Ocado shares are sliding in today’s stock trading action in London, despite the firm posting a solid 40% jump in its quarterly revenues as a result of the reintroduction of lockdowns during the period.

The Hatfield-based online grocery store saw its sales jump to £599 million during the 13 weeks ended on 28 February, up 39.7% from the £429 million it booked during the same quarter a year ago.

Average orders per week landed at 329,000, up 2.5% compared to the same period, with the firm citing a potentially “permanent shift” towards online grocery shopping.

This 40% jump in sales is not necessarily unexpected for market participants as the baseline period excludes the worst days of the first lockdown. Meanwhile, the seemingly shy advance in the number of total orders processed by Ocado (OCDO) compared to a pre-pandemic baseline could explain why shares are heading down today as market participants might interpret this as a sign that the firm’s momentum is stalling.

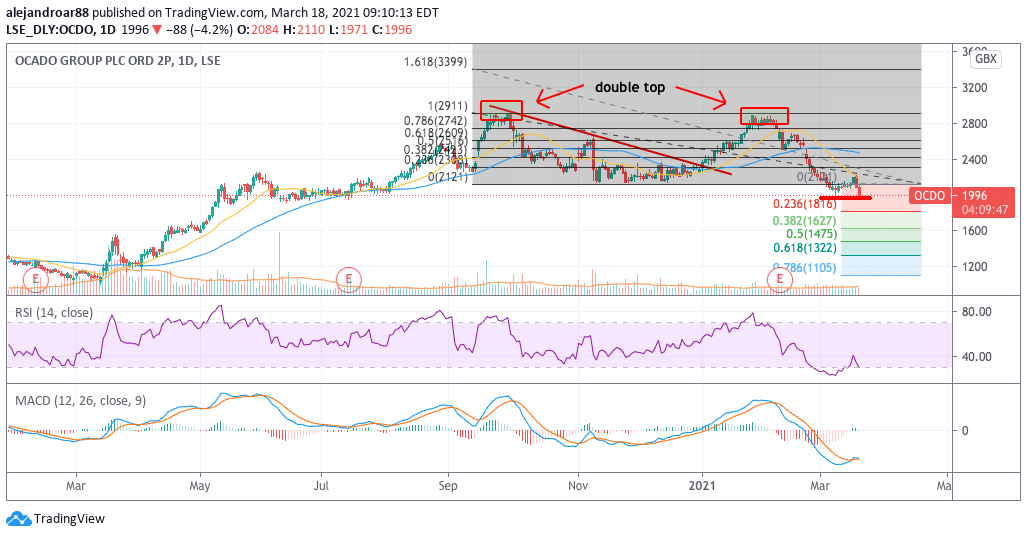

Ocado shares dropped as much as 5.1% today at 1,977p per share, with the price retesting a previous 8-month low at this level, while the stock has lost roughly a third of its value since its early February double top at 2,900p per share.

The firm announced that the opening of a mini Customer Fulfilment Centre in Bristol, along with the opening and reopening of other centres later this year, should help it in ramping up its delivery capacity by 40%.

Meanwhile, investors will be eagerly awaiting the company’s financial results and performance during the next few quarters to determine if this alleged “permanent shift” towards online grocery shopping is as real as the company claims.

In this regard, Ocado’s management team stated: “Rates of sales and EBITDA growth in future quarters will reflect annualisation against periods of Covid-19 related lockdown experienced in FY20 and, by comparison, the extent to which Ocado Retail returns to a ‘normalised’ trading week, as well as the timing of when planned capacity goes live”.

For now, the firm said that it expects to post sustained revenue growth during the second quarter of this year, a period during which certain restrictions should endure in the UK. Meanwhile, Ocado did not provide guidance for any of the subsequent quarters.

How have Ocado shares performed so far this year?

Ocado shares are down 9% this year as investors have grown less optimistic about how the normalisation of activities in the UK could impact the firm’s top-line, which was dramatically boosted during the pandemic as shoppers had to rely on online channels during lockdowns.

This negative performance contradicts the overall market trend, as the FTSE 100 has advanced 4.7% during the same period.

That said, Ocado shares enjoyed quite a run last year, as they posted a 79% jump as a result of this pandemic tailwind – which means that many investors could still be sitting on a handsome profit & loss statement despite the latest drop in the share price.

What’s next for Ocado shares?

As vaccines continue to be rolled out in the United Kingdom, investors may have started to take some of their 2020 profits off the table as reflected by the latest sharp drop seen by Ocado’s stock.

This plunge came as a result of a double top formation highlighted in the chart, with market participants refusing to bid up the price beyond the 2,900p level, while the 2,000p psychological threshold could now be serving as a last line of defence for the share price.

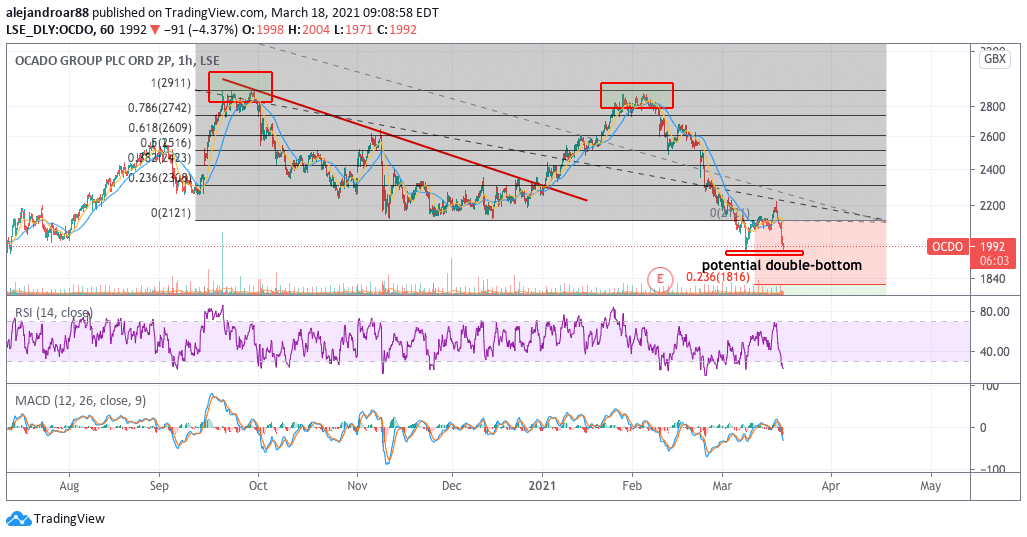

Meanwhile, today’s price action could be quite revealing for the future of Ocado shares, as a double bottom formation could be in the making if the price were to hold that 2,000p support while bouncing off it in the following sessions.

If that were to happen, chances are that the stock price could reverse its current downtrend, at least for a while. This view is reinforced by the RSI and the MACD – both of which are submerged in deeply oversold levels, which indicates that the time has come for a technical bounce.

The hourly chart above shows how this particular level could serve as a launching pad for Ocado shares if such a bounce were to happen.

On the other hand, if the price were to move below this threshold, chances are that the latest bear market could continue in the following weeks, possibly eyeing the 1,900p level as the next area of support.

Question & Answers (0)