US housing market was a strong pillar of growth for the economy for almost two years. The sector started to show signs of stress amid the Fed’s rate hikes. The US Central Bank has raised rates four times in 2022.

US mortgage rates spiked to multi-year highs earlier this year after having fallen to record lows last year. Now, there are ample signs of a severe slowdown in the housing market and even the Federal Reserve has acknowledged the stress in the sector.

US housing sales fall

Data released today showed that the US existing home sales fell 6% in July as compared to June. The YoY fall was even more severe at 20%. As the US economy started to recover in the back half of 2020, housing prices spiked. The market was constrained by supply as not enough homes got built due to the labour shortage situation. Then we had the input cost inflation as prices for everything from steel to lumber spiked.

This, coupled with the demand-supply mismatch, put upwards pressure on housing prices. Meanwhile, the home affordability index also plunged as wage growth lagged the increase in home prices. Now, after two years, the US housing market is showing signs of stress.

Home price growth has stalled

Danielle Hale, chief economist at Realtor.com said, “The median home sales price continued to climb, but at a slower pace for the fifth consecutive month, shining a light on how downshifting buyer demand is moving the housing market back toward a more normal pace of activity.” Hale added, “A look at active inventory trends shows that home listings were nearly twice as likely to have had a price cut in July 2022 compared to one year ago.”

Meanwhile, the market is still reasonably tight as there were 1.31 million homes for sale at the end of June which is 3.3 months of supply. One of the factors that have been supporting the housing market is the strong job market. Despite the US economy having contracted in the first half of 2022, the unemployment rate has continued to fall and is at a 50-year low.

Housing recession

The National Association of Home Builders/Wells Fargo Housing Market Index fell to 49 in August. Readings below 50 signal a recession—just like we have in PMIs. “Tighter monetary policy from the Federal Reserve and persistently elevated construction costs have brought on a housing recession,” said NAHB Chief Economist Robert Dietz.

He added, “The total volume of single-family starts will post a decline in 2022, the first such decrease since 2011. However, as signs grow that the rate of inflation is near peaking, long-term interest rates have stabilized, which will provide some stability for the demand-side of the market in the coming months.”

Mortgage rates have come down

Mortgage rates have dropped despite Fed’s rate hikes. The bond yields have also come down as markets expect the Fed to pivot towards rate cuts. Those hopes were meanwhile dashed when the Fed July meeting minutes were released. The minutes made it amply clear that the Fed is not pivoting towards rate cuts anytime soon.

The Fed minutes said, “With regard to current economic activity, participants noted that consumer expenditures, housing activity, business investment, and manufacturing production had all decelerated from the robust rates of growth seen in 2021.”

It added, “Participants also observed that housing activity had weakened notably, reflecting the impact of higher mortgage interest rates and house prices on home affordability. Participants anticipated that this slowdown in housing activity would continue and also expected higher borrowing costs to lead to a slowing in other interest-sensitive household expenditures, such as purchases of durable goods.”

The housing slowdown is bad for other sectors also

The housing sector has a domino impact on the economy. It is among the major consumers of metals and also a key employment generator. With the US real estate sector showing signs of stress, we could see its repercussions on other sectors also.

As investors would recall even the 2008-2009 Global Financial Crisis emanated from the US housing market. The real estate sector in China, the world’s second-largest economy, is in no good shape either. Many see the Evergrande debt crisis as just the tip of the iceberg in the Chinese real estate market.

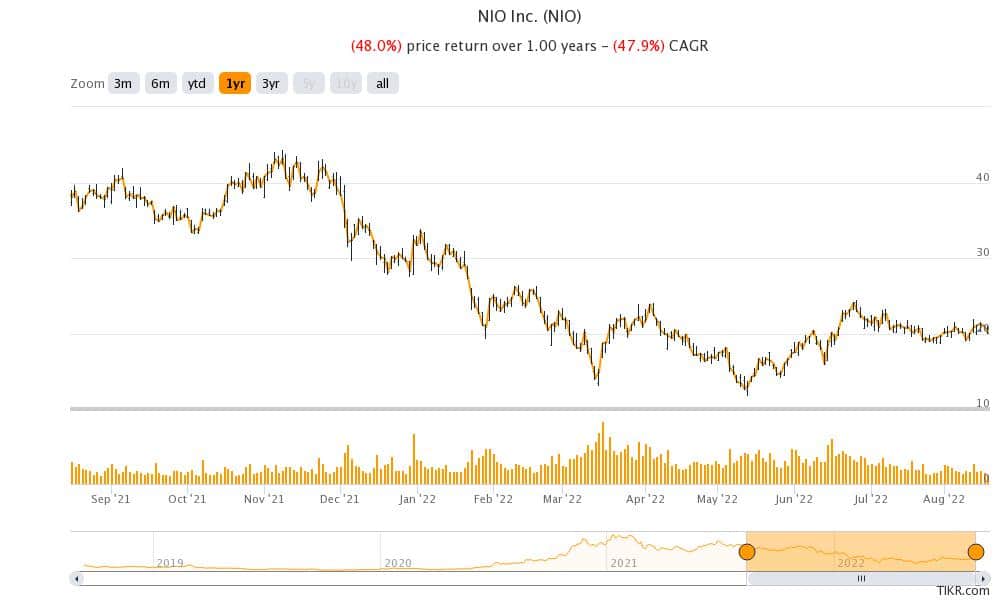

Chinese shares face delisting in the US

Meanwhile, US-listed Chinese shares like NIO and Alibaba recently plunged on fears of delisting. Three Chinese state-owned companies were delisted from the US markets. US laws now mandate auditing of foreign companies also and those who refuse, risk delisting. Chinese companies are especially under scrutiny after the Luckin Coffee accounting scandal and the rising US-China tensions.

Question & Answers (0)