Disney shares were trading sharply higher in US premarket price action today after its quarterly earnings smashed estimates. The shares have underperformed the markets this year but the earnings release might help reverse the tide.

Disney released third-quarter fiscal 2021 earnings yesterday after the close of US markets. The company reported revenues of $17.02 billion in the quarter which was ahead of the $16.76 billion that analysts polled by Refinitiv were expecting. It posted an EPS of 80 cents which was also higher than the 55 cents that analysts were expecting.

Disney earnings

Disney reported 116 million Disney+ subscribers at the end of the quarter which was higher than the 114.5 million that analysts were expecting. Notably, the company had missed subscriber growth numbers in the previous quarter and the shares fell after the second-quarter earnings release. However, its fiscal third-quarter earnings were better than expected across the board.

“We ended the third quarter in a strong position, and are pleased with the Company’s trajectory as we grow our businesses amidst the ongoing challenges of the pandemic,” said Disney CEO Bob Chapek.

Parks segment posted profits

Looking at the segment-wise breakdown, Disney’s Media and Entertainment distribution business reported revenues of $12.6 billion which was 18% higher than what it did in the corresponding quarter last year. The company’s Parks, Experiences, and Products segment reported revenues of $4.3 billion which were significantly higher than the $1.06 billion that it did in the corresponding quarter in 2020. Notably, Disney’s theme parks in the US were closed last year amid the COVID-19 pandemic. The parks reopened in April this year with restrictions.

Meanwhile, the Parks segment posted an operating income of $356 million in the quarter as compared to an operating loss of $1.8 billion in the third quarter of the fiscal year 2020. Disney’s Direct-to-consumer revenues increased 57% to $4.3 billion in the quarter while the operating loss narrowed to $300 million from $600 million. The company attributed the lower operating loss to “improved results at Hulu, partially offset by a higher loss at Disney+”

Disney subscriber numbers rise

Disney+ reported average revenue per subscriber of $4.16 which was 10% lower than the corresponding quarter in 2020. The fall in the metric was due to the higher percentage of Disney Hotstar bundle offering which has a lower price. The service is offered to subscribers in India and Indonesia.

The subscriber numbers for Disney+ more than doubled to 116 million at the end of the quarter. The subscriber numbers for ESPN+ increased 75% to 14.9 million over the period. Total Hulu subscribers increased 21% year-over-year to 42.8 million.

Streaming service

Last year, Disney had streamlined its business to put streaming at the heart of the business. It had released its Mulan online for the first time last year and has since been experimenting with the streaming service. It intends to release Shang-Chi in cinemas for 45 days and then would offer it on streaming. “The prospect of being able to take a Marvel title to the service after going theatrical with 45 days will be yet another data point to inform our actions going forward on our titles,” said Chapek in the earnings release.

Disney sees the total addressable market as 1.1 billion households across the globe. The company has outlined aggressive growth plans for its streaming business and expects Disney+ subscriber numbers to rise three-fold by fiscal 2024 to between 230-260 million. After accounting for Hulu and ESPN+ subscribers, the company expects to have been 300-350 million subscribers by the end of 2024. The company reiterated its guidance in an interview with Jim Cramer of the Mad Money show

Disney versus Netflix

The streaming war has been intensifying and legacy media companies are giving a tough challenge to Netflix. While Netflix has maintained that it is not witnessing competitive pressures and instead sees the entry of new players as a testimony to the streaming industry’s positive long-term outlook, its subscriber numbers portray a different picture. Netflix has been reporting tepid subscriber numbers for the last four quarters. The shares had fallen sharply after the second-quarter earnings release as the management’s guidance for the third quarter subscribers fell short of analysts’ estimates.

Netflix is the worst-performing FAANG share in 2021 and the only one to trade with a YTD loss. Alphabet is the best FAANG shares of the year followed by Facebook. Apple, which Gene Munster had forecast as the best FAANG of 2021 is a distant third and is underperforming the S&P 500.

Disney shares look attractive

Meanwhile, Disney shares look attractive from a fundamental perspective. While there are concerns over the Parks segment amid the surge in COVID-19 cases in the US. Meanwhile, the company sought to downplay the fears and said that the reservations presently are higher than what it saw in the fiscal third quarter.

In the short term, Disney is a play on the recovery in the Parks segment. However, in the medium to long term, the shares would benefit from the streaming business. While the streaming business is currently in the investment phase and posting operating losses, things would get better in the long term.

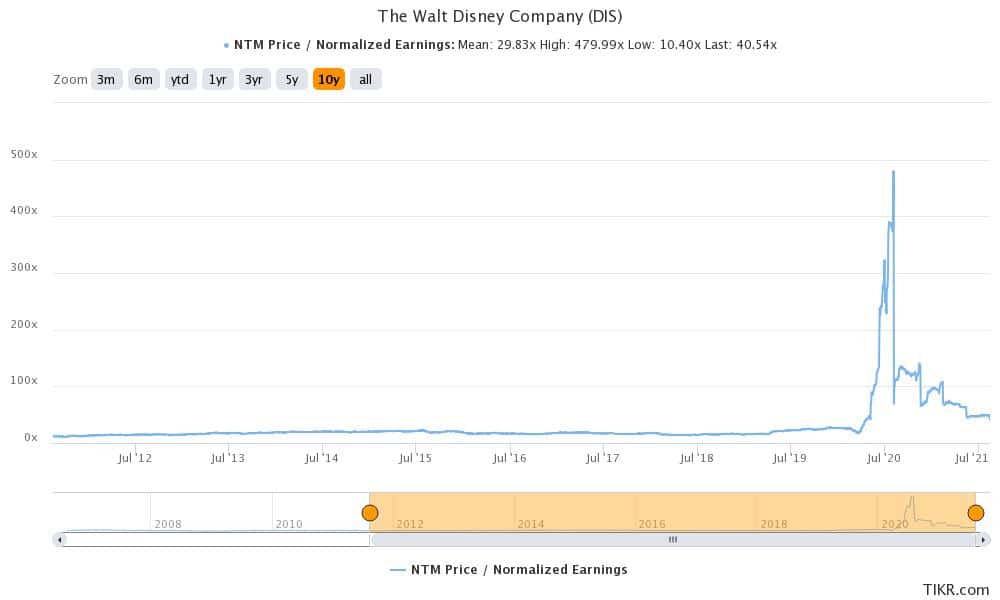

The shares trade at an NTM (next-12 months) PE multiple of 40.5x. While the multiples might seem high based on the historical averages, they are high for a reason. Firstly, the Parks segment’s earnings are still depressed and secondly, the streaming business is yet to contribute to the earnings. Finally, Disney has seen a valuation rerating and markets are valuing it as a streaming play. The valuation for the shares is still much lower than pure-play streaming companies like Netflix.

While Netflix would command a premium over Disney, it goes to show the valuation premium for streaming companies versus legacy media companies.

Disney shares were trading almost 5% higher in US premarket price action today. The shares are trading flat for the year and have a 52-week trading range of $117.23-$203.02.

Question & Answers (0)