Shares of telecom operator Vodafone were trading over 3% higher at 123.3p in early trading today after the company posted better-than-expected earnings for the first half of the fiscal year.

Lower roaming revenues dented the company’s first-half performance. The company expects its performance to improve in the second half. Vodafone also announced an interim dividend of 4.50 (Euro cents per ordinary share, 4.07p), with a record date (cut-off date for payments) of 18 December.

Vodafone first half earnings

Vodafone reported Group revenues of €21.4 billion in the first half of the year. Its revenues fell 2.3% year over year. The company blamed lower roaming revenues, fewer visitors due to COVID-19, and lower handset sales for the decline in revenues.

Meanwhile, Vodafone’s adjusted EBITDA (earnings before interest, tax, depreciation, and amortisation) fell 1.9% over the period to €7 billion. The company delivered better than expected performance on the EBITDA level despite the 2.3% fall in revenues due to cost cuts. It realised €300 million worth of savings in its operations in the first half of the year at its Europe operations.

Calling the first-half performance “resilient” despite the COVID-19 related headwinds, Vodafone’s Group CEO Nick Read said that that it is increasingly confident of meeting its full year outlook.

Vodafone’s guidance

Vodafone reaffirmed its fiscal 2021 guidance of adjusted EBITDA between €14.4-€14.6 billion. This would mean adjusted EBITDA of between €7.4-€7.6 billion in the second half of the year. At the midpoint of the guidance, Vodafone expects its second half adjusted EBITDA to rise by €500 million as compared to the first half of the year.

The company expects to post over €5 billion in free cash flows in the fiscal year 2021. The guidance does not assume any expenses related to restructuring and spectrum. In the first half of the fiscal year, Vodafone reported pre-spectrum and pre restructuring free cash flows of only €451 million. However, its net debt fell to €43.9 billion at the end of the fiscal first half 2021 as compared to €48.1 billion at the corresponding period last year. The net debt fell primarily due to the disposal of assets.

Restructuring

The company has launched 5G services across 127 cities in Europe. Vodafone is restructuring its business to focus on Europe and Africa where it is the market leader. Overall, the company is the second-largest telecom operator globally. The company has exited New Zealand, Egypt and Malta and has gone for a merger with other companies in India and Australia.

The restructuring made sense for the company as most of its profitability comes from Europe and Africa markets, and it has a strong market-leading position in these markets. In the first half of fiscal 2021, Europe accounted for 80% of Vodafone’s adjusted EBITDA. In contrast, its competitive position is weak in some of the other markets.

India operations are making massive losses

For instance, it is third in the Indian telecom market, where there are only four operators. Despite going for a merger with Indian telecom company Idea, Vodafone’s competitive position is weak in Indian markets and the operations are posting losses. To add to the woes, the joint venture owns billions of dollars to the Indian government as dues.

IPO of tower business

Vodafone plans to list its towers business through a spin-off in Frankfurt next year. The company would be providing more details about the IPO on Tuesday. Globally, many telecom operators have spun off their tower business to unlock value.

Vodafone shares in 2020

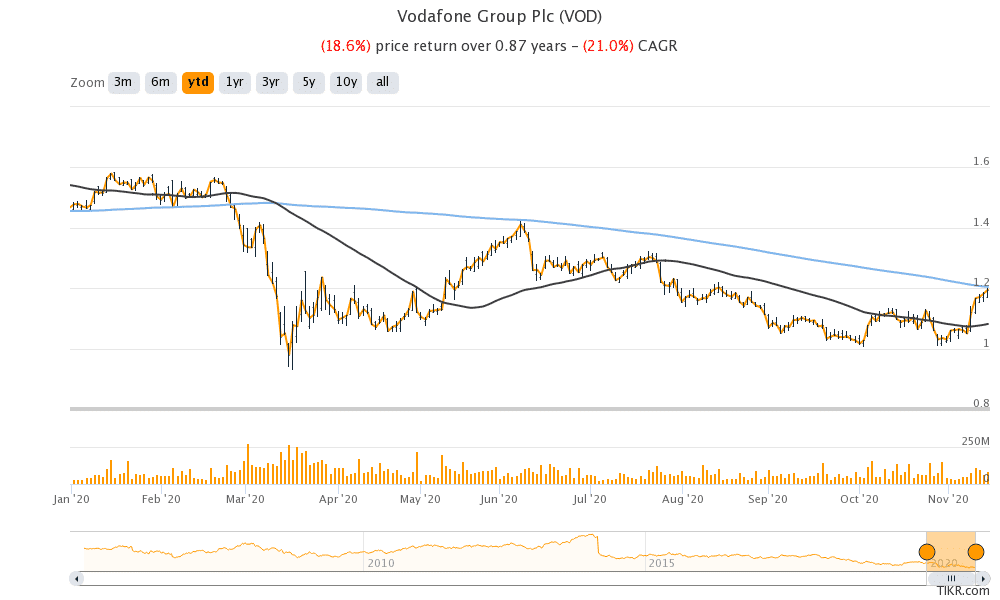

Vodafone shares has lost over 17% so far in 2020. That said, the share is now approaching its 200 day SMA (simple moving average). It fell below its 200 daily moving average in February and fell sharply thereafter amid the sell-off in share markets,

Vodafone shares tested their 200-day SMA again in June but could not break the level convincingly. Over the last few months, the 50-day SMA has acted as a resistance line for Vodafone shares. However, it crossed above its 50-day SMA earlier this month. If the shares can cross above the 200-day SMA as well, it would confirm the short-term uptrend. The shares trade at an NTM (next-12 month) price to earnings multiple of 18x which looks reasonable.

Question & Answers (0)