Shares of Japanese conglomerate SoftBank are sliding this afternoon despite the fact that the company headed by Masayoshi Son (pictured) swung to profits during its first fiscal quarter of 2020 after reporting a record loss of $13 billion during the last fiscal year.

The company reported a quarterly pre-tax profit of $12 billion, managing to recover most of the loses it saw at the end of the previous fiscal year, although a significant portion of these gains are unrealised profits – meaning that they come from higher valuations of the financial assets held by the conglomerate.

Higher equity prices resulting from the broad-market rally that followed the pandemic sell-off of February were one of the primary drivers for these positive quarterly results, along with the partial sale of T-Mobile, which netted the firm around $3.96 billion pre-tax.

Moreover, the Japanese firm said it partially monetised its Alibaba shares by receiving funds from prepaid forward contracts, procuring a total of $13.7 billion as a result of this operation.

How is the market reacting to the news?

Although the company’s results beat estimates of $7 billion in profits that S&P Global had forecasted for the conglomerate, SoftBank (SFTBY) shares are sliding 2.15% so far on Wall Street after dropping 2.45% in Tokyo earlier in the day.

This drop could be because of suspicions that the firm is resorting to pulling a few rabbits out of the hat rather than showing improvements in the fundamentals of its underlying businesses. Specifically that means looking at the performance of its investments in startup businesses including Uber (UBER), WeWork, and more recently Lemonade (LMND).

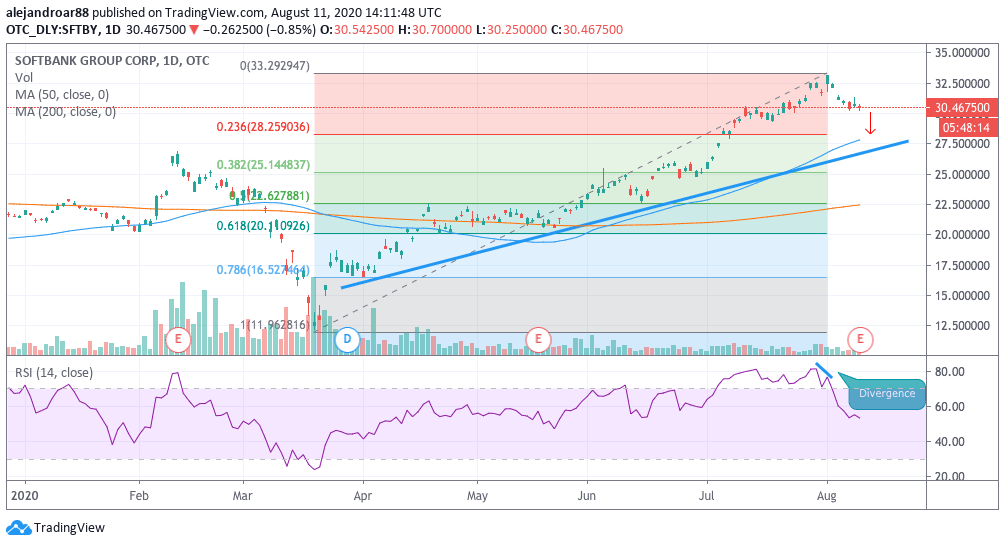

SoftBank shares topped at $33 per share on 31 July and slid back down to $30 during this morning’s stock trading activity, posting a 9% loss in roughly 11 days.

What could be expected from SoftBank shares in the coming days?

SoftBank is preparing some major moves that could dramatically influence the price of its shares in the coming days.

First of all, the company said it was contemplating the idea of selling UK chip designer Arm, an investment that cost the bank $32 billion, with graphics chip maker Nvidia being among the list of potential buyers.

Additionally, SoftBank has been consistently buying back shares, following its ¥4.5 trillion ($43 billion) buy-back plan proposed this year. So far, around ¥2.5 trillion has been repurchased already according to the quarterly report, but more buy-backs would result in another push for the company’s share price.

SoftBank shares are still riding a strong uptrend from 2016 but the stock is highly over-extended from its 200-day moving average, which represents a significant risk for traders, as any negative news – especially from the side of its investment fund – could trigger a sharp sell-off as a result of a potential mean-reversing move.

Moreover, the weekly RSI is sending an overbought signal at the moment, a situation that has not turned into good news in the short run for SoftBank shares in the past.

That said, there are still some major elements playing in favour of the conglomerate’s shares. First, the share buyback programme should provide strong support for the price of the stock. On the other hand, most of the businesses that the Vision Fund has invested in are in the tech space, a sector that has been highly favoured during the pandemic, although a sector rotation resulting from improving macroeconomic factors could reverse that trend.

At this point, there are a few support levels that traders should keep an eye on if this downward momentum continues to build up in the following sessions.

First, there’s the 0.236 retracement level at $28.23 per share, which has not been crossed since early July. After that, there’s the 50-day moving average line at $27.5 and then there’s another key support right at the lower trend line the stock has been on since the March lows.

Breaking below those levels in the following sessions should spark worries about a major mean-reversion move, although the chances for that to happen are low at the moment after considering some of the elements cited above.

Question & Answers (0)