Pearson shares are sliding 0.5% at 567p today in London following the release of a trading update covering the first nine months of 2020 during which the publisher saw its sales slide 14% as a result of school closures amid the pandemic.

Pearson Global Assessment sales suffered the most, plunging by 19% during the nine-month period as test centres for Professional Certifications remain closed, while the North American Courseware segment also saw a 14% decline in sales as the demand for digital materials has outpaced physical ones during lockdowns.

This decline in sales was partially cushioned by a surge in Global Online Learning sales, as the firm saw a 41% jump in enrollment for its Virtual Schools, along with stronger sales for Pearson’s Online Program Management (OPM).

Pearson’s (PSON) outlook for what remains of the year is still within the boundaries of what the market expects from the firm – according to the management team – although John Fallon (pictured), the firm’s CEO, acknowledged that the future continues to be uncertain as the company enters the fourth quarter – especially now that virus cases have been spiking in Europe, threatening to derail the possibility of a full-blow resumption of school activities.

Significant challenges lie ahead for Pearson

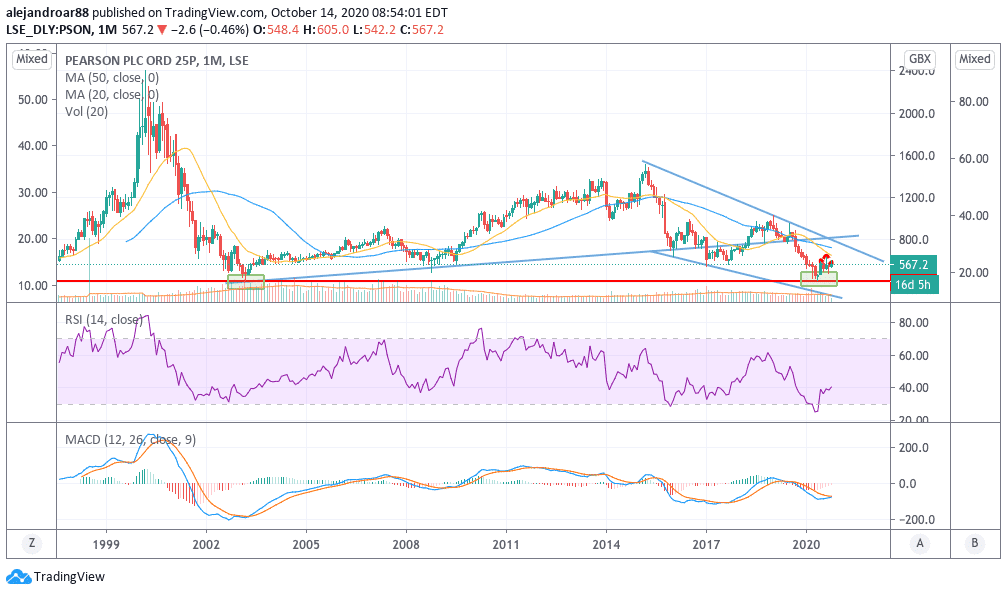

Market sentiment remains pessimistic towards Pearson shares, as reflected by its stock price which is trading at historically low levels.

The firm’s shares continue to be submerged on a downtrend that dates back to 2015, following the sale of important business units including the FT Group and The Economist.

The firm continues to struggle to turn around its business in the face of a major shift towards digital materials and technology in education, although the appointment of a new Chief Executive Officer, former Disney executive Andy Bird, could have a positive impact on the firm’s long-term performance.

That said, a strong resurgence of the virus in Europe has cast doubts about the pace of the economic recovery in the region, and more specifically, on the possibility that schools will resume their activities any time soon.

A prolonged shutdown of the school system in key countries would endanger Pearson’s recovery, which could end up keeping the stock price at these low levels for longer than expected.

Pearson shares have temporarily found support at the 420p level lately, but chances are that the stock price could go below that threshold – especially after considering a bearish pattern that is forming at the moment.

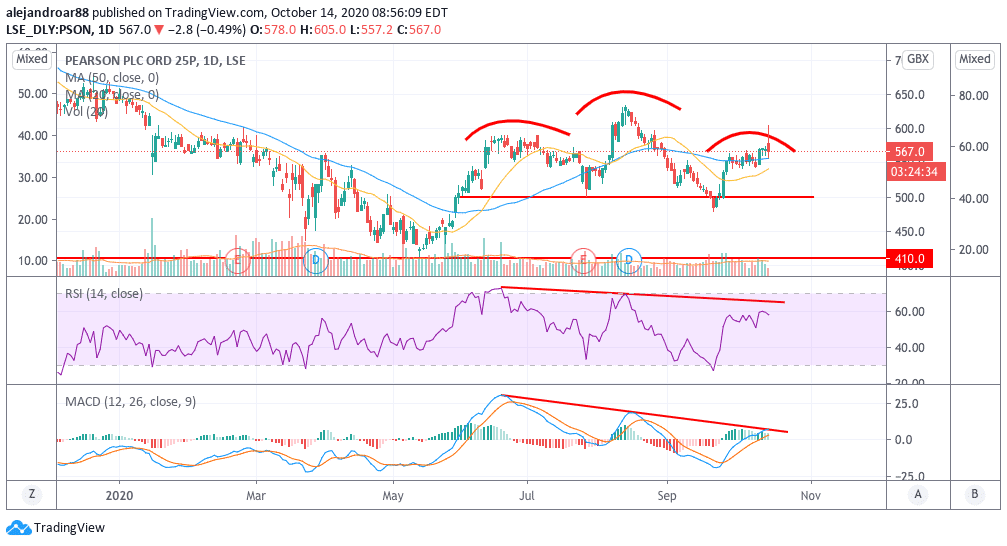

Head & shoulders pattern in play for Pearson shares

The daily chart above shows how the price action seen by Pearson shares since June has ended up forming an overly bearish pattern known as the head and shoulders, with the price failing to make a new high a few months after the stock’s August peak.

Although the pattern hasn’t been fully formed yet, everything points in the direction of a bearish breakout, with the RSI and the MACD showing a divergence in the price action as well, as the price of Person shares has made new highs on weaker momentum.

Confirmation of this bearish pattern would be provided if the price moves below the 500p neckline shown in the chart while the height of the head suggest that a move of that nature could plunge the price down to the 400p level if market participants feel the company is poised to see a prolonged downturn.

At this point, a major catalyst for that move to occur could be the announcement of country-wide lockdowns not just in the United Kingdom but also all across Europe, which would further delay the reopening of schools in the region.

Question & Answers (0)