SoftBank shares dropped 7% earlier in the day in Japan to close the session at ¥5,881 after reports indicated that the conglomerate made speculative bets on big tech stocks amounting to $4 billion.

Fears of a potentially popping tech stock bubble are driving shares down as the firm headed by billionaire investor Masayoshi Son is being blamed for pumping shares of popular tech companies such as Amazon (AMZN), Apple (AAPL), and Tesla (TSLA) to take advantage of the positive momentum they saw as a result of the pandemic.

Sources told the Wall Street Journal that the conglomerate took speculative options positions in these companies, which forced stock brokers who sold the options to hedge their exposure by purchasing the underlying stock outright – further fueling their price to new heights.

Meanwhile, retail investors who have flocked to the markets by using stock trading platforms such as eToro and Plus 500 during pandemic lockdowns as a way to make a buck while confined at their home have followed through with this now seemingly artificial tech stock rally, also placing speculative options bets that ended up increasing the implied volatility of these instruments – a situation that drives the price of the options up.

The result from SoftBank’s bet is still unknown but the move has been flagged as a risky play as options are highly volatile instruments that could either turn big profits or massive losses if the value of the underlying asset moves in the opposite direction of the trade.

The reports highlighted that SoftBank may have bought call options – which benefit the holder if the price of the underlying asset goes up. If that is the case, SoftBank may have taken big losses as a result of the negative performance of tech stocks in the past few days.

Has SoftBank closed positon?

However, SoftBank may have already exited the position prior to Wall Street’s latest red days – which could have actually triggered the sell-off as brokerage firms may have offloaded the stocks they only held as a hedge for the operation in the first place.

On the other hand, if Son’s firm is still stuck with the options, the recent correction could end up wiping a significant portion of the value of those derivatives which could result in severe losses for the firm.

Son has been in the spotlight lately after some of his company’s bets on tech startups like Uber and WeWork have failed to deliver the results that investors were expecting.

More recently, the firm received a liquidity injection from the sale of multiple assets and opened an asset management unit to handle this cash excess by investing the money in publicly-traded tech companies.

With tech stocks diving in the past couple of sessions and Nasdaq futures opening the week in the red zone – losing roughly 1% so far today – Son’s firm may start to face pressure from investors to disclose the result of this speculative operation.

Where are SoftBank shares headed?

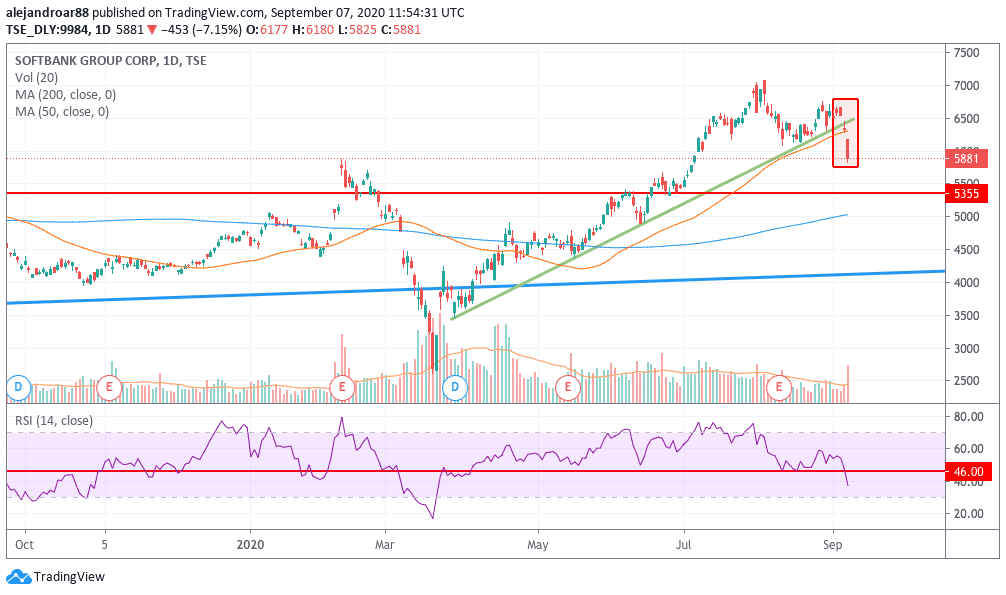

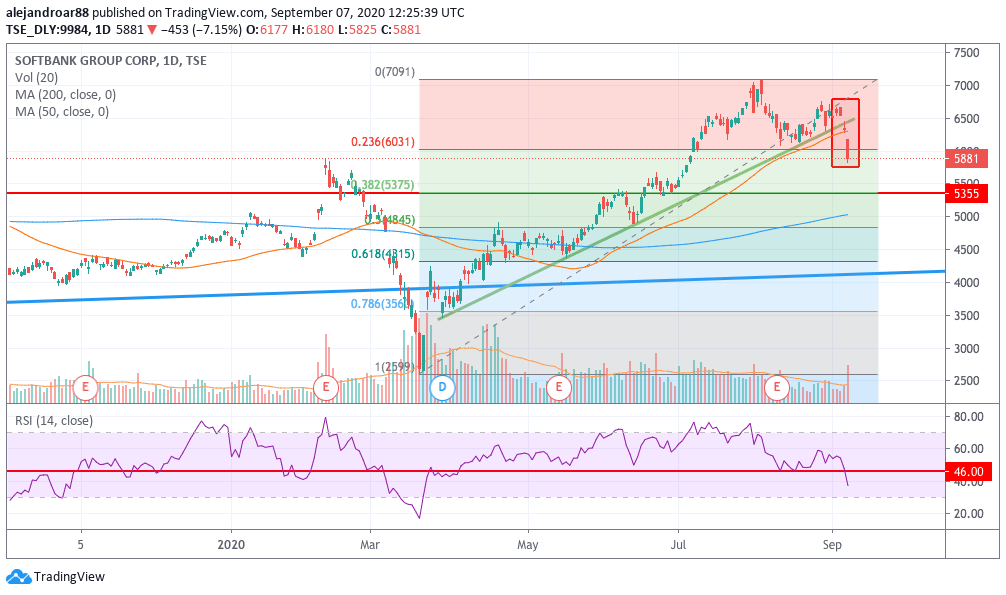

SoftBank shares have been on an uptrend since they rebounded from their March lows – curiously following a similar pattern compared to the Nasdaq 100 tech-heavy index.

The stock seems to have topped after stretching to the ¥7,000 level and reversed the course towards the low ¥6,000s in the past weeks, finding support in the lower trend line shown in the chart.

However, Friday’s stock sell-off pushed SoftBank shares below that trend line and today’s plunge seems to confirm that a full-blown trend reversal is taking place.

The next major support level for SoftBank shares is found at the ¥5,355 level, which coincides with the 0.382 Fibonacci retracement level.

Meanwhile, the RSI continues to head down and has already crossed the 46 level – from which it had rebounded many times in the past – pointing to increased weakness in the price trend.

SoftBank hasn’t yet officially addressed these reports about its speculative bets and news on that front could end up driving the price either higher – if the reports reveal to a profitable exit – or lower if SoftBank failed to exit the position before the market’s sharp drop.

Question & Answers (0)