ASOS shares are ticking higher since early stock trading action in London after the online fashion retailer announced the acquisition of four brands formerly owned by the now-bankrupted Arcadia empire for a total of £265 million.

The four brands are Topshop, Topman, Miss Selfridge, and HIIT, all of which went into administration after the company, owned by fashion mogul Phillip Green, collapsed during the pandemic.

According to ASOS’s press release, the brands will be “complementary to existing ASOS brand portfolio”, while the firm plans to pay for the transaction in cash.

The completion of the acquisition is expected to take place three days from now, on 4 February, with one-off restructuring transaction costs landing at £20 million.

“The acquisition of these iconic British brands is a hugely exciting moment for ASOS and our customers and will help accelerate our multi-brand platform strategy”, said ASOS’s Chief Executive Nick Beighton in regards to the acquisition.

During the 52 weeks ended on August 2020, the four brands generated a negative EBITDA of £2.2 million, while ASOS expects that any incremental EBITDA coming from their integration to the firm’s financials would be offset by the initial investment and other related costs in 2021.

As for the future, ASOS expects that the contribution of these brands to the firm’s incremental sales will be flat during 2022 as the company will focus on driving growth to other areas of the business. That said, ASOS does expect that the acquisition will yield “double-digit return on capital in the first full year”.

Online fashion retailers keep expanding during the pandemic

ASOS scooping of Arcadia’s fallen empire is one of the latest developments in the recent digitalization of the fashion retailing industry in the UK, as companies that relied on physical establishments to sell their products saw their top-line ravaged by the virus crisis amid lockdowns and other similar restrictions.

Only a few days ago, ASOS’s rival Boohoo (BOO) announced the acquisition of the brand name and intellectual property of Debenhams for a total of £55 million as part of the firm’s strategy to strengthen its presence in the UK market.

Meanwhile, today’s uptick in ASOS shares is effectively pushing the firm’s performance to neutral territory in 2021, while the stock snapped a 42% gain in 2020 on the back of the pandemic tailwind.

What’s next for ASOS shares?

ASOS’s successful move to acquire Arcadia’s brands should strengthen the firm’s competitive positioning in a market that remains highly fragmented, with other players like Next (NXT), Boohoo, and Burberry also fighting to become the go-to shop for British online shoppers.

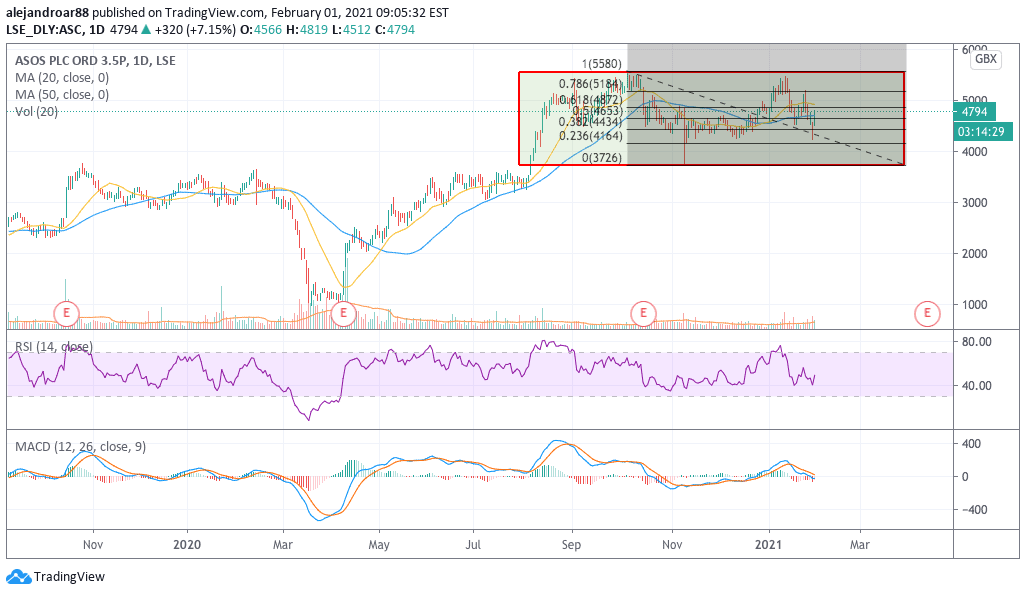

Today’s surge in ASOS shares is pushing the stock back to a higher Fibonacci scale but the price is still far from its post-pandemic all-time highs. This means that the following weeks will end up determining if investors truly believe in the long-term success of ASOS’s strategy or if this is just a temporary uptick derived from a sentiment boost.

For now, the MACD has not sent a buy signal just yet while it remains on negative territory. If traders were to lift the price further – above the 4,900p mark – chances are that the stock price might retest its post-pandemic highs of 5,200p per share on the back of the positive momentum prompted by this acquisition.

On the other hand, for that to happen, the price also has to overcome the 20-day moving average – a level that served as resistance in the past few days during the 11.5% downtick that started on 26 January.

Question & Answers (0)