The FTSE 100 index is trading 0.35% lower today at 6509 as market players take a breather as they await the reintroduction of the stricter lockdown measures in London and uncertainty continues to surround the ongoing Brexit talks.

Today’s downtick would make this the third consecutive day of losses for the ‘footsie’ after a furious 8-day rally that ended up pushing the British stock index above the 6,500p level for the first time since June.

The two key drivers behind this latest pause appear to be a worsening virus situation in the UK’s capital city, as London has seen a spike in the daily virus tally despite the number of cases being in retreat countrywide.

Data from the city’s official website indicate that the number of confirmed cases surged to 4,309 on 9 December, while the rest of the country reported a total of 12,918 cases during the same period.

Meanwhile, the number of patients currently hospitalized after having contracted the virus has surged to 10,000 – a level only seen during the worst days of the pandemic in April.

UK Health Secretary Matt Hancock said on Monday that the capital is being moved to Tier 3 – the highest risk level in the country’s scale when referring to the virus situation in a particular area – which means that hospitality venues will remain closed while individuals cannot meet others in confined spaces.

Moreover, the FTSE 100 index seems to be reacting negatively to the resumption of negotiations between the UK and the European Union in regards to Britain’s exit from the economic block, with a new deadline now set for this next Sunday although investors seem unfazed despite the prospect of a no-deal Brexit.

The activity seen by the footsie in the past few days reflects this indifferent attitude towards a no-deal outcome, as market players remain hopeful that negotiators will achieve some sort of agreement that sets the path for an organized exit.

FTSE 100 today: Consumer defensive stocks go down while Basic Materials offset

Consumer defensive shares are the most affected during today’s downtick with online grocery company Ocado (OCDO) notably losing 2.6% at 2,215p in mid-day stock trading activity, while HSBC (HSBA) and Standard Chartered (STAN) are declining 1.2% and 1.4% respectively as well.

Moreover, the health care sector is also seeing its fair share of downward momentum, with shares of AstraZeneca (AZN) dropping 1.9% while GlaxoSmithKline (GSK) shares are also down 1.1% at 1,377p.

Meanwhile, the Basic Materials sector of the index seems to be offsetting the losses seen by the FTSE 100 today, with shares of mining company Fresnillo (FRES) advancing 2.4% during the session at 1,144.

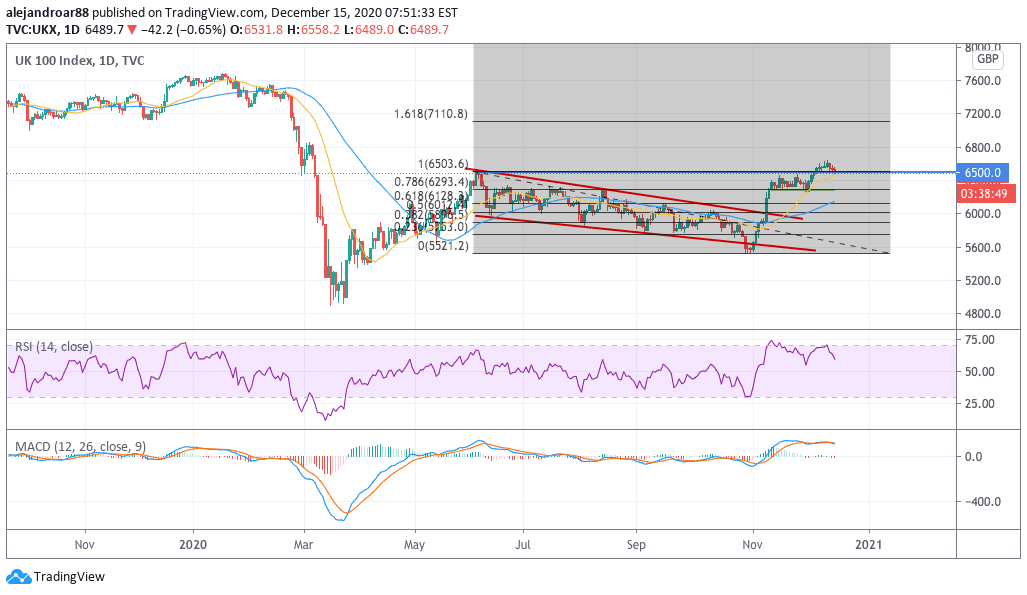

The 6,500 level remains a key level to watch for the FTSE 100 today

The ‘footsie’ has been seeing strong support at the 6,500 as late buyers could see this level as a plausible entry point, while eyeing further upside over the coming weeks on the back of hopes of an improving economy next year once the virus situation subsides.

Given the forward-looking nature of markets, London’s lockdown seems to have already been priced into the index as market players expect a few more weeks of restrictions before inoculations reach the majority of the population – possibly by the end of the first quarter of 2021.

On the other hand, the outcome of this potential last round of Brexit talks could determine the faith of the FTSE 100 index over the coming days with the 6,500 level being the key threshold to watch.

A break below this price point could send the FTSE 100 to the 6,130 mark – another major support on which the index hovered before its latest uptick – while a break above over the coming days, possibly catalyzed by a Brexit deal, could be the starting point of a surge towards 7,000.

Question & Answers (0)