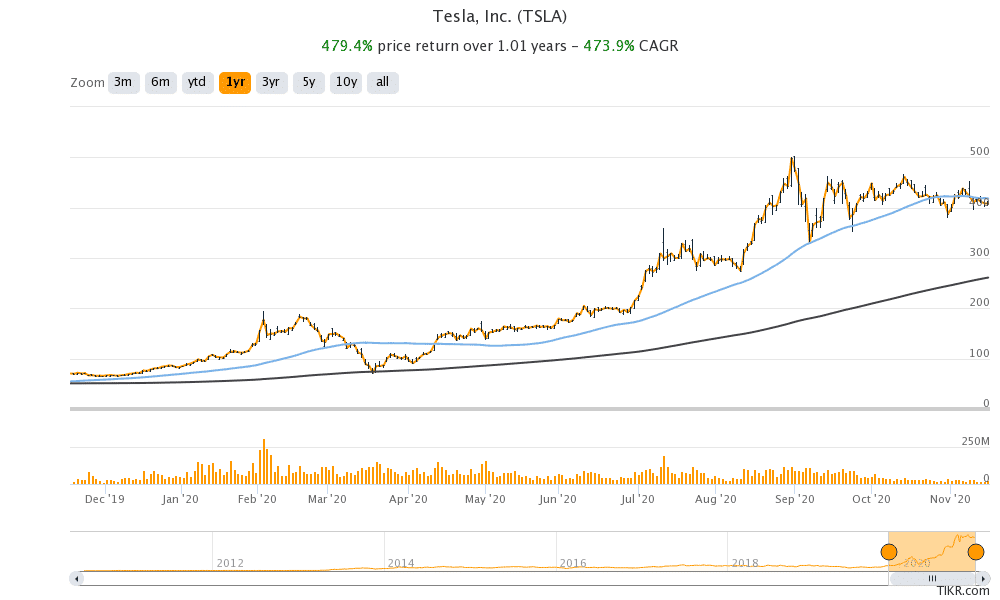

Tesla share are trading more than 12% higher at $459.32 in the US premarket today, after it was included in the S&P 500. It looks like a well-deserved place for the popular electric vehicle maker after being snubbed in September.

Tesla gets a place in the S&P 500

Stock indexes frequently rebalance their constituents in order to maintain the accuracy of the weightings of companies in the market or sector they are based on. The broader market indices such as the S&P 500 and Dow Jones Industrial Average are seen as a barometer for the US economy. Therefore, both these indices change their constituents so that their price movement is reflective of the US economy. As far as Tesla is concerned, it has redefined the automotive industry. Tesla’s success and soaring market capitalisation have prompted legacy automakers to focus on electric vehicles instead of traditional internal combustion engine cars.

Both Dow Jones and S&P 500 have reshuffled constituents in 2020

At times, the index shakeups are necessitated due to corporate actions. For instance, the Dow Jones had to reshuffle its constituents in August after Apple, its largest constituent, split its stock four for one. Since the Dow Jones is a price-weighted index, Apple’s weight, and hence the tech sector’s weightage in the index, would have come down post the split.

On other occassions indices add or remove a constituent so that the index remains representative of the economy. Incidentally, this year both the Dow Jones and S&P 500 have changed their constituents. In August, the Dow Jones announced that it would add Salesforce, Amgen, and Honeywell – that represented a major shakeup for the 30-share index. These companies replaced Raytheon, Exxon Mobil, and Pfizer.

S&P 500 passed on Tesla in September

In September, the S&P 500 also announced the inclusion of three new constituents. These were Teradyne, Etsy, and Catalent. The news came as a surprise to markets as well as Tesla fans. In July, Tesla met a key condition for inclusion into the S&P 500 after it posted a net profit in the second quarter of 2020—its fourth consecutive quarterly profit. The company posted a net profit in the second quarter despite the headwinds from COVID-19 pandemic. Its Freemont plant, where it produces most of its cars, was shut for many days during the quarter. Unlike legacy automakers that carry inventories of more than a month, Tesla is a supply-constrained company. It can sell only as many cars that it can produce.

Tesla has reshaped the automotive industry

Meanwhile, despite the production headwinds, Tesla has maintained its original guidance of selling over half a million cars in 2020. This is a remarkable achievement for the company and CEO Elon Musk. Five years back, Tesla was seen as a niche automaker selling only a few thousand cars a year. This year, Tesla’s cumulative deliveries since inception crossed 1 million. In the third-quarter earnings call, Musk alluded to the fact that Tesla might deliver a million cars in 2021.

Tesla posted a net profit in the third quarter of 2020 – a reflection of the fact that it is finally becoming a sustainably profitable venture. Tesla shares have soared almost 400% this year and the company has capitalised on the opportunity by raising over $7 billion by issuing more stock.

Tesla’s balance sheet is in strong shape

The share issuance has bolstered Tesla’s balance sheet and it now has enough cash to fund its new factories in Berlin and Texas, as well now having enough to continue funding its research and development on autonomous vehicles.

Coming back to Tesla’s inclusion into the S&P 500, it looks a well-deserved place. Notably, Tesla shares had tanked in September when it got a snub from the S&P 500. However, markets cheered the news of its inclusion in the S&P 500 by sending its shares north by over 13%. Musk, who is now among the top 10 richest persons globally, saw his net worth increase by around $15 billion after the spike.

Why is the inclusion into the S&P 500 important?

The S&P 500 is the most indexed globally and over $11.2 billion is either indexed or benchmarked to the index. Out of these $4.6 billion is indexed to the S&P 500. After Tesla’s inclusion into the S&P 500, funds that are indexed to it would have to buy $51 billion worth of Tesla shares while selling other shares in the index.

That’s a massive amount of buying for Tesla’s whose market capitalisation was a little less than $400 billion based on yesterday’s closing prices. The inclusion could drive Tesla shares even higher. In 1999, Yahoo shares rallied 64% over five sessions after its inclusion in the S&P 500 was announced.

Tesla’s valuation

Tesla would be one of the biggest constituents to join the S&P 500 and it would be among the top 5% of companies in the index. Here it is worth noting that since the S&P 500 is a market capitalization-weighted index, a share’s weighting is determined by its market cap.

Meanwhile, many have been apprehensive about Tesla valuation as its market capitalisation went above the combined market capitalisation of the largest automakers including Toyota, Volkswagen, General Motors, and Ford. While Tesla has achieved a critical mass with its deliveries, its annual deliveries are still a fraction of what other automakers sell.

“(Monday’s) price jump means the retirees and other individual investors who put their money into index funds will see some of their money go into Tesla share at a price even higher than its controversially high pre-S&P price. It’s a downside of index investing for conservative investors,” said Erik Gordon, a professor at the University of Michigan’s Ross School of Business.

Tesla versus Chinese electric vehicle makers

That said, looking at the valuations of Chinese electric vehicle shares including NIO, XPeng, and Li Auto, Tesla’s valuations look much more sombre. In fact, NIO’s valuation premium is over 2x of Tesla based on the NTM (next-12 months) price to sales ratio and the gap is the widest in history.

This, however, does not mean that Tesla is not overvalued at these levels. But then, it’s a share running on dopamine of liquidity which was reinforced when it split share five for one in August. Now, as that boost was dying down, the S&P 500 has given the Elon Musk run company another liquidity boost. For now, its a well-deserved entry into the S&P 500 for Tesla.

Question & Answers (0)