With the FTSE 100 down 28% from its January highs and only 12% off its March lows, the risk of a prolonged bear market is back on the table as the UK struggles to deal with a strong resurgence of the virus.

The situation for the “footsie” was already shaky last week, as the index kept rebounding off the 5,800 support level that served as a stronghold since August while failing to make a fresh new high since then as well.

This situation pointed to a weakness in the momentum for the British stock index already and a reversal was possibly just a matter of time as the country keeps dealing with complicated Brexit negotiations along with the virus situation.

However, this week, the severity of the outbreak in the UK and in other developed countries within Europe triggered a strong risk-off move that ultimately pushed the index below that threshold, with its outlook now looking gloomier as it trades below its May levels.

With the introduction of lockdowns – although in a less strict way than March – now threatening to derail the already fragile economic recovery of the British nation, the risk of a prolonged bear market is materializing for investors, especially if the government does not step in to assist the economy to stop the free fall.

Sectorial weights remain one of the key challenges for the FTSE 100

One of the reasons why the FTSE 100 has failed to see a strong rebound off its March lows during the months that followed is the high percentage that certain virus-battered sectors have in the index.

For example, as of December 2019, the energy sector accounted for roughly 14% of the index, while financial companies accounted for 20% according to data from Siblis Research.

What is perhaps most worrying, is the fact that the information technology sector only accounted for 1% of the index back then, in contrast with the high concentration of tech companies seen in foreign indexes such as the S&P 500 and the Nasdaq 100, both of which have rebounded strongly due to the positive performance of these firms during the pandemic.

This sectorial composition poses a big risk for the recovery of the FTSE 100, as financial companies are likely to see lower profitability levels over the coming years due to the low-interest-rate environment the world is currently in, while a combination of low oil prices and a shift towards renewable sources of energy is also threatening to plunge the energy sector into one of its most severe recessions in decades.

In that context, the possibility of a prolonged bear market for the FTSE 100 seems very real and investors should be aware of this so they can take appropriate measures that could include the incorporation of defensive stocks in their portfolios – such as those in the technology sector – along with other instruments that could perform better in today’s landscape.

What’s next for the FTSE 100 index?

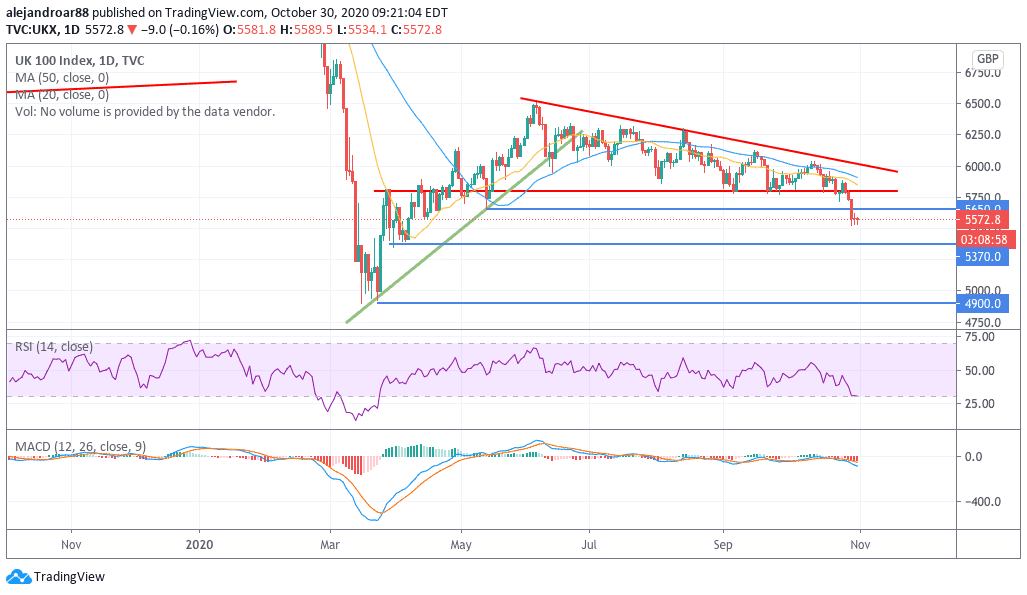

I had already warned in a previous article that a move below the 5,800 could lead to a strong plunge in the footsie, with the next support found at 5,650 – which would serve as some sort of “last line of defense” for the index.

Now, with the latest price action pushing the index below that level, the next support could be found at 5,370 if the virus situation – and the resulting lockdowns – don’t get any worse.

On the other hand, if the situation does get worst, there’s nothing else – from a technical standpoint – that can stop the FTSE 100 from moving down to the 4,900 mark seen in March, with the potential catalyst for that being the reintroduction of more severe countrywide lockdowns and business shutdowns.

One potential way to anticipate such a move is to keep an eye on hospitalization levels as indicated by the UK government on this official website. So far we can see that COVID-19 hospitalizations in the UK have been surging along with the number of daily cases in the country but they remain lower compared to the April highs of 20,000 patients.

If that number were to move down again to the levels seen back then, the likelihood of a second wave of more severe lockdowns will increase and a sharp downward move in the FTSE 100 could follow.

Question & Answers (0)