How to Invest in Fractional Shares

Many newbie investors in the UK are put off by stocks and shares, as they are under the impression that they need heaps of cash to get a look in. However, this couldn’t be further from the truth, as a number of stock broker platforms active in the UK allow you to invest in fractional shares. Put simply, this means that you no longer need to purchase a ‘full’ share.

In this guide, we explain the ins and outs of how to invest in fractional shares in the UK. We also give you some handy information on how fractional shares actually work and cover what you need to consider before making an investment.

-

-

What Are Fractional Shares?

Before we get into the specifics of how to make an investment, it is important that we first explain what fractional shares actually are. As the name suggests, the phenomenon allows you to purchase a ‘fraction’ of a share, essentially meaning users can invest smaller amounts than they would have to otherwise.

This is important for three key reasons, which we elaborate on below.

Invest in Shares With Small Amounts

Firstly, fractional shares allow traders to enter the stock market with a relatively low initial investments.

Interestingly, this may not be very beneficial in the UK stock markets. This is because companies listed on the London Stock Exchange are priced in ‘pence’ as opposed to ‘pounds’. In other words, FTSE 100 shares are cheap to purchase, so low minimums are typically not an issue.

For example, check out some of the share prices of leading UK stocks as of July 2020:

- Royal Mail: 174.24p

- Tesco: 215.90p

- BP: 300.30p

- HSBC: 382.85p

As you can see from the above, some of the largest and most established companies in the UK have super-cheap share prices. However, for those of you that wish to gain exposure to popular shares in the US – things are much different.

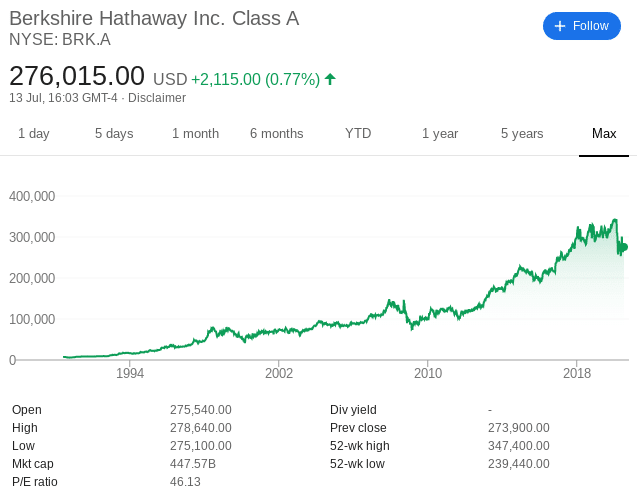

For example, check out some of the share prices of leading US stocks as of July 2020:

Invest at an Amount ‘Exact’ to Your Budget

When using a traditional stock broker, you are forced to purchase shares in ‘whole units’.

- For example, let’s say that you are buying shares in a company that has a stock price of £46

- You have £500 that you wish to invest in the said firm

- You won’t be able to invest exactly £500, as the broker does not support fractional ownership

- Instead, you will only be able to purchase 9 shares – which takes your investment to £414 (9 x £46)

- As such, this leaves £86 of your investment funds sitting idle at the broker

Brokers supporting UK fractional shares allow you to invest an amount that mirrors your exact budget. In this example, this would leave you with 10.86 shares (£500/£46). Once again, we’ll explore how this works in greater detail further down.

Create a Diversified Portfolio With Ease

This particular feature combines the previous two that we discussed. In a nutshell, creating a diversified portfolio can be difficult when using a traditional stock broker. As noted above, this is because you will need to purchase whole shares.

- For example, let’s suppose that you have £1,000 to invest.

- In order to mitigate your risks, you decide that you want to invest in 20 companies at £50 each.

- However, this would be virtually impossible when using a traditional stock broker – as each company will have a different share price.

- This is especially the case if investing in a basket of US shares, as stock prices are typically in the hundreds of dollars.

As such, you are going to be left with a highly uneven portfolio, which in turn, will negatively impact your ability to diversify.

Once again, these hindrances are not in play when purchasing fractional shares. This is because you are able to specify the exact amount that you wish to invest. As long as you meet the broker’s minimum investment amount, diversification has never been easier.

For example, let’s say that you have £400 to invest. Your portfolio could consist of:

- £80 worth of shares in BP

- £80 worth of shares in British American Tobacco

- £80 worth of shares in RBS

- £80 worth of shares in AstraZeneca

- £80 worth of shares in GlaxoSmithKline

Irrespective of the stock price of each of the aforementioned companies, each investment would be worth exactly £80.

How Does a Fractional Shares Investment Work?

So now that we have discussed some of the reasons why purchasing fractional shares in the UK can be highly beneficial for your long-term investing goals, let”s see how the investment process works.

Example 1: Fractional Facebook Shares

- At the time of writing, one Facebook share is going to cost you $239. This amounts to just over £190.

- You don’t want to invest £190 into Facebook shares, so you decide to use a broker that supports fractional ownership

- As such, you invest just £40 into Facebook

- To figure out how much you actually own, you need to divide £40 into the share price of £190

- This works out at 0.21, meaning you own 21% of one Facebook share

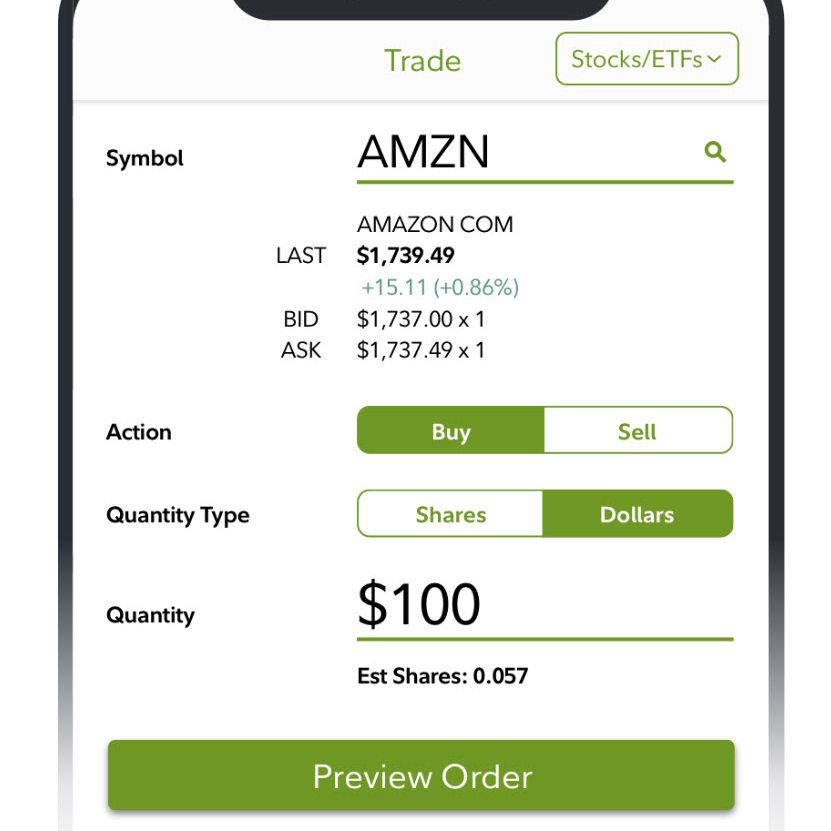

Example 2: Fractional Amazon Shares

- At the time of writing, one Amazon share is going to cost you $3,104. This amounts to just over £2,480.

- You don’t want to invest a whopping £2,480 into Amazon shares, so you decide to engage with fractional ownership

- As such, you invest just £100 into Amazon

- Once again, we need to divide £100 into the share price of £2,480

- This works out at 0.04, meaning you own 4% of one Amazon share

As you can see from the above, as long as you meet the broker’s minimum deposit policy, you may invest as little or as much as you please.

Capital Gains on Fractional Shares

The process of making money from your fractional share investment works in exactly the same way as a traditional stock purchase. Put simply, if you sell the shares at a higher price than you initially paid, then users have the chance to make a gain. The key difference is that when calculating these gains, we need to take into account the fractional share.

For example, when you purchase shares in the traditional sense, you would:

- Take the share price at the time of the sale

- Minus the share price that you originally paid

- Multiple the difference against the number of shares you hold

But, in the case of investing in fractional shares, we should do it like the following:

- You invest £1,000 into IBM shares

- When you bought the shares, IBM had a stock price of $120

- When you sell the shares, IBM is priced at $132

- This means that the shares have increased by 10%

- On an investment of £1,000, this means that you could have made a gain of £100

Dividends on Fractional Shares

If you purchase fractional shares in a company that pays dividends, then you will still be entitled to your share of any payments. Once again, you just need to be aware of how this works, as you need to factor in the fractional share that you own.

Here’s how it works with respect to dividend stocks:

- Let’s say that you have £1,000 worth of shares in Apple

- Based on a GBP-equivalent share price of £304, this means that you own 3.4 Apple shares

- To keep things simple, let’s say that Apple pays a dividend yield of £15 per share

- As you own 3.4 shares, this means that you will be entitled to £51 in dividends (£15 x 3.4 shares)

Regardless of whether its capital gains or dividends, your chosen fractional share broker will perform all of the calculations for you.

How to Invest in Fractional Shares

So now that you know the ins and outs of how fractional shares in the UK work, we are going to run you through the process of making an investment.

Step 1: Choose a Stock Broker That Offers Fractional Shares

Your first port of call will be to choose a stock broker that offers fractional shares. As the UK investment space is still dominated by established players, the number of platforms supporting fractional ownership is still growing. Moreover, you should never choose a broker just because it offers fractional shares.

On the contrary, you also need to look at metrics such as the types of shares it offers, the minimum users can invest, fees and commissions, and supported payment methods.

Taking all of this into account, below you will find a review of brokers that allow you to invest in fractional shares.

1. Plus500

Plus500 is an online trading platform that offers CFD instruments and other asset classes to invest in. This means that you will be ‘trading’ as opposed to ‘investing’ in shares. The platform offers over 2,000 stock CFDs and thousands of other instruments. This includes heaps of UK and international markets, so you may diversify with ease.

if you want to invest smaller amounts, Plus500 allows you to trade fractional stock CFDs. As such, you will be speculating on the short-term price movement of the CFD in question. You will have the option of going long (buy position) and short (short position). You may also apply leverage to your positions, meaning that you are trading with more than you have in your account.

At Plus500, this stands at 1:30 for UK retail traders, albeit, this is reduced to 1:5 if trading stock CFDs. Put simply, this means that a £150 account balance would allow you to enter a CFD position worth £750. Professional traders, however, will be offered significantly higher limits. If you do like the sound of this particular platform, you may open an account in minutes.

Trading on Plus500 takes place on the broker’s own proprietary platform, which comes with handy tools like price alerts and basic charting. Plus500 also offers a mobile app, which can be accessed on iOS and Android.

The minimum deposit amount at Plus500 is low at just £100. It allows you to facilitate this with a debit/credit card, bank account, or Paypal. There are no fees to deposit funds, nor will you be charged to make a withdrawal. When it comes to safety, Plus500UK Ltd is authorized & regulated by the FCA (#509909). The platform’s parent company is listed on the London Stock Exchange, too.

Sponsored Ad. There is no guarantee you will make money with this provider.

Step 2: Open an Account and Verify Identity

Once you decided which platform you wish to use to purchase or trade fractional shares, you will then need to open an account. The process remains constant regardless of which broker you opt for, insofar that you will need to provide some personal information. This typically includes your:

- Full name

- Nationality

- Home address

- Date of birth

- National insurance number

- Contact details

As you will be using an FCA-regulated broker to purchase fractional shares, you will be required to have your identity verified. The process can actually be completed within minutes. All you need to do is upload a copy of:

- Passport or driver’s license

- Recently-issued utility bill or bank account statement

Step 3: Deposit Funds

Once you have gone through the verification process, you will then be asked to deposit some funds into your brokerage account.

In terms of supported payment methods, you may have the choice to use the following options:

- Debit cards

- Credit cards

- E-wallets

- Bank account transfer

Step 4: Purchase Fractional Shares

So now that you have funded your trading account, we are going to guide you through the order process of buying fractional shares in the UK.

First and foremost, you need to decide which stock you wish to purchase. Enter the name of the stock on the search column of your chosen platform and hit enter.

Enter the amount you wish to invest in the stock and confirm your purchase.

The Verdict

In summary, fractional ownership of stocks has completely revolutionized the online share dealing space. Not only does this allow you to purchase shares that would otherwise be out of financial reach, but you can also diversify with ease. This is especially the case when you consider just how costly the likes of Amazon, Google, Facebook, and heaps of other popular US stocks are.

However, make sure to pick a suitable broker that fits your investment requirements and only put in money after researching the company and stock.

FAQs

Which brokers offer fractional shares?

If you are looking to invest in fractional shares, multiple brokers allow users to begin fractional sharing from just $1.

What fractional shares can you purchase online?

This will depend on your broker of choice. Users may have the option to invest in hundreds of the largest stocks in the world, using fractional sharing options.

Do you still get dividends with fractional shares?

You certainly do. The size of your dividend payment will be dependent on the total amount you invest. There is no need to calculate it yourself as the payment will be reflected in your online brokerage account.

What is the minimum amount of fractional shares I can purchase?

This will vary from platform to platform. Users can get started anywhere from $1 to $10.

Can you short fractional shares?

You have the option to, but you will need to use a CFD trading platform. In essence, you are simply placing a sell order, which means that you are speculating on the value of the shares going down.

Kane Pepi

View all posts by Kane PepiKane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Academically, Kane holds a Bachelor’s Degree in Finance, a Master’s Degree in Financial Crime, and he is currently engaged in a Doctorate Degree researching the money laundering threats of the blockchain economy. Kane is also behind peer-reviewed publications - which includes an in-depth study into the relationship between money laundering and UK bookmakers. You will also find Kane’s material at websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

BuyShares.co.uk © 2026 All Rights Reserved. UK Company No. 11705811.

The process of making money from your fractional share investment works in exactly the same way as a traditional stock purchase. Put simply, if you sell the shares at a higher price than you initially paid, then users have the chance to make a gain. The key difference is that when calculating these gains, we need to take into account the fractional share.

The process of making money from your fractional share investment works in exactly the same way as a traditional stock purchase. Put simply, if you sell the shares at a higher price than you initially paid, then users have the chance to make a gain. The key difference is that when calculating these gains, we need to take into account the fractional share. Your first port of call will be to choose a

Your first port of call will be to choose a