AstraZeneca (AZN) shares are dropping 1.5% at 8,191 in mid-day stock trading activity in London after the British drugmaker said its vaccine for the COVID-19 virus showed a 72% effectiveness on average, a level that is lower than the vaccines developed by its rivals.

The firm’s interim analysis evaluated the results seen within a group of 131 infected patients, with the levels of efficacy fluctuating from 90% in patients who were given one and a half doses – half a dose first and then a full dose one month later – and 62% within recipients who took two doses – one first and the remaining one a month after. The combined analysis resulted in a 72% average efficacy.

The vaccine, which is being developed alongside the University of Oxford, showed a lower level of efficacy compared to those developed by AstraZeneca’s rivals Pfizer (PFE) and Moderna (MRNA), which appears to be disappointing investors as shares dropped right after the announcement.

Regardless of the lower average efficacy levels, AstraZeneca (AZN) said it has already “met its primary endpoint”, with the company now preparing to seek regulatory approval for its vaccine candidate in multiple countries around the world.

Only a few days ago, American drugmaker Pfizer moved to obtain emergency-use approval of its vaccine with the US Food and Drug Administration (FDA), although the health agency has not yet issued a response to the company’s submission.

How have AstraZeneca shares been performing lately?

Despite today’s downtick, AstraZeneca shares are still holding on to a 7.5% gain so far this year, as the drugmaker benefitted from an early jump in its share price since becoming a strong contestant in the race to find a vaccine.

However, the stock has traded in a narrow range between 8,500p and 9,000p since late July as other companies also made significant advances in developing treatments and vaccines for the disease.

The performance of AstraZeneca shares is outpacing that of the broad-market FTSE 100 index, which has dropped 15.8% since the year started, with the pandemic ravaging the oil and banking sector – two of the most prominent sectors that constitute the senior UK stock index.

What’s next for AstraZeneca shares?

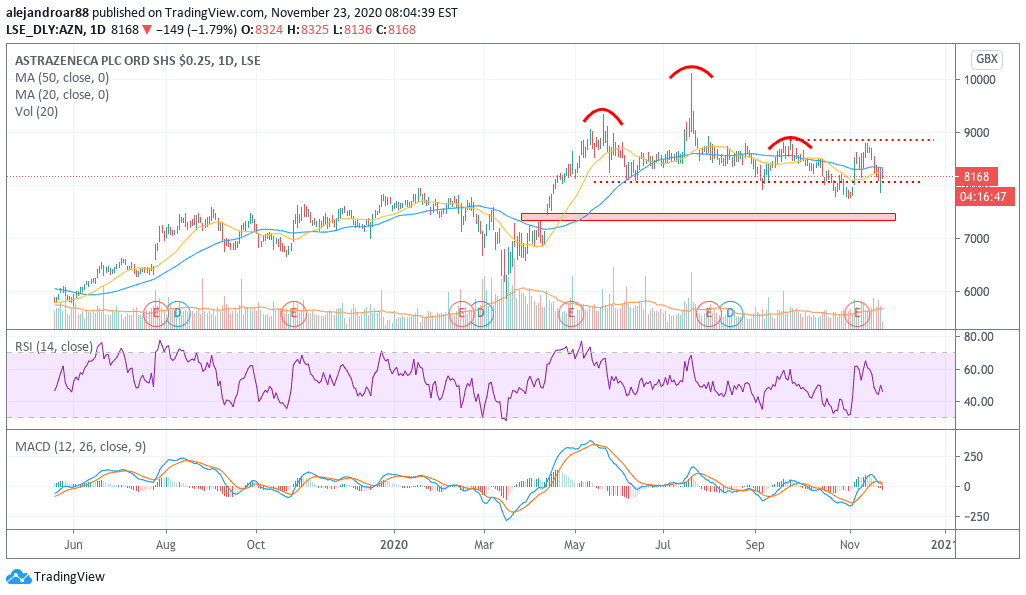

The latest price action in AstraZeneca shares has been quite interesting. The value of the stock dropped to the low 7,700s after moving below the neckline of a head and shoulders pattern we warned a few weeks ago.

The price bounced off those lows as a result of the post-US election rally, but this uptick didn’t last that long as AZN’s stock struggled once again to move above the 9,000 level.

Vaccine news remains a primary driver for AstraZeneca shares, which means that today’s announcement is weighing on the stock’s short-term outlook. Investors are likely to continue assessing how the different levels of efficacy, along with the complexities of distributing the vaccines, could end up affecting the performance of companies developing and manufacturing them.

Meanwhile, Friday’s session had bulls scrambling to push the price above the 8,050 level – the neckline level – which reinforces the importance of this threshold as a major support.

If the price were to drop below that level in the next few sessions, a much sharper correction could be seen by the stock in short notice as bears could take over by using this latest headline as a potential catalyst to prompt a downturn.

If that were to happen, those long on AstraZeneca should keep an eye on the bullish gap left behind at the 7,350 by the stock in April, after the company announced it started developing the vaccine. That gap seems like the last line of defence for AZN’s post-COVID rally.

Meanwhile, the MACD has already sent a sell signal and, although the oscillator remains in positive territory for now, it seems to be inevitably headed into the red zone.

Question & Answers (0)