The FTSE 100 is starting the year with a positive tone after the United Kingdom finally exited the European Union, while the COVID vaccine developed by AstraZeneca and Oxford University started its roll out in the country in an effort to inoculate as many people as possible to contain the virus’ advance.

The British stock index is advancing as much as 2.7% so far in mid-day stock trading activity to 6633 on investor optimism about the prospect of putting the virus situation in the rearview mirror during the first quarter of the year.

Meanwhile, the achievement of a ‘cooperation agreement’ with the European Union after years of stalled negotiations regarding the UK’s exit from the economic bloc seems to have put an end to the uncertainty related to this event, although the road towards a full-blown economic recovery remains challenging.

According to a summary published by the British government, both parties agreed on a 100% tariff liberalisation – which means that goods can freely move across their borders. This is the first time that the EU has agreed to embrace zero tariffs with a trading partner.

Moreover, the agreement acknowledges Britain’s sovereignty over its own affairs, which means that the country can decide policies and make agreements with other countries without having to follow EU legislation.

Other matters agreed upon in the deal include the UK’s sovereignty over its fishing waters, ongoing cooperation in criminal and law enforcement matters, guarantees regarding the mobility of UK professionals across EU borders, and non-visa travel across EU borders.

The agreement effectively eliminates the looming threat of a no-deal Brexit – a scenario that could have derailed the country’s already shaky economic recovery – while experts seem to be acknowledging the deal as a win for Prime Minister Boris Johnson as it maintains most of the benefits derived from the country’s participation in the economic bloc, while leaving out some of the issues that came with it – i.e. limited sovereignty on multiple affairs. Crucially, however, services – which accounts for the bulk of the UK economy – is not included in the deal.

Investors appear to be eyeing the short-term financial benefit of the deal from the perspective of how the country can now manage its current economic crisis without having to get the green light from the EU on specific monetary and fiscal matters.

Miners advance strongly amid higher commodity prices

Only 9 out of the 100 components of the FTSE 100 are declining today while miners are leading this morning’s uptick on the back of higher commodity prices.

Among them, Fresnillo (FRES) and Glencore (GLEN) are showing the strongest performance, advancing 9% and 7% respectively as gold and silver are trading higher during early commodity trading activity as well.

Meanwhile, gaming company Entain Plc (ENT) – owner of bookmakers Ladbrokes and Coral – is advancing as much as 29% to 1,465p per share after a proposed takeover from MGM Resorts International was rejected because it “significantly undervalues” the company.

It is important to highlight that the UK stock index ended 2020 with a 14% annual decline, as the virus situation ravaged the economy, while the recent identification of a new strain of COVID forced the government to introduce a Tier 4 lockdown in the country’s capital.

What’s next for the FTSE 100 index?

Multiple factors from both a fundamental and technical perspective seem to be supporting the thesis that the FTSE 100 could move higher over the coming weeks.

First, on the fundamental front, the removal of the no-deal Brexit threat from the picture could end up driving some demand that was temporarily on the sidelines until the situation.

Secondly, the rollout of the AstraZeneca (AZN) vaccine in the country will likely further assist the economic recovery during the coming months, which would effectively push the value of the index’s most depressed constituents higher.

Finally, higher commodity prices – especially metals and oil – could end propel the index to new heights as the world economy crawls out of the virus hole.

That said, the short-term performance of the financial sector could put a cap on the index’s progress, as low interest rates will likely keep the profitability of the entire sector fairly stalled.

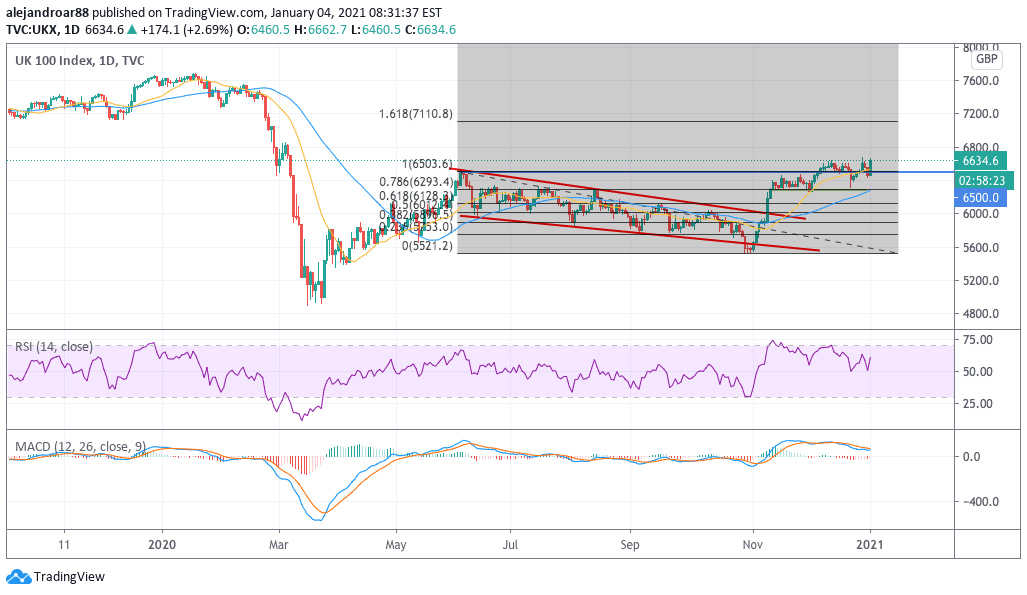

Finally, from a technical perspective, the FTSE 100 seems to be struggling to hold its ground above the 6,500 level, although it seems to have found a strong floor at 6,300.

For now, everything seems to be pointing to what could be the start of a brand new bullish phase that could use the 6,500 level as a launching pad with a first target set at 7,100 – the 1.618 extension shown in the chart. Such a move would represent a 9% upside for investors if the target were to be accomplished.

However, the MACD seems to be trending lower recently after a series of failed breaks above 6,600. This temporary weakness, although worrying, should not be too discouraging as investors are still digesting the impact of this wave of recent developments, which has effectively resulted in a short-term consolidation phase.

Question & Answers (0)