The price of Moderna shares jumped during yesterday’s stock trading action after the company announced that it is currently developing a single-dose vaccine that will serve as both a COVID booster and flu shot.

Shares of the Cambridge-based biotech company soared nearly 8% during the day at $455.92 per share as a result, this being the seventh winning session for the stock in the past eight.

In a press release published yesterday, the company highlighted that its mRNA platform was created for solving “the world’s greatest health challenges”. With that in mind, it announced that this single-dose COVID and shot will be the first product of its respiratory vaccine program.

Moderna (MRNA) provided an update on its flagship COVID vaccine, which has already completed Phase 3 trials, meaning that it may soon receive full approval from the United States Food and Drug Agency (FDA).

Moreover, the company is also developing shots for specific variants of COVID including mRNA-1273.617, which is being developed to target the Delta variant specifically. Studies also showed that a third shot of the firm’s mRNA-1273 COVID vaccine was highly effective at neutralizing new variants of the virus while reducing their deadliness.

Other updates related to its COVID vaccines included comments about its advances in the Phase 2/3 trials for vaccinations among adolescents between 12 and 17 years. No cases were observed among this group after two doses were administered. On the other hand, the company reported no relevant advances in its trials involving pediatric patients from 6 months to 11 years old.

On other fronts aside from COVID, these are some of the drugs that are currently undergoing Phase 2/3 trials and that may move up the chain soon to seek approval from the FDA if they meet their primary endpoints:

- Respiratory syncytial virus (RSV) vaccine: Moderna will soon start a Phase 2/3 study for this vaccine that will include 34,000 participants. The FDA has granted Fast Track status to this candidate.

- Personalized cancer vaccine (PCV): The company has fully enrolled the 150-patient cohort needed to conduct studies for its mRNA-4157 candidate – a treatment that seeks to ramp up the body’s anti-tumor response. This study is being performed alongside Merck as shots of pembrolizumab, a drug developed by the pharmaceutical giant, will be administered in combination with Moderna’s candidate.

Finally, the company stated that, by the end of 31 August, it had approximately $15 billion in cash and equivalents.

How have Moderna shares performed so far this year?

Including yesterday’s pronounced uptick, shares of Moderna are up 336% since the year started on top of last year’s pronounced 434% gain.

The successful development of a COVID vaccine has validated the power of the firm’s mRNA platform while it has given Moderna the resources and credibility it needs to push forward many other projects within its pipeline.

As a result, market participants appear to be pricing the impact that other drugs could have on the company’s top-line results in the future.

What’s next for Moderna shares?

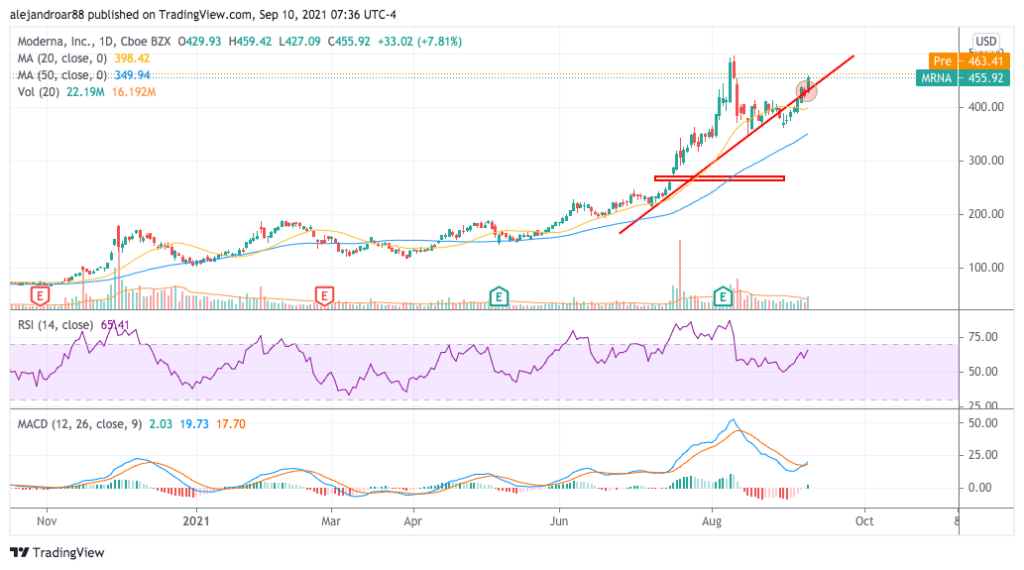

Yesterday’s uptick has reclaimed a trend line support that had been lost on 27 August amid the steep decline that the stock experienced after the company reported its financial results covering the second quarter of 2021.

This move, which was accompanied by above-average trading volumes, is signaling that positive momentum for the stock has been reignited on the back of yesterday’s announcement.

In this regard, the MACD has just made a turn above the signal line that is being accompanied by the first positive histogram reading in the past 18 sessions. This event reinforces a bullish outlook for MRNA stock as it indicates that a potential reversal of the latest downtrend may be taking place.

From a fundamental perspective, Moderna is being valued at only 10 times its forecasted earnings per share for the next twelve months, possibly as market participants believe that bottom-line results will likely grow at a slower rate once the pandemic situation is over.

Data from Koyfin shows that for 2023, Moderna’s adjusted EPS is forecasted to land at $12 per share. This figure is roughly a third of what the company is expected to make this year. Using that forecast, the price-to-earnings (P/E) ratio will be much higher at 38, which is rather stretched unless the company manages to keep growing its earnings in the future at a rate of 20% or higher per year.

This would only be accomplished if non-COVID treatments or this promising COVID & flu shot get a nod from the FDA – something the market appears to be pricing already.

With that in mind, even though the company’s valuation seems attractive based on its earnings for the next two years, the market’s appraisal is highly dependent on the firm’s ability to get other candidates within its pipeline approved in the future.

Question & Answers (0)