General view of the BooHoo store in the Northern Quarter, Manchester, UK. Picture date: Thursday July 18, 2019. Photo credit : Anthony DevlinFor a story about the Missguided brand and textile manufacturing in Manchester by Andrew Bounds

Boohoo shares slipped after an early spike in today’s stock trading action following the release of the company’s financial results covering its 2021 fiscal year.

Shares of the online fashion retailer initially jumped 2.8% during the session but slid 2.0% to 320p by the end of the session, even though the firm reported a strong yearly performance with both its top and bottom line surging as a result of the pandemic tailwind.

Boohoo (BOO) sales ended the year at £1.745 billion, which represents a 41% jump compared to 2019, while slightly surpassing analysts’ estimates of £1.7 billion for the year.

Strong sales in the US market aided the firm’s top-line performance as they moved 63% higher from £263.6 million to £435.1 million while sales in the United Kingdom, the largest market for Boohoo by revenue, came second in terms of growth, jumping 39% by the end of the year at £945.1 million.

The number of active customers for Boohoo increased 28% to 17.8 million while the number of orders moved higher as well at 53.4 million. Moreover, the average order value climbed from £43.50 to £46.06.

Meanwhile, the firm’s gross margin retreated mildly from 2019’s figure, ending the year at 54% or 20 basis points lower than the previous period.

The firm’s adjusted EBITDA moved to £173.6 million by the end of 2020 for a 37% year-on-year increase while adjusted diluted earnings per share (EPS) closed the period 47% higher at 5.88p per share.

By the end of the period, the company had £276 million in cash and equivalents and was able to generate around £151.8 million in free cash flows excluding the acquisition of new brands. That represents a 50% jump compared to a year ago.

Boohoo’s outlook & guidance

In regards to the future, Boohoo expects to close February with a 25% jump in sales, with 5% coming from the acquisition of new brands including its deal to purchase Debenhams. However, the management acknowledged that the outlook remains uncertain for the firm while emphasising that profitability could suffer from higher returns once the COVID situation is off the table.

Boohoo is anticipating that its adjusted EBITDA margin could fall to around 9.5% as a result of poorer margins from these recently acquired brands, while the company is forecasting capital expenditures between £125 to £175 million for the year. Meanwhile, the company’s mid-term target for sales growth remains at 25% per year.

What’s next for Boohoo shares?

Boohoo’s sales have been growing non-stop from 2015 to 2019, moving from £139.9 million to £856.9 million at a compounded annual growth rate (CAGR) of 57.3%. However, the pandemic accelerated that growth rate as sales more than doubled in a single year.

Moving forward, the slower growth rate anticipated by the management comes out of a higher baseline and, therefore, it doesn’t necessarily mean that the firm is growing at a slower pace.

If we take the management’s forecast for granted, we could anticipate that, three years from now, Boohoo’s sales will land at around £3.41 billion which leaves us with an adjusted EBITDA of approximately £323.95 million.

Based on today’s market capitalisation of £4.10 billion, Boohoo is being valued at 12.7 times its forecasted fiscal 2024 sales even though its adjusted EBITDA would be growing at a rate of around 23.1%.

That would give us a price-to-earnings-to-growth ratio of 0.55, which is quite conservative and could be a reason to consider Boohoo and undervalued stock based on its growth prospects and current valuation.

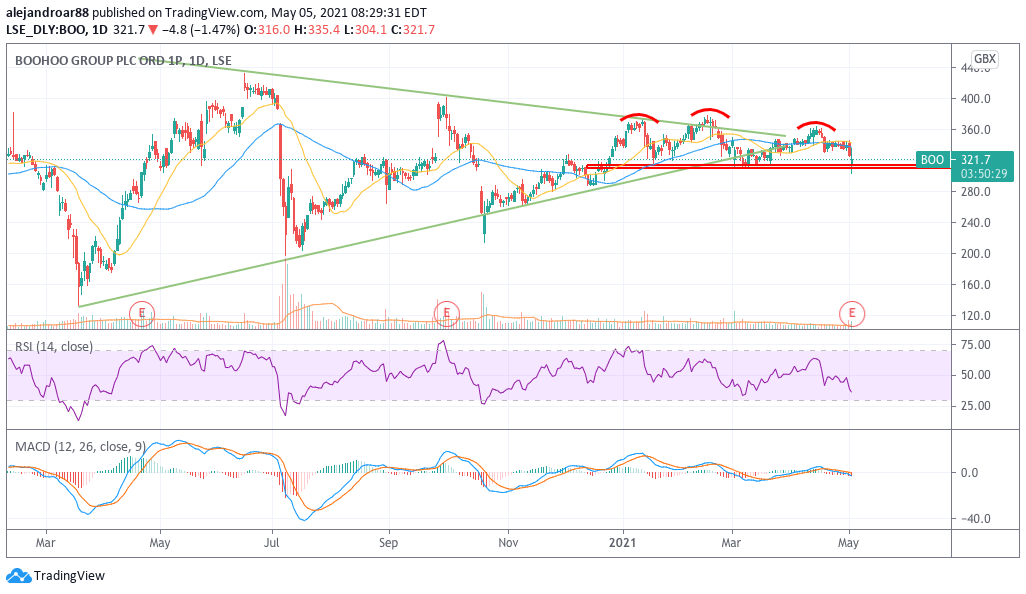

Meanwhile, from a technical standpoint, Boohoo shares appear to be poised to succumb to a bearish head and shoulder pattern if they slip below the 310p neckline in the following sessions.

It remains to be seen if investors will continue to react negatively to this report, even though the company’s fundamentals are strong and its growth prospects are quite promising.

One of the factors that could be weighing on Boohoo’s short-term performance is related to ongoing investigations from US authorities in regards to accusations of slave labour. If that situation leads to a halt in imports from the company, as commentators have pointed, that could affect the firm’s performance and growth as it would dramatically reduce its sales in the North American country – a segment that has become very important for the firm lately.

Question & Answers (0)