Norway, Belgium, France and the UK have all imposed restrictions on holidaymakers returning from Spain, sending shockwaves of pain through the tourist industry, with airline group International Consolidated Airlines Group (IAG) seeing its shares crushed, off 7.4% (184p/€2.04).

The owner of British Airways, Aer Lingus, Vueling and Iberia wasn’t the only flyer laid low. German carrier Lufthansa lost 6% of its value at the time of writing.

When the UK decided on Saturday to require holidaymakers returning from Spain to quarantine for 14 days, it underlined that the difficulties still faced by the tourism sector were not likely to be ending anytime soon.

More than that, hopes for any kind of meaningful lift-off for the leisure travel and airline industries are now in doubt.

Ryanair and TUI down too

Budget airlines were not immune from the quarantine fallout either, regardless of the opportunities for grabbing market share by lower-cost operators that may have been present in the current reshaping of the marketplace.

Ryanair is down 5% and EasyJet an eye-watering 11% lower. Package holiday juggernaut TUI’s shares have shrivelled 12%.

Ryanair on Monday announced a quarterly loss of €185 million to the end of June, with chief executive Michael O’Leary warning “our biggest fear is a second wave of Covid-19 cases”. Those losses were incurred despite an aggressive cost-cutting programme.

Not mincing words, a British Airways spokesperson said the decision of the UK government was “yet another blow for British holidaymakers and cannot fail to have an impact on an already troubled aviation industry”.

Industry critiques of the government’s approach say it should have taken a more nuanced stance, focusing on regions that were seeing spikes, such as Catalonia, rather than applying the quarantine to travellers returning from the whole of Spain.

The Spanish government says the country is safe, as they push back against European partners.

IAG puts defences in place

This latest setback for the airlines comes after a number of relatively positive developments for IAG.

Last week it reached an agreement on job cuts with its pilots. There was also pleasing news regarding shoring-up its balance sheet when it extended a $955 million deal with AMEX, in which the card provider pays in advance for loyalty reward points for its customers.

Also, a mooted rights issue to raise €2.75 billion in addition to the loans and other bailout help it has already received from state entities, were expected to help strengthen its balance sheet.

Macro backdrop deteriorating as gold hits record high?

Airlines’ stalled recovery could be taken as a leading indicator of trouble ahead for the wider equity markets as hopes for a V-shaped recovery recede.

For instance, JPMorgan today removed Apple from its analyst Focus list ahead of this week’s quarterly results. Tech shares have led the S&P 500 higher over the last quarter, with Apple shares 30% improved compared to the index’s 18%.

Gold traded at record highs today ($1,944 per troy ounce) while real yields on US Treasuries are negative and worries about a second wave of the pandemic encourages some investors to turn to safe havens.

Digital currency bitcoin has also been catching a bid. It broke through the all-important $10,000 mark for the first time since early June.

The weakening dollar, although normally a boon for US multinationals, may be a siren call warning of ballooning deficits, fears of stagflation, not to mention the rising tensions between the US and China.

All of this piles on the uncertainty for airlines.

Rights issue a stretch

How investors react to IAG’s rights issue may be influenced by whether governments in the home countries of the airlines the group owns are willing to do more to help it weather the pandemic storm.

With British Airways, for example, proposing swingeing job cuts after taking millions in furlough money from the state while accessing government-backed loans through the Covid Corporate Financing facility, it is hard to envisage more state funds being forthcoming. So a rights issue looks like the only way to bring in more cash.

With a market cap of $3.9 billion – less than that at market close today – the floated share sale that almost matches that capitalisation, can only mean one thing for current shareholders: massive dilution. That means the rights issue may struggle to attract interest.

Long-term view for long haul gains

But for those holding for the long-term and the resumption of the tasty 6.23% dividend payments, dilution might be a price worth paying.

IAG is a well-run company in what in normal times is a profitable industry.

Bears on the other hand point to the systemic threat posed by the pandemic in fundamentally changing travel habits, with climate change mitigation policies adding to the pessimistic outlook for airlines. However, that’s probably the doomsday scenario that shouldn’t be a concern for the near to mid-term.

Traders may be shorting and long-term investors with an income bias holding tight with the added incentive of not wanting to crystallise losses – they will therefore likely participate in a rights issue.

Long-termers will assume that IAG and its constituent parts will be among the survivors to reap the benefits of the lucrative transatlantic routes once a vaccine removes the turbulence of uncertainty.

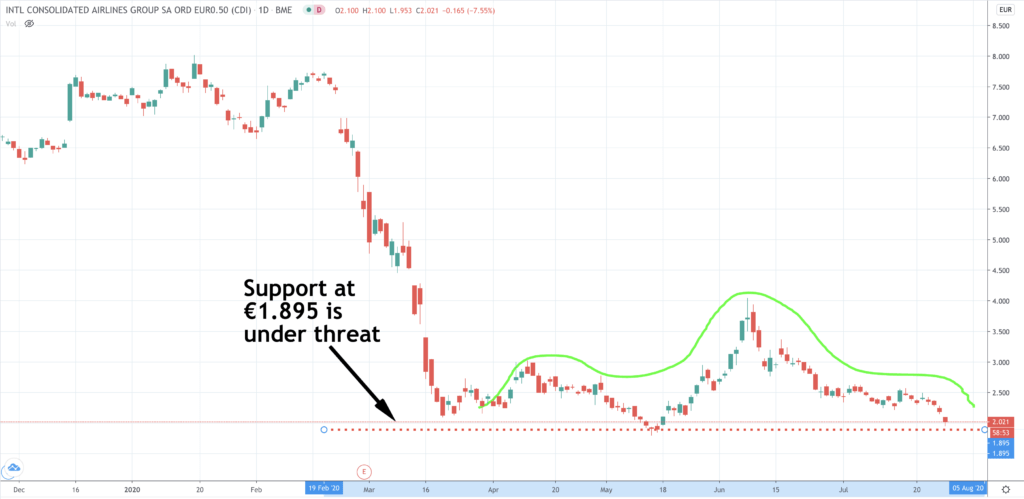

Fundamentals aside, on a technical view, support at €1.895 (see chart above) is threatened, so buying here would be decidedly risky.

Question & Answers (0)