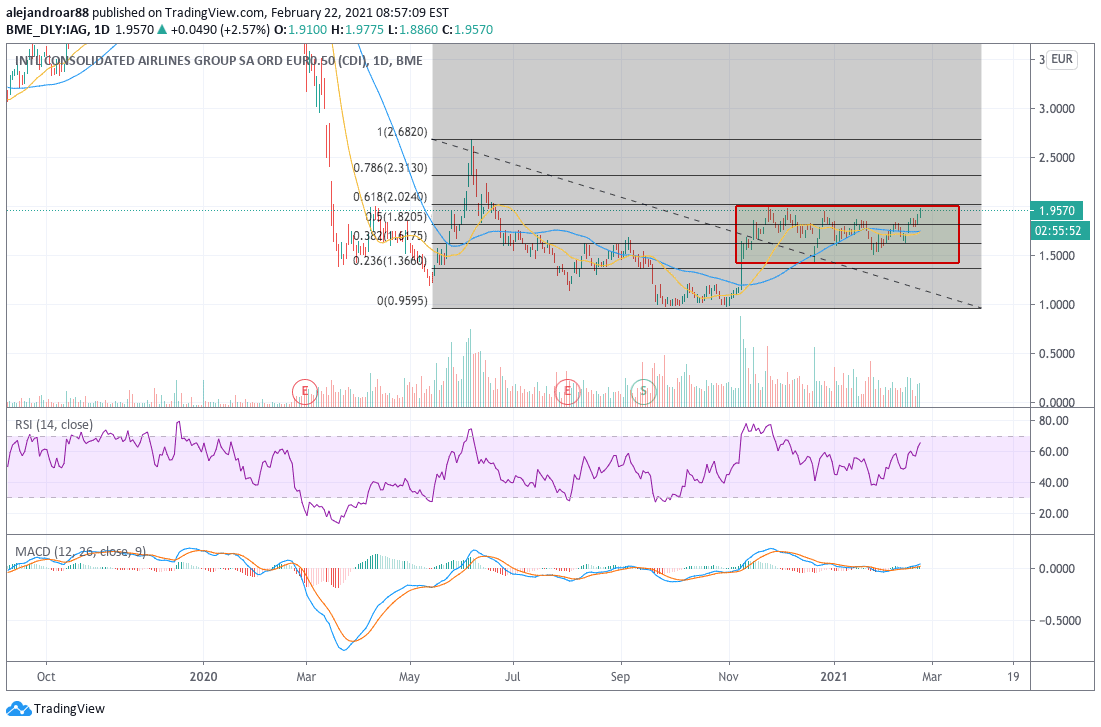

The chart above shows confluence between what seems to be the upper end of a consolidation rectangle and the 0.5 Fibonacci level of the stock’s June retracement, which points to the importance of this threshold if the uptrend were to continue over the coming weeks.

Based on this setup, a move above the €2 level could result in a strong bull run towards the June highs – a view that is reinforced by an uptrend in the RSI (currently at 65) and a buy signal sent by the MACD as the oscillator enters positive momentum territory.

With a first target of €2.7 in mind, there’s a 38.5% potential upside on the table as long as vaccinations keep playing their role in providing a positive backdrop for airline stocks.

That said, it is important to note that IAG stated recently that they do not expect a full-blown recovery to pre-pandemic levels at least until 2023.

Question & Answers (0)