The price of Glencore (GLEN) shares is surging during today’s stock trading activity in London following the release of the firm’s preliminary results for its 2020 fiscal year, with the British mining company moving to resume its dividend payments amid a reduction of its net debt.

The firm reported revenues of $142 billion during the 12 months ended on 31 December, representing a 34% slide compared to its 2019’s sales.

The disruptions caused by the COVID-19 pandemic to the firm’s operations were the main cause for this downtick, while plunging commodity prices – especially oil – during the worst days of the virus crisis contributed to the downturn as well.

Meanwhile, Glencore took a $5.9 billion asset impairment charge resulting from the shutdown of its Mopani copper operations and a Colombian coal mine.

This write-off was the main cause of the firm’s statutory net loss of $1.9 billion for the year, although Glencore managed to generate a total of $2.6 billion in cash from operating activities, while reducing its net debt to $15.8 billion. This reduction in the firm’s indebtedness allowed for the resumption of dividend payments, starting with a $0.12 annual distribution for the 2021 fiscal year.

At the current price of 292p per share, the dividend yield will stand at 3% for Glencore shares, while the total amount to be distributed during 2021 will be approximately $1.6 billion.

Glencore’s CEO and biggest shareholder passes the torch

Glencore’s chief executive and second-largest shareholder, Ivan Glasenberg, will be leaving the helm during the first half of 2021, handing over the crown to successor Gary Nagle, after 18 years serving as the head of the mining company.

Glasenberg, a Glencore veteran who started working for the firm’s South African unit back in 1984, has become the single largest individual shareholder in the company with a 9% stake and an estimated net worth of $5.7 billion.

The soon-to-be-departed CEO gave a pat on the back to Nagle, when he stated that he has “no intention” of selling his shares since he believes that his successor will do a good job over the coming years.

Meanwhile, Nagle reassured investors by stating that the company does not need any kind of restructuring at the moment, while Glencore’s chief financial officer Steven Kalmin said that the firm plans to keep distributing dividends as long as commodity prices stay high.

What’s next for Glencore shares?

Last year, Glencore shares lost roughly 1% as oil prices plunged because of the Covid pandemic health emergency.

This milder loss, compared to a 14% plunge in the FTSE 100, was aided by higher copper prices, as the price of the commodity advanced as much as 25% during 2020.

Meanwhile, oil’s strong recovery this year on the back of vaccine rollouts and prolonged supply cuts from OPEC countries, have lifted the value of Glencore shares as much as 21%, while copper prices have continued to climb 8.8% since the year started.

Today’s price action has left behind an interesting bullish gap, as market players see a potentially sustained improvement in the company’s bottom-line in an environment of higher commodity prices.

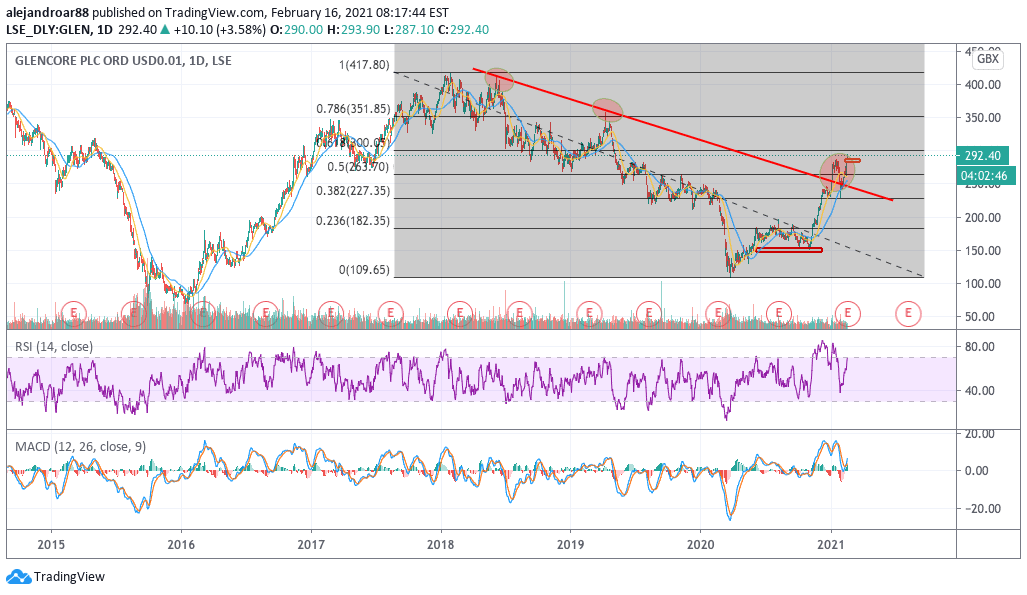

This uptick reinforces the bullish view outlined in our most recent Glencore share price forecast, with a first target for the share price set at 350p if the stock were to move above the 300p Fibonacci threshold shown in the chart above in the following weeks.

Question & Answers (0)