Chinese electric vehicle (EV) company Zeekr, which went public in the US earlier this year, has said that its batteries can now charge faster than Tesla’s batteries. The shares closed sharply higher yesterday after the news came out.

The Chinese EV market is anyways the most competitive globally and foreign and domestic companies compete aggressively for a pie of the world’s biggest market for electric cars. With Chinese EV companies coming up with compelling product propositions at attractive prices, foreign automakers like Tesla could face a bumpy road ahead.

Zeekr says its new batteries can charge faster than a Tesla

Notably, Zeekr’s new batteries can go from 10% to 80% charge in a mere 10.5 minutes. According to the company, it can achieve the feat in 30 minutes when the temperature drops to -10 degrees Celsius. Tesla Model 3 on the other hand can charge upto 175 miles in 15 minutes.

Fast charging, access to more charging stations, and a higher range are among the factors that can boost EV adoption and get more fence-sitters into buying an electric car. Importantly, a battery is the most important hardware component of an EV and is the costliest as well.

Companies have been taking several steps to improve their overall proposition for EV buyers. NIO for instance offers a battery swap and subscription service wherein the customer can buy the vehicle without the battery – thereby lowering its initial buying price. The car owner can then take the battery on a subscription. Also, the company offers a 3-minute swap service which is among its USP.

Tesla on the other hand has built its sprawling network of Superchargers and other players like Ford, General Motors, Volvo, and Polestar have partnered with it to share these Superchargers.

Zeekr shares fell to record lows

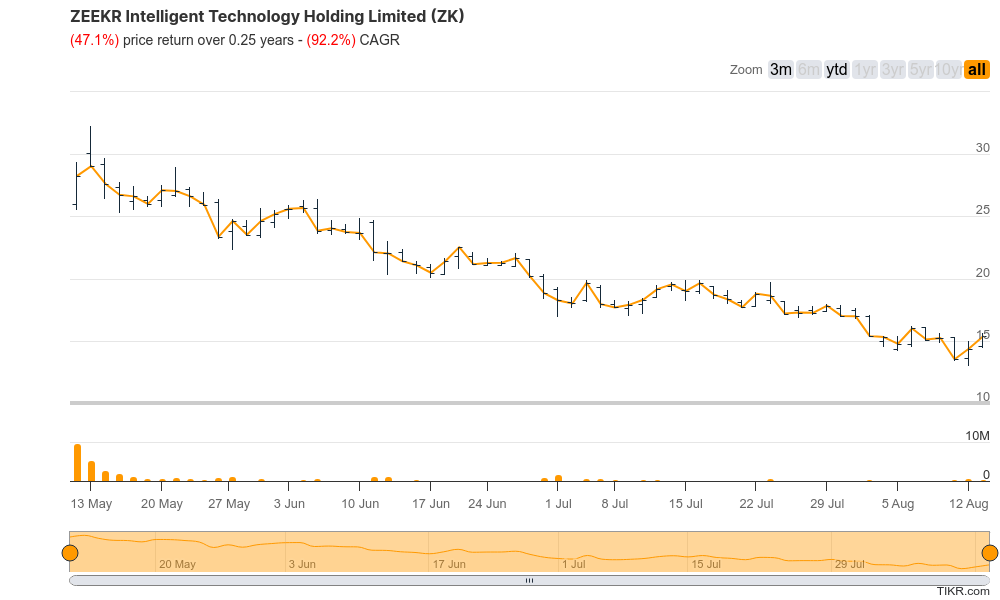

Zeekr which is backed by Geely went public in the US markets in May – pricing the issue at the top end of the guidance and issuing more shares than initially planned.

The Chinese EV company sold 21 million shares in the IPO and raised $441 million from the offering. Geely, which also owns the UK’s Lotus and Sweden’s Volvo would continue to hold over a 50% controlling stake in Zeekr post the IPO.

However, the stock fell from the IPO price of $21 and recently fell to record lows amid the broad-based selling in Chinese EV shares.

Zeekr reported a 30% rise in July deliveries

Zeekr delivered 15,655 EVs in July which was 30% higher YoY. In the first seven months of 2024, it has delivered 103,525 EVs which is 89% higher than the corresponding period last year. In July, it reached the milestone of delivering its 300,000th vehicle and its cumulative deliveries now stand at 300,158.

Musk has praised Chinese EV companies

Tesla CEO Elon Musk has been all praise for Chinese EV companies and the country’s EV ecosystem. During Tesla’s Q4 2023 earnings call earlier this year he said, “Frankly, I think, if there are not trade barriers established, they will pretty much demolish most other companies in the world.”

He added, “The Chinese car companies are the most competitive car companies in the world. So, I think they will have significant success outside of China depending on what kind of tariffs or trade barriers are established.”

Ford has also said that the company needs to compete with Tesla and Chinese EV companies to succeed in the electric car market.

Chinese EV companies face tariffs in the West

Meanwhile, in what’s a challenge for Chinese EV companies like Zeekr and NIO, Western countries are looking to clamp down on imports of Chinese electric cars. In June, the Biden administration increased the tariffs on Chinese EVs from 25% to 100%. “With extensive subsidies and non-market practices leading to substantial risks of overcapacity, China’s exports of EVs grew by 70% from 2022 to 2023—jeopardizing productive investments elsewhere. A 100% tariff rate on EVs will protect American manufacturers from China’s unfair trade practices,” said the White House in its statement.

Meanwhile, speaking at the VivaTech conference in Paris, Musk opposed these tariffs and said, “Neither Tesla nor I asked for these tariffs.” He added, “In fact, I was surprised when they were announced.”

China is the second-largest market for Tesla

Notably, China is the second biggest market for Tesla after the US. The company has a Gigafactory in Beijing which is regarded as the company’s most efficient plant.

However, relations between Tesla and China have soared somewhat and the company hasn’t been able to get permission to expand its Berlin factory.

Notably, last year, the Communist country chided Musk after he replied to a tweet about a report about the COVID-19 pandemic’s connection to China.

In its report, The US Department of Energy concluded with “low confidence” that the COVID-19 pandemic “likely” originated in a lab in Wuhan. China has been quite itchy about being linked to the pandemic even as the first cases of the virus which took away millions of lives across the world were reported in Wuhan.

While Musk tends to speak his mind (often controversially) about various topics, he has in general not been public with his views on China – at least critically.

Meanwhile, after the US, the E.U. also imposed additional tariffs on Chinese EVs. China opposed the tariffs and has officially filed a complaint with the WTO over the provisional tariffs.

China EV price war

All said, the competition and price war in the Chinese EV market might only intensify as companies try to increase their deliveries. Notably, there has been a brutal price war in the Chinese EV industry since Q4 of 2022 when Tesla started to cut car prices to spur sales.

Tesla’s price cuts were followed by similar announcements from other carmakers including Xpeng Motors, Ford, Toyota, and Nissan. Last year, even NIO lowered car prices. Previously the company had categorically said that it wouldn’t join the price war.

Question & Answers (0)