Royal Dutch Shell shares are sliding 0.4% this morning to 979p per share, a slightly worse performance than the FTSE 100 index as a whole, following the release of a trading update in which the company announced the cutting of 7,000 to 9,000 jobs.

The measure comes amid an accelerated shift towards renewable energy sources, which is likely to result in a drastic decline in oil demand in years to come. The job cuts would take place over the course of the next two years and the measure is part of a restructuring programme to save between $2 and $2.5 billion for the company by 2022.

Shell chief executive Ben van Beurden commented: “We have looked closely at how we are organised and we feel that, in many places, we have too many layers in the company”.

The company recently took significant asset impairment charges – around $17 billion during the second quarter of this year – as a result of a shift towards renewable energy sources, a segment of the industry that is now becoming Shell’s strategic priority.

Meanwhile, the oil giant is planning to take between $1 and $1.5 billion in impairment charges during the third quarter as well, while exploring alternatives to cut its spending on oil & gas production and exploration.

The company’s exposure to volatile – and lower – oil prices amid the pandemic has been one of the key elements driving its downsizing effort, with Brent crude prices sliding from $70 per barrel at the beginning of the year to $41 per barrel as of this morning.

Shell (RDSA) highlighted in today’s report that it estimates a price sensitivity of $6 billion per year for each $10 movement in the price per barrel for Brent crude.

How are Royal Dutch Shell shares reacting to the news?

Shell shares are down almost 60% this year as a result of the pandemic-induced demand shock to the sector, to an extent nobody could have foreseen.

Meanwhile, a growing sustainability trend is further demand for oil over the long-term, as automakers continue to push for vehicles that use renewable sources of energy like hydrogen or electricity.

This shift is threatening oil’s stand as the primary source of energy for mobility and in other areas as well, which is why Shell is now scrambling to shift its business model towards renewables.

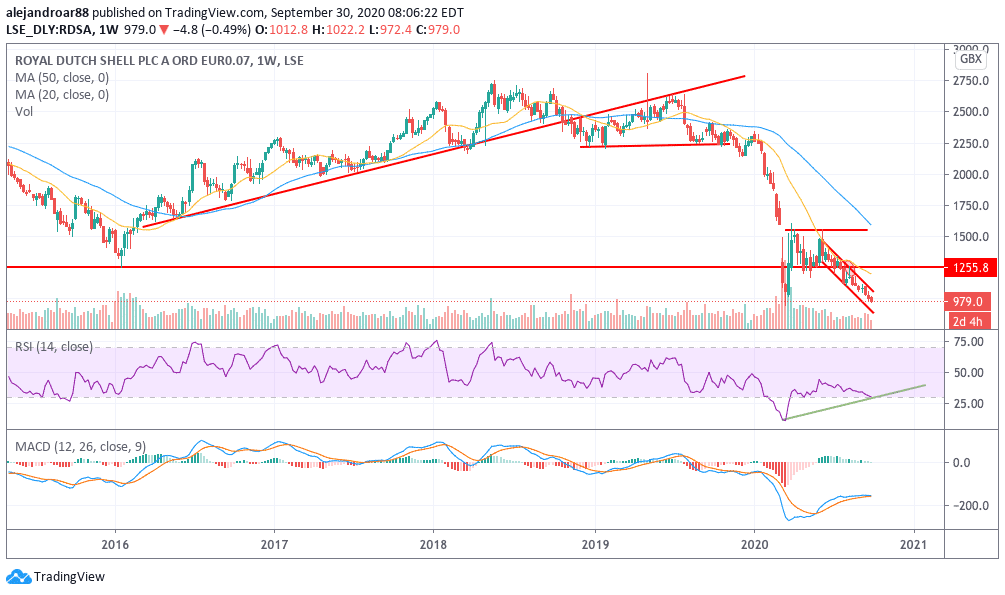

Shell shares have seen a tremendous drop after falling from a long-dated uptrend that lasted from 2016 to the late 2018s, as shown in the chart above.

The price action tried to climb back to those levels during the first months of 2019 but the move was rejected, which resulted in a strong slide that was accelerated by the pandemic.

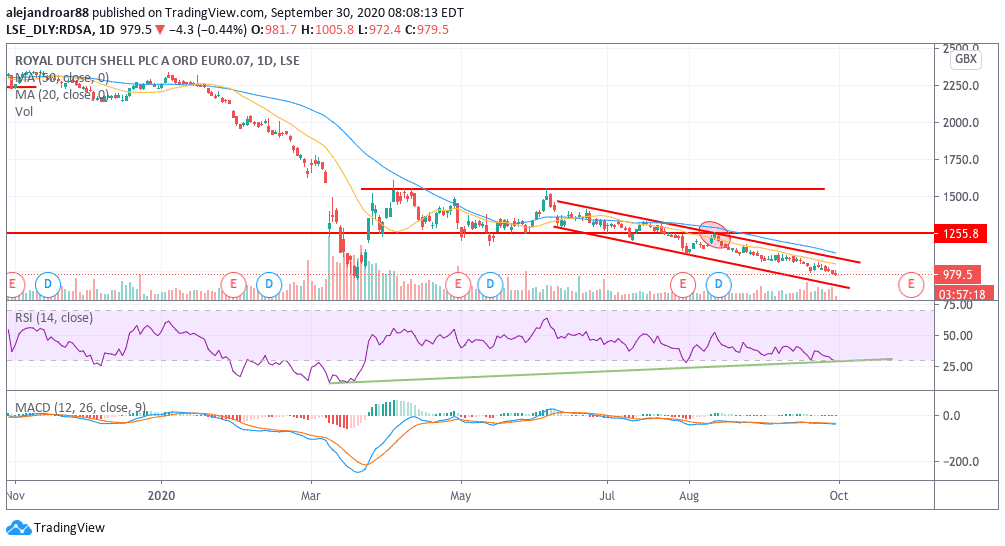

Now Shell shares are approaching their 2020 bottom – which the stock saw in mid-March at 955p per share. This would be again the lowest level for the stock since its inception and shows how strong the current downtrend is.

However, the weekly chart shows that Shell shares are progressively stepping out of oversold territory on the back of a bullish divergence in the RSI, as the price made a new low while making a higher low in the RSI.

This divergence is also seen in the daily RSI, although in both cases the MACD is still not sending a buy signal as it remains fairly close to the signal line and on negative territory.

Traders should keep an eye on how the stock price behaves as it approaches the pandemic bottom, as Shell shares could present a buying opportunity if they start to rebound progressively off these depressed levels.

In this regard, a move above the downward price channel shown in the chart, and a series of higher lows in the RSI, could provide confirmation that a short-term reversal might be in play.

Question & Answers (0)