Boohoo shares are ticking higher during today’s stock trading action in London, after the company moved to acquire the brand name and intellectual property of former rival Debenhams for a total of £55 million ($75.5 million).

Debenhams, the largest department store chain in the United Kingdom, recently announced that it planned to close down its operations in the country, threatening 12,000 jobs, as coronavirus lockdowns ravage the retailer’s top-line.

Boohoo (BOO) seems to be seizing this opportunity by buying Debenhams’ long-standing reputation through its brand and other intangible assets of the company, which include its online platform and website – one that attracts a total of 300 million visits per annum according to Boohoo’s press release.

“The acquisition represents an exciting strategic opportunity to transform our target addressable market through the creation of an online marketplace that leverages Debenhams’ high brand awareness and traffic through the development of beauty and fashion partnerships connecting brands with consumers”, said Boohoo’s CEO, John Lyttle, in regards to the purchase.

Along with other strategic pursues, Boohoo aims to enter the beauty market by leveraging on Debenhams’ strong presence, as the firm reportedly amassed more than 6 million shoppers in this category along with 1.4 million Beauty Club members.

Meanwhile, the British online fashion retailer expects to re-launch the Debenhams platform during the first quarter of 2022 while the purchase of the rights and brand will be paid in cash by using the company’s outstanding cash balance, which ended 2020 at £386.9 million.

Similarly, Boohoo’s rival ASOS is reportedly moving to acquire the now-bankrupted retail firm Topshop – formerly owned by the Arcadia Group – to consolidate its presence in the market as well.

How have Boohoo shares performed lately?

Boohoo shares posted a decent 15% gain in 2020 on the back of a pandemic tailwind that lifted the firm’s online revenues, as shoppers were forced to buy apparel online while they remained confined within their homes.

This performance outpaced that of the British broad-market FTSE 100 index by almost 29%, although it paled in comparison to the 42% uptick seen by its rival ASOS during the same period.

Meanwhile, retail firms that relied on foot traffic to bring in revenue saw the collapse of their business model amid lockdowns, bringing multiple opportunities to the table for up-and-coming online fashion firms to grab their assets at a bargain.

Analysts seem to have greeted today’s acquisition announcement from Boohoo, with investment bank Peel Hunt qualifying the move as a “sound acquisition strategically”, while Susannah Streeter from Hargreaves Lansdown emphasised Boohoo’s refusal to buy Debenhams’ real estate assets while focusing on its intangible assets as a positive move from the firm to “propel [Boohoo] into international expansion”.

What’s next for Boohoo shares?

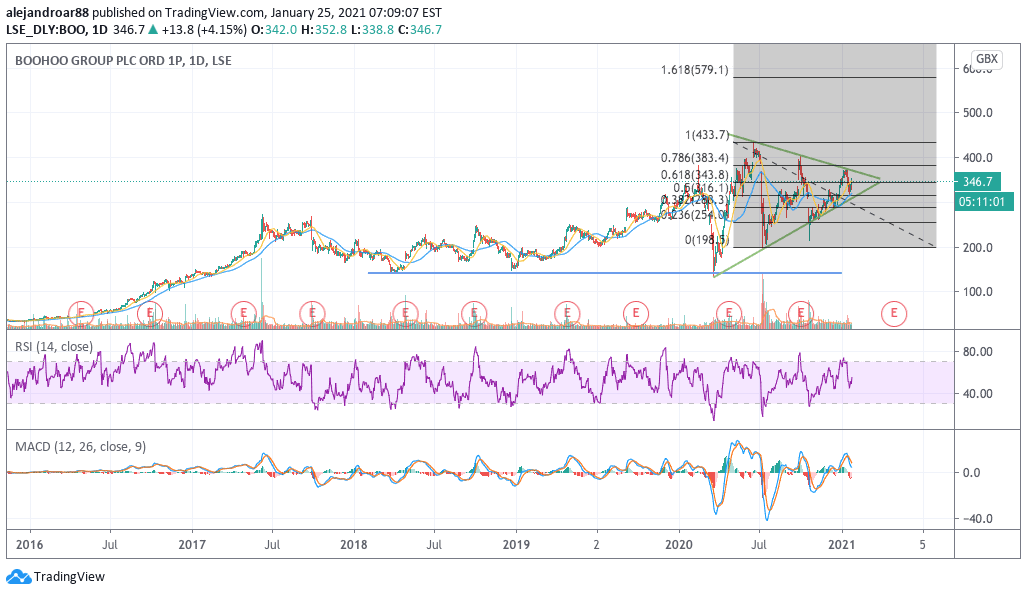

The chart above shows how the latest price action in Boohoo shares has formed a symmetrical consolidation triangle, as market players seem to be undecided in regards to which direction the shares should take from here.

It is important to note that the progressive rollout of COVID vaccines in the United Kingdom and other latitudes within Europe could be weighing on the positive momentum the firm has seen lately, as shoppers could increasingly turn to brick and mortar retailers once the pandemic situation is under control – a situation that would affect Boohoo’s top-line in the near future.

The next few months will be important for the company, as investors are eager to see if Boohoo’s newly-acquired customers will continue to drive the firm’s revenues higher.

As to the future of the stock price, symmetrical triangles do not have a directional bias, which means that the price can move in any direction once the triangle is broken.

That said, today’s move could catalyse a short-term uptick if market players feel that Boohoo is taking the right steps to keep strengthening its competitive edge against a growing number of rivals in the marketplace.

If such a move were to occur, a short-term target for the shares could be set at 433p, the firm’s post-pandemic all-time high, representing a potential 25% upside if the target is hit.

Question & Answers (0)