Berkshire Hathaway released its third-quarter earnings over the weekend, showing that the company repurchased $9 billion worth of its own shares. That’s a new record for the company breaching the $5.1 billion figure in the previous quarter. It begs the question, is Berkshire running out of good companies to buy at a cheap price?

In the first nine months of 2020, Berkshire Hathaway has repurchased $15.7 billion of its shares. This is a new record for the company. In fact, the $9 billion buybacks that the company completed in the third quarter is more than what it has done in any full year.

Warren Buffett and share buybacks

Historically, Berkshire Hathaway chairman and legendary value investor Warren Buffett hasn’t been a big fan of buybacks and has preferred to invest the cash, either organically or through investments in publicly traded companies.

Before 2018, Berkshire Hathaway had a quantitative share buyback policy and it repurchased shares when the stock price was above 120% of the book value. However, in 2018, the company amended its buyback policy and gave more leeway to Buffett and vice chairman Charlie Munger.

That said, despite having the mandate to increase the buybacks, Buffett and Munger have largely been conservative with the buybacks. Also, over the last two years, Buffett hasn’t also found many opportunities where he can deploy Berkshire Hathaway’s cash.

Berkshire Hathaway’s cash pile

Buffett did not go overboard buying shares in the fourth quarter of 2018 even as the markets tanked. Apple, that’s Berkshire Hathaway’s largest holding also crashed 30% in that quarter. On the contrary, the company sold some Apple shares in the quarter. It later clarified that it wasn’t Buffett but one of its lieutenants who made the sale. Apart from Buffett, Ted Weschler and Todd Combs are the other two investment managers at Berkshire Hathaway. They, however, have a limited amount to invest.

Buffett also sold stocks in the first and second quarters of 2020. In April, he also exited all the four airlines that Berkshire Hathaway was holding at a massive loss. Many were left perplexed at Buffett’s decision to exit the airline stocks as a massive loss as he has often preached to be greedy when others are fearful.

Berkshire Hathaway has been selling shares this year

Buffett continued to sell shares and net sold a record $13.1 billion worth of shares in the second quarter. He has sold his stake in some of the banks this year but added more Bank of America shares. Buffett did bought stakes in five leading Japanese trading companies and purchased the natural gas assets of Dominion Energy, but these did not help much in bringing down the company’s massive cash pile that soared to $147 billion at the end of the second quarter.

Despite record buybacks, Berkshire Hathaway’s cash pile moved little and it ended the third quarter with $145.7 billion worth of cash. We’ll get more information about what all Berkshire Hathaway brought and sold in the third quarter later this month when it files its 13F. However, looking at the cash pile, it is unlikely that the conglomerate made any big bang purchases in the third quarter as well.

What should investors make out of Berkshire Hathaway’s record buybacks?

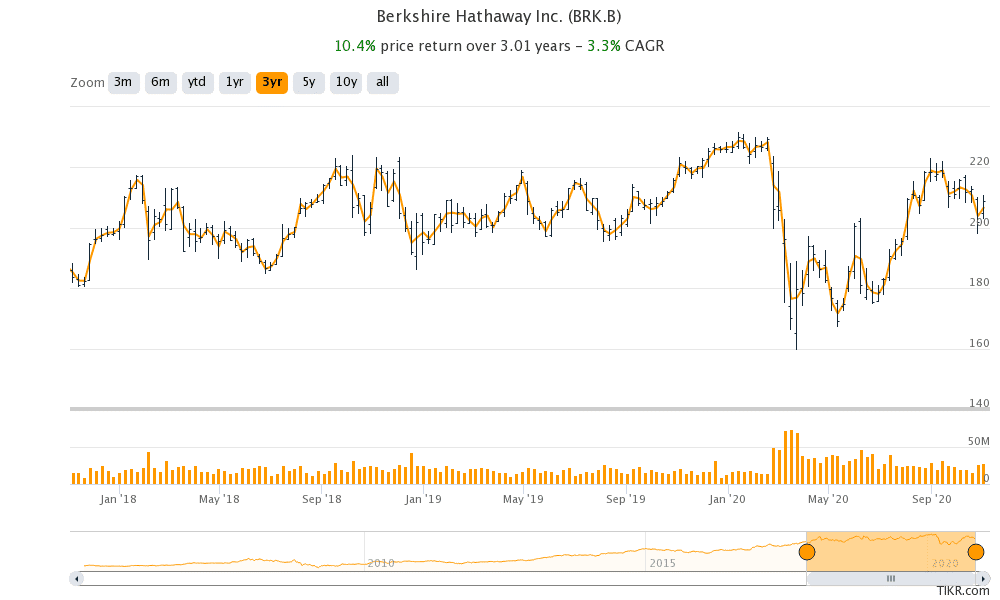

Berkshire Hathaway stock underperformed the S&P 500 by over 20% last year. This year, the stock has lost 7.8% even as the S&P 500 is up 8.6%. While Berkshire Hathaway has narrowed its underperformance versus the S&P 500 slightly, it is still underperforming by almost 16.5% this year and this does not include the S&P 500’s roughly 2% dividend yield.

After the underperformance over the last two years, Berkshire Hathaway is now trailing S&P 500 over the last decade. That’s not the kind of returns investors expect from Warren Buffett who is arguably among the best investors of all times.

Why is Warren Buffett underperforming?

One of the main reasons Berkshire Hathaway is underperforming is because value investing has underperformed growth investing by a wide margin. The current divergence between the valuation of growth and value stocks is running at record levels.

Also, Buffett has largely stayed away from tech stocks that have been the key enablers of this market rally. While Berkshire Hathaway is Apple’s second largest shareholder, Buffett sees it as a consumer company rather than a tech company. Berkshire Hathaway also has a small exposure to Amazon stock but it was a different investment manager and not Buffett who took the stake in Amazon. In 2018, Buffett had admitted to missing out on companies like Amazon and Google (now Alphabet).

Given the surging valuations and the unavailability of deals that might look tempting to a value investor like Buffett, he hasn’t been investing a lot of money which is hurting Berkshire Hathaway’s performance.

Why buybacks are the correct move for Berkshire Hathaway

According to Warren Buffett, if a company is not able to profitably invest the money it should return the money to shareholders. Supporting Apple’s buybacks, Buffett said in 2018 that if Apple stock is “selling for less than their worth and they have the money and they don’t see an acquisition that’s even more attractive, they should buy in their shares.”

In this case, Buffett hasn’t been following his own advice by only making small buybacks. Here it is worth noting that while Berkshire Hathaway collects billions of dollars in dividends every year, it does not pay any to its shareholders. In that scenario, buybacks are the only way it can return back the money to shareholders and Buffett and Munger have taken the correct decision by increasing the buybacks.

Should you also follow Warren Buffett?

Looking at Buffett’s actions, it seems that the Oracle of Omaha, as he’s popularly known as, does not see a lot of investment opportunities. That’s understandable given the soaring valuations and the COVID-19’s economic impact.

Meanwhile, by repurchasing a record number of Berkshire Hathaway shares, Buffett has signalled that he finds value in the stock at these prices. If you are a relatively risk-averse value investor, you should consider adding Berkshire Hathaway stock to your portfolio. While the stock has underperformed the markets over the last decade, value investing might soon stage a comeback. To add to that, you can never rule out a comeback from Buffett especially when he has a war chest of over $145 billion at his disposal.

Question & Answers (0)