Bitcoin prices are tumbling today amid fears of a capital gains tax hike by the Biden administration. US stock futures are up marginally in premarket price action after falling yesterday.

Bitcoin fell below $50,000 on fears of a capital gains hike in the US prompted investors to sell the digital currency. The cryptocurrency market has lost over $250 billion in market capitalisation over the last 24 hours amid a broad-based sell-off in all crypto assets.

Biden plans to raise capital gains tax

Capital gains is a form of a direct tax that is paid on the profits made on the sale of capital assets. These can be a financial asset like stocks or digital currencies, or a physical asset such as real estate. Under current US law, short-term capital gains, or the gains on assets sold within one year, are taxed at the marginal income tax rate. Long-term capital gains are taxed in various schedules based on the taxpayers’ total income.

Currently, the maximum capital gains tax (CGT) rate is 20% at the federal level, although states like California and New York charge a higher rate. Reports suggest that Biden intends to increase the maximum CGT rate to 40%. When the 3.8% surcharge for the Affordable Care Act is included, the maximum capital gains tax in the US will rise to 43.4%.

Biden versus Trump

During his election campaign, Biden had talked about raising taxes on the rich. This was in stark contrast to Republican candidate Donald Trump who said that he would lower taxes further. Trump’s tax reforms had helped US stock markets move higher, even though organic earnings growth rate was tepid throughout his tenure.

Trump had even mocked Biden, saying no president can win elections on the plank of a tax hike. However, as it turned out, Biden won the elections and took office as the 46th US president earlier this year.

Biden’s economic stimulus

Biden made some quick decisions including providing the stimulus to the US economy. Last month, Biden unveiled the $2 trillion infrastructure spending programme named the American Jobs Plan. While it talked about spending massively on the country’s crumbling infrastructure and scaling up the ecosystem for electric vehicles, the plan also targeted increasing the corporate tax rate from 21% to 28% ,so that “corporations pay their fair share of taxes.”

Also, it proposed to tax US companies on a country-by-country basis so that they also pay taxes on businesses in tax havens. The plan also says that “It will also eliminate the rule that allows US companies to pay zero taxes on the first 10 percent of return when they locate investments in foreign countries.”

Biden’s capital gains tax plan

Biden’s proposed increase in capital gains tax had been trailed earlier so shouldn’t haven been a surprise. Ed Mills, an analyst at Raymond James was surprised at the reaction to the proposed tax hike. “I am shocked that it’s shocking. This is exactly what Biden had ran on,” said Mills.

He added, that Biden “has been saying for weeks that there is going to be a social infrastructure bill coming that is going to include increase in taxes on the top income households.” According to Mills, “I do think this is a high-water mark. It would’ve been more shocking if this was not going to be included in the plan.”

Is Biden testing waters for capital gains tax hike?

Doug Sandler, head of global strategy at RiverFront Investment Group, believes that Biden might be testing the waters by proposing a massive hike in CGT, and eventually a lower rate might be negotiated with Republicans. “That’s just the way politics work,” said Sandler.

According to Sandler, “We’re going to negotiate from here. We probably have some compromise, but anyone who is shocked by this has not been paying attention to exactly what Biden has said he’s going to do and what he has been doing since he’s been inaugurated.”

Why the US needs to raise taxes

The US has little option but to raise taxes, although there are conflicting opinions on the intensity and the timing. While the massive stimulus package announced by both the Trump and Biden administration helped the US economy, in the medium to long term the extravaganza has to be repaid. US debt-to-GDP ratio has already crossed 100% and is set to rise further with the stimulus and infrastructure investments that the Biden administration is announcing.

If the fiscal largesse is not repaid, it will have a long-term impact on the country’s financial stability and its status as the world’s strongest economy. The Federal government has been running a deficit budget for years now and the pandemic has only amplified the shortfall between what the US government receives in taxes and what it spends.

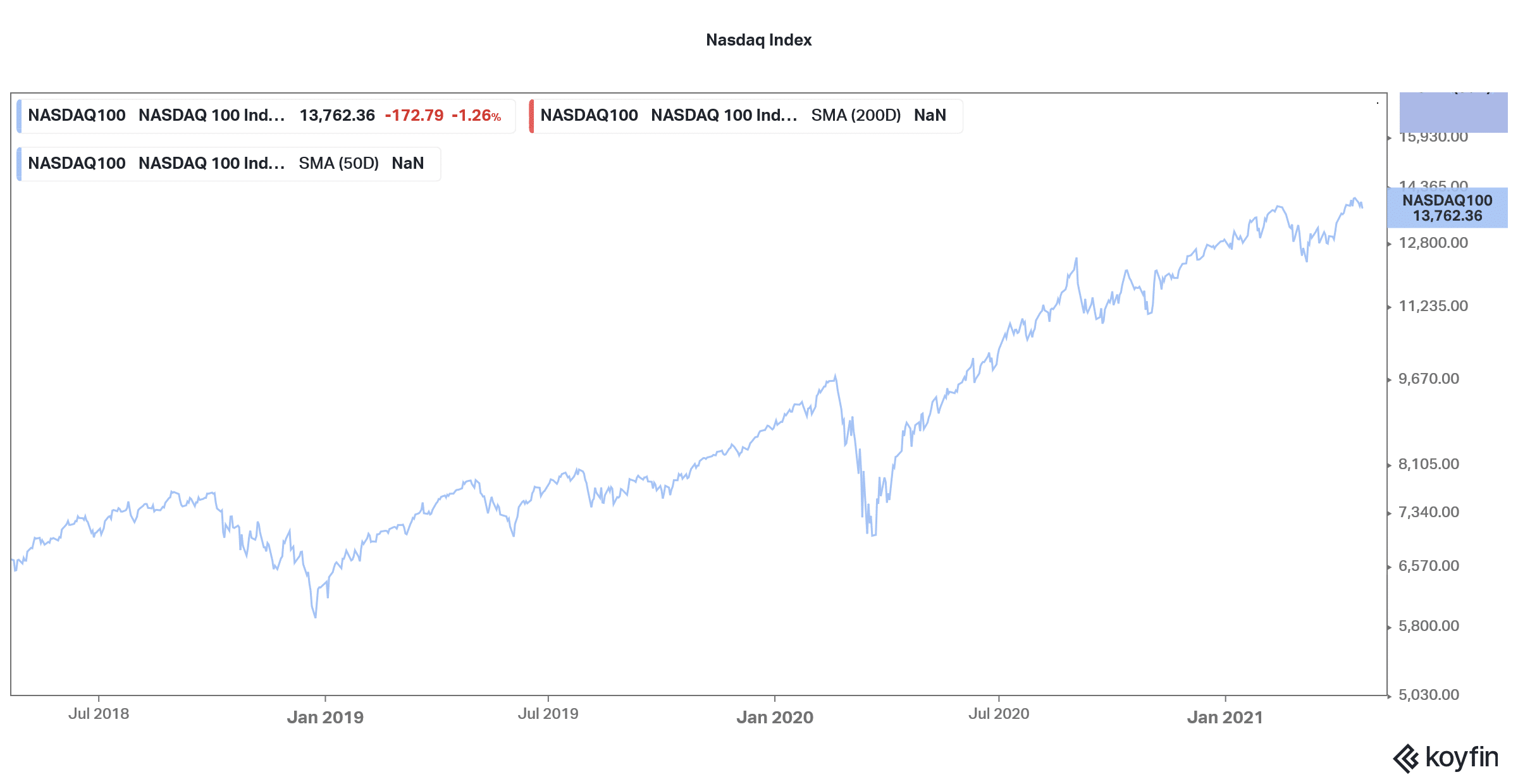

In the short term, the capital gains tax might be negative for the markets and we could see a sell-off in assets as investors sitting on massive capital gains on their investments scramble to sell them before the tax hike kicks in.

However, in the medium to long term, it may help the US economy. The hike in CGT could be among the first steps that the Biden administration takes to steer US fiscal policy towards a more normalised environment.

Question & Answers (0)