Day Trading UK Guide 2026

Day trading can be done with stocks, options, funds, forex, and more.

In this guide, we’ll explore day trading and some popular day trading strategies. We’ll also take a look at five brokers that offer day trading in the UK.

-

-

Key Points on Day Trading

- Day trading is a popular trading strategy amongst some investors.

- As the name suggests, day traders buy and sell financial assets within one trading day.

- The main logic behind day trading is to purchase and sell various instruments before the market closes to capitalize on small price movements.

- Day traders need to make fast, on-the-spot decisions, to make short-term profits after executing multiple trades in a relatively short amount of time.

What is Day Trading?

Day trading is the practice of buying and selling financial instruments in a single day. You might buy a stock or option in the morning and then sell it a few hours later before the end of the trading day. Whether you hold for a few minutes or a few hours, one tenet of UK day trading is that you should close out all of your positions by the end of the day.

Since the timeframe for holding positions is so short, most day trading strategies focus on making many small gains. For example, you might place dozens of trades in a single day, each of them only returning around one or two percent. Place enough winning trades, though, and those gains can compound into a significant amount over time.

Another important thing to keep in mind when day trading in the UK is that minimizing your losses is critical. You don’t have to win every trade, but you do have to prevent any single loss from wiping out a whole day’s worth of successful trades. For that reason, day traders rely heavily on risk management tools like stop losses.

One of the exciting things about day trading is that it can be done with a wide variety of different assets. Let’s take a closer look at some of the types of assets that day traders favor.

Day Trading Stocks

Buying and selling stocks is one of the most common ways to get involved in day trading. You can buy shares of major UK companies like Royal Mail, Tesco, or BP, or look internationally to trade on movements in the price of companies like Amazon and Facebook.

You can also try day trading penny stocks. Penny shares are typically extremely volatile, which makes them prime targets for short-term trading. Just make sure you know what you’re getting into when trading these shares, as they’re not subject to the same regulations as blue chip stocks.

When day trading stocks, look for major events like company announcements and earnings reports that are likely to cause big swings in share prices. Day trading in the UK is less about finding undervalued stocks or growth stocks compared to long-term investing. Rather, the goal is to spot short-term price changes that happen throughout the trading day.

Day Trading ETFs

Day trading ETFs (exchange-traded funds) can be tricky since these funds are typically less volatile than individual company shares. After all, the price of a single ETF is influenced by dozens or hundreds of price changes that can counteract each other.

However, some ETFs do make big swings based on news. For example, a tech-focused ETF might suddenly jump in response to a positive earnings report by Netflix or a regulatory win for the industry. Country-specific ETFs can also react to the news, leaving day traders an opportunity for profit.

Day Trading Crypto

Cryptocurrency is relatively new to traders, but coins like Bitcoin have quickly become popular among UK day traders. Digital coins experience much more volatility than traditional currencies, and the price can skyrocket or fall suddenly based on just rumours. Be cautious when trading lesser-known cryptocurrencies, as they are subject to many of the same fraudulent schemes as penny shares.

Forex Day Trading

Forex trading is another popular target for day traders. The forex market operates 24 hours a day, five days a week, so you can day trade forex outside of standard UK market hours. That’s ideal for beginner day traders who want to trade in the mornings or evenings around a full-time job.

There are several other advantages to day trading forex. Most UK forex brokers offer leverage, which enables you to multiply your return from small price changes and short trading windows. In addition, you can use forex signals and forex robots to put your trading on auto-pilot.

Day Trading Options

Day trading options are somewhat complicated since the value of options contracts depends on time as well as the price of the underlying asset. However, options open up a whole world of day trading strategies since you can hedge your bets and profit even if the market moves sideways.

Day Trading

Compound your account

The number one advantage of day trading is that you can compound your account balance. You might trade all of the money in your account several times in a single day, as opposed to once a year for long-term investing.

Even if you only make a profit of 1% per day, that’s more than a 30% return after a month of trading. As your account size grows, you can potentially make bigger bets and compound your returns even more.

This is why day trading can possibly be more lucrative than long-term investing if done properly. £100 compounded at 1% daily by day trading would be worth £3,700 after a year of trading. If you earn, say, a 10% annual return by investing in FTSE 100 shares, you’d only end up with £110 at the end of the year.

Minimize overnight risk

Another important aspect of day trading is that it may minimize or eliminate overnight risk. Particularly in the stock market, prices can jump up or down overnight in response to news and earnings reports. Holding positions overnight exposes you to these price jumps, and there’s very little you can do to exit a position outside of market hours.

Day trading is exciting

For many traders, day trading is simply exhilarating. It requires a unique mix of strategy, focus, cunning, and dedication. This is part of what makes day trading for beginners particularly exciting. There are few things quite like putting your money on the line every day and getting immediate feedback about whether your trade was good or bad.

Define your own goals

While day trading is a significant time commitment, it also allows you to set your own goals to some extent. You can choose your own hours and decide whether to spend two hours day trading each day or eight.

If you’re using day trading to supplement your income, you can even set a goal of a daily number of trades or a certain percent return for yourself. Once you reach that target, you can walk away from your computer for the rest of the day.

Day Trading Strategies

It’s essential to approach day trading with a clearly defined strategy. There are hundreds of popular day trading strategies, many of which suit different types of traders or work towards different trading goals. To help you choose a strategy, let’s take a closer look at three of the most popular day trading methods.

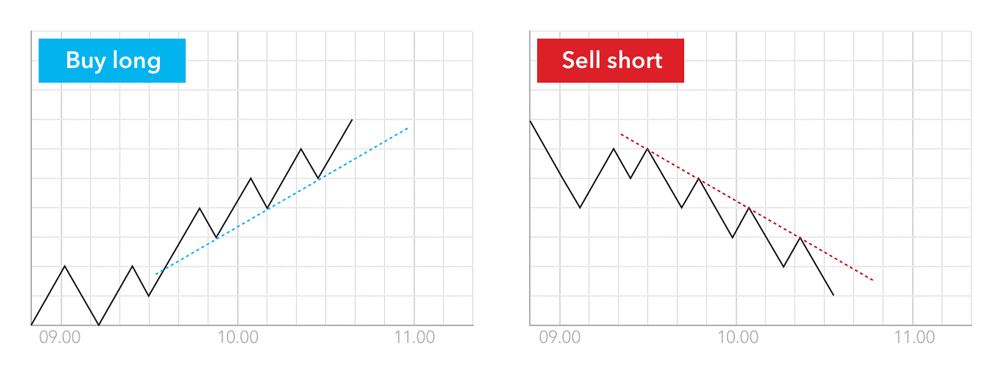

- Momentum trading

One of the day trading strategies for beginners is momentum trading. With this style of trading, you simply ride price trends as they happen throughout the day. For example, when the price of a stock or currency is rising, buy it. As soon as the upward momentum starts to fade, sell your position.

When momentum trading, it’s important to use momentum indicators like MACD and RSI. Generally, it is better to sell earlier rather than later – you want to lock in profits rather than hold too long and risk a trend reversal.

- Scalping

Scalping is a very short-term day trading strategy that involves buying and selling on the scale of seconds to minutes. The idea is to make many small, profitable trades over the course of the day. Each trade may only yield a gain of 0.1% or so, but if you make a dozen of these trades in a single day the profits can add up.

Scalpers often adopt strategies from momentum trading, looking to capitalize on short-lived trends. When scalping, it’s important to limit your losses. A single large loss can wipe out a whole day’s worth of small profitable trades.

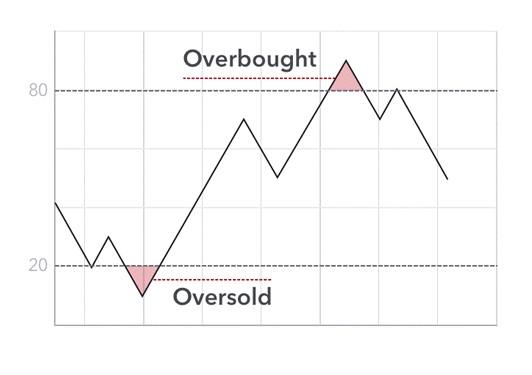

- Overbought and oversold trading

Many day traders buy and sell assets based on whether they are overbought or oversold relative to recent market conditions. Overbought and oversold levels are usually defined by technical indicators like RSI and Chaikin Money Flow. When an asset is oversold, buy it – and then sell as soon as the asset is no longer oversold according to the indicators you’re using.

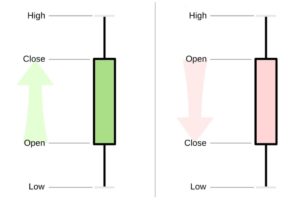

How to Read Candlestick Chart for Day Trading

The key to learn day trading is understanding candlestick charts. A candlestick chart is the most common tool that day traders use for analysing price movements. A single candlestick has two parts, the box, and the wick. The box shows the opening and closing price of the time interval – the opening price is on the bottom if the price rises, or on top if the price falls. The wick shows the high and low for that time interval.

Candlesticks often show one minute’s worth of price data. However, you can also look at candlesticks that span one second, 15 minutes, or an hour. Many charting platforms colour candlesticks greens when the price rises and red when the price falls.

Swing Trading vs Day Trading

Swing trading and day trading share many strategies in common. However, whereas with UK day trading you place multiple trades per day and exit all positions by the end of the day, swing trading takes place over several days to several weeks.

It is possible to take part in both day trading and swing trading. However, you’ll need to look for different opportunities that match the different timeframes, even if you’re using a single strategy.

Day Trading Software

Most day traders get trading software from their broker. Exactly what tools and features your day trading software includes can vary, but you generally need access to advanced candlestick charts with plenty of technical indicators and drawing tools. Many day traders also look for news feeds, social networks, stock scanners, and price alerts within their trading software.

One important thing to consider when choosing a day trading software is whether or not you can create your own custom indicators. You might not need this functionality when starting out, but having the ability to build a personalized trading strategy can be important as you progress with day trading in the UK.

Day Trading Risks

Day trading is inherently risky, like any form of trading or investing. There is always a chance that a trade will go against you, in which case you could be forced to sell for a loss.

Day trading in the UK is somewhat riskier than other types of trading, though, in that you are constantly making decisions. During the trading day, there might not be much time to reflect on how things are going. Since day trading positions are often leveraged, there is also the possibility that sudden changes in the price of an asset can lead to a significant loss in the value of your position.

Day Trading Taxes

Figuring out taxes on day trading in the UK can be somewhat confusing. For better or worse, there’s no set tax rate on day trading profits. Rather, your tax depends on whether day trading is your primary income and what type of instrument you’re using to day trade.

For example, if you are trading by spread betting, you are not subject to capital gains tax in the UK. If you’re CFD trading, though, you do have to pay capital gains tax – which can be up to 20% of your profits. If you are stock trading, you are responsible for both capital gains tax and a stamp tax.

Popular Day Trading Books

If you want to learn more about day trading, there are plenty of books on the topic. Several we’d recommend diving into day trading for beginners are:

- ‘Trading in the Zone’ by Mark Douglas

- ‘Technical Analysis of the Financial Markets’ by John J. Murphy

- ‘How to Day Trade: A Detailed Guide to Day Trading Strategies, Risk Management, and Trader Psychology’ by Ross Cameron

- ‘Start Day Trading: A Quick and Easy Introduction to Making Money while Managing Your Risk’ by Michael Sincere

UK Day Trading Platforms

Finding the right broker for day trading is important. Your broker controls everything from the fees you pay to what assets you can trade to what day trading platform you can use.

1. Plus500

Plus500 is another commission-free CFD broker. You can trade hundreds of global shares, as well as forex, cryptocurrencies, and commodities. Plus500 has some of the lowest trading spreads we’ve seen, making it particularly cost-effective for day trading.

This UK day trading platform is easy to use and comes with more than 90 technical indicators. You also get access to dozens of drawing tools. However, note that you cannot create your own studies or forex signals with this platform.

One of the things we like the most about Plus500 is that it offers advanced price alerts. You can set triggers for any asset, and then a notification will be pushed to your smartphone when the target price is hit. That makes it easy to stay on top of the market even when you’re not at your computer.

2. IG

This broker gives you access to MetaTrader 4 for forex trading and ProRealTime for stock trading. Both charting platforms offer the ability to create custom indicators, set up automated signals, and backtest your trading strategy.

The catch is that IG is somewhat pricey. The platform charges above-average spreads for most trades, and you could even find yourself paying a commission for stock trades.

IG offers stock options and commodity futures in addition to stocks and forex trading. Options day trading with IG is particularly convenient since ProRealTime enables you to enter multi-leg options trades with ease.

Sponsored ad. 66% of retail investor accounts lose money when trading spread bets and CFDs with this provider.

3. FinmaxFX

FinmaxFX is built primarily for forex trading, but this broker also offers day trading on US and UK stocks, commodities, and indices. There are more than 45 different currency pairs available for trading and you’ll never find commission on FinmaxFX.

One of the nice things about this high leverage broker is that it offers ‘Micro’ trading accounts that require a minimum deposit of just £190. You can trade with leverage up to 200:1 to get the most out of a small account size. Plus, FinmaxFX often offers deposit bonuses to help bump up your available balance.

FinmaxFX uses the popular MetaTrader 5 day trading platform, which is one of the most popular in the industry. You can set up automated trading systems, backtest a custom strategy, or create custom dashboards to monitor different markets. MetaTrader 5 for FinmaxFX is also available on mobile. If you’re wondering what the most popular MT5 broker is, read our in-depth guide to find out.

Sponsored ad. Your capital is at risk.

Day Trading UK – Conclusion

Day trading requires hard work, determination, and focus in order to profit. But when done correctly, UK day trading can be an exciting and potentially lucrative form of trading. You can day trade in nearly any market and there are tons of existing strategies you can use or modify.

Frequently Asked Questions on Day Trading

How does day trading work?

Day trading involves buying and selling assets like stocks, forex, or options within a single day. Day traders rarely or never hold positions overnight. The goal is to capitalize on small price changes and compound your account value every day.

What is pattern day trading?

The pattern day trading rule applies to US traders, but not to UK traders. This rule requires day traders to keep a minimum account balance of at least $25,000.

What is day trading?

Day trading consists of buying and selling financial assets before the end of a single trading day. Day traders trade many instruments within a single day to make profits from small price movements.

Michael Graw

Michael Graw is a freelance journalist based in Bellingham, Washington. He covers finance, trading, and technology. His work has been published on numerous high-profile websites that cover the intersection of markets, global news, and emerging tech. In addition to covering financial markets, Michael’s work focuses on science, the environment, and global change. He holds a Ph.D. in Oceanography from Oregon State University and worked with environmental non-profits across the US to bridge the gap between scientific research and coastal communities. Michael’s science journalism has been featured in high-profile online publications such as Salon and Pacific Standardas well as numerous print magazines over the course of his six-year career as a writer. He has also won accolades as a photographer and videographer for his work covering communities on both coasts of the US. Other publications Michael has written for include TechRadar, Tom’s Guide, StockApps, and LearnBonds.View all posts by Michael GrawWARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

BuyShares.co.uk © 2026 All Rights Reserved. UK Company No. 11705811.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up

The key to learn day trading is understanding candlestick charts. A candlestick chart is the most common tool that day traders use for analysing price movements. A single candlestick has two parts, the box, and the wick. The box shows the opening and closing price of the time interval – the opening price is on the bottom if the price rises, or on top if the price falls. The wick shows the high and low for that time interval.

The key to learn day trading is understanding candlestick charts. A candlestick chart is the most common tool that day traders use for analysing price movements. A single candlestick has two parts, the box, and the wick. The box shows the opening and closing price of the time interval – the opening price is on the bottom if the price rises, or on top if the price falls. The wick shows the high and low for that time interval.