Uranium-related stocks and ETFs are taking off today after the US Senate passed a bill supported by both parties that – among other things – included the establishment of a national strategic reserve of uranium.

The US legislative body, through the Committee on Environment and Public Works, has cleared the path for the country to build a reserve of the mineral after it deemed it as one of “vital importance to national security”.

The bill, known as the American Nuclear Infrastructure Act (ANIA), would effectively exclude companies that are controlled, owned, or based in Russia or China, from participating in the program, which according to a rough draft of the 2021 budget published by the Senate Appropriations Committee will be granted an initial amount of $150 million to start the inventory build-up.

Companies with uranium mining operations in the US will be among the most favored by the bill, as one of its goals is to revitalize the local industry to strengthen the country’s strategic positioning in regards to this important mineral, which is vital for the operation of the 96 active reactors that the nation currently operates.

Shares of Canada-based uranium miner Cameco Corp (NYSE: CCJ) are soaring for the second consecutive day, posting a 10% daily gain both yesterday and today, while jumping to their highest level since April 2019.

Meanwhile, shares of the Texas-based miner Uranium Energy Corp (NYSE: UEC) are jumping 17% today as this firm could be among the most favored amid the resolution, given its important presence in the country with active sites in Arizona and Colorado and a late-stage project in Reno Creek, Wyoming.

However, if you are looking to expose your portfolio to this now up-and-coming industry, the Global X Uranium ETF (NYSE: URA) could provide the level of diversification required to keep volatility in check while also offering the upside that this entire sector could see amid this important development.

Growth drivers for the uranium mining industry in the US

There are multiple factors that are currently supporting a favorable outlook for the US uranium mining industry, including the following:

- There is bipartisan support in regards to the importance of building a strategic uranium reserve by strengthening the local industry as reflected by the passing of ANIA.

- UEC forecasts indicate that building a strategic reserve for the United States by relying on local miners could result in $1.5 billion in inflows for the industry over the next 10 years.

- Effectively banning imports from China and Russia could help turn around the situation for uranium imports in the country, as imports have outpaced domestic production levels for more than two decades based on data from the US Energy Information Administration.

The technical case for URA

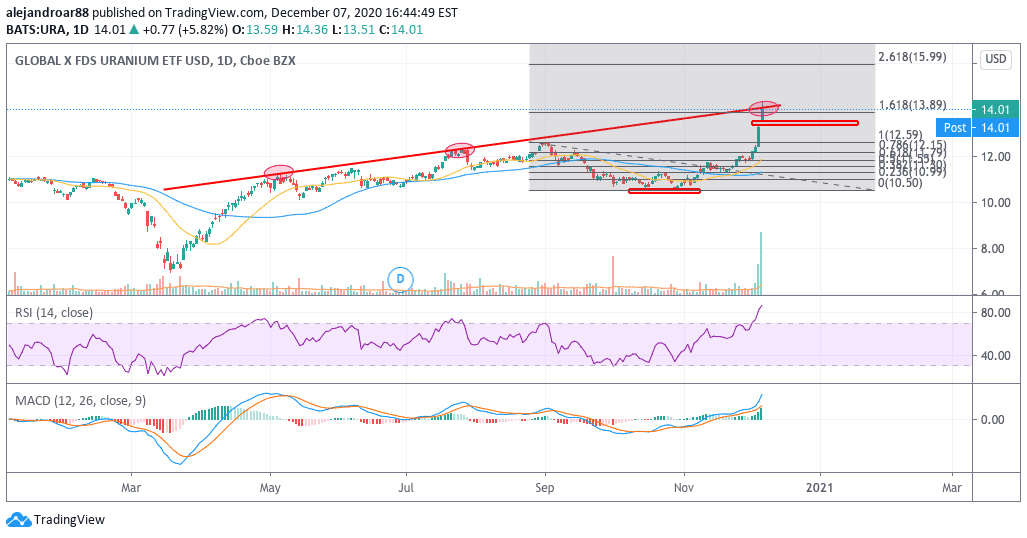

The latest action seen by Global X’s Uranium ETF has pushed the price above the upper trend line shown in the chart during intraday stock trading activity, although the price settled just below that line by the end of the session.

This four-day bull run seen by URA has pushed both the RSI and the MACD to overheated levels as the price action has shifted from a consolidation phase to a potentially new uptrend supported by a double-bottom at the $10.50 level.

Trading volumes have accompanied the surge and buyers seem to have outpaced sellers by a long shot, which ended up creating a bullish gap today that should serve as support over the coming days while the price takes a breather after this furious uptick.

The combination of an intraday breakout above the upper trend line shown above, the crossing of the 1.618 Fibonacci level, and the appearance of that bullish price gap is a confluence that traders should not ignore as it could be just the beginning of an important industry-wide uptick that could push URA to levels not seen in years, with a first short-term target set at $16 for this ETF.

URA enjoys an A MSCI ESG rating, which is given to funds that are rated positively from the standpoint of ESG. Additionally, URA’s holdings include a diversified basket of multiple US-exposed uranium stocks including Cameco, NexGen Energy, Denison Mines, and Uranium Energy Corp.

Question & Answers (0)