Pearson shares have quietly rallied since late October after the company was upgraded to a buy by Swiss investment bank UBS, which sees a “material opportunity” for the company in the US higher education market.

This quiet rally has delivered an eye-popping 35% gain since the stock bounced off the 500p level on 29 October – three days after UBS’s comments – with the price now hovering close to the 700p mark at 674p per share in today’s afternoon stock trading activity.

Meanwhile, the Swiss bank raised the 12-month price target for the British publisher today to 750p per share, up from a previous forecast of 650p given to Pearson on 26 October – back when those initial bullish comments were made.

This latest reaction from UBS comes as the bank sees an accelerated shift towards digital learning as a result of the Covid pandemic, while the formal education market continues to grow alongside informal programmes – both of which will increasingly rely on technology to cope with consumers’ preference for online learning.

UBS believes Pearson is “well-positioned to take advantage of these trends”, according to the bank’s latest note accompanying the price target raise, while it estimates that global spending in education amounts to at least $5 trillion.

Interestingly, Pearson recently appointed Mike Howells as the company’s Chief Strategy Officer. Howells is a former British diplomat with ties to the United States and the firm’s CEO Andy Bird expects to take advantage of his connections to build stronger relationships with American institutions.

In reaction to UBS’s comments, Pearson shares are being lifted 2% today, building on a 3% gain so far in the week.

How have Pearson shares performed so far this year?

Pearson shares have delivered a decent 7.5% return so far this year, outpacing the British FTSE 100 index by almost 20%. Investors are optimistic about the company’s ability to take advantage of the digital transformation trend to turn around its struggling book publishing and printing business.

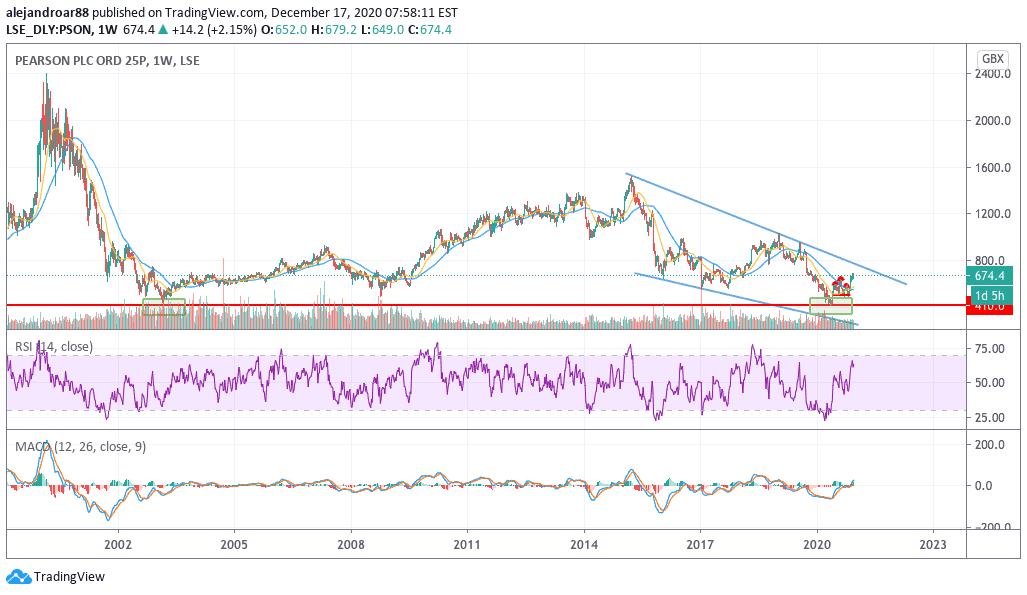

Notably, Pearson shares have bounced off the 400p level this year, completing a multi-year double bottom that could catalyse a strong upward movement over the coming months.

That said, the stock has been submerged in a pronounced downtrend since 2015, as a series of underperforming acquisitions along with a slow shift towards digital learning weigh on the price of the stock.

What’s next for Pearson shares?

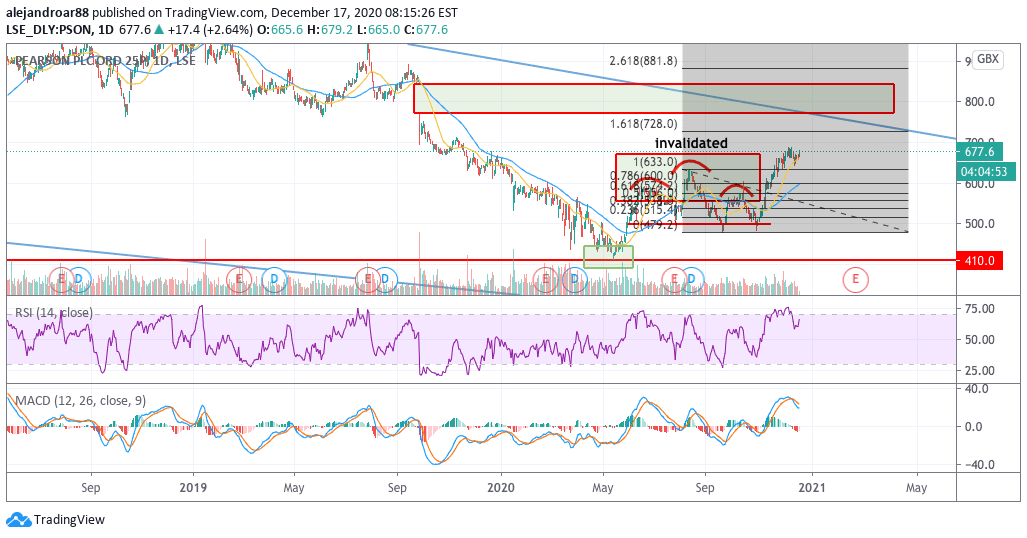

The daily price action shows that Pearson shares bounced off the neckline of a head and shoulders pattern in late October amid UBS’s comments – effectively invalidating the pattern in mid-November as the stock jumped above the head of the formation.

This neckline appears to have served as a launching pad for Pearson’s share price, as it bounced strongly off the 500p level while surging close to 700p today.

The multi-year double bottom mentioned above is perhaps the most bullish setup currently in play for Pearson, and given the long-dated nature of this pattern it could result in serious gains – especially if the price breaks above the downward channel shown in the weekly chart.

To achieve that, bulls would have to fill the bearish gap left behind in September 2019 after the company issued a profit warning amid a deceleration in demand from US universities.

For now, the share price seems on pace to move to the low 700s based on the Fibonacci retracement shown in the chart.

Question & Answers (0)