NIO EC6 launch in August 2020

NIO shares jumped 12% yesterday to $48.30 and are pointing to a higher opening as they surge 8% in pre-market stock trading action on Wall Street. The price jump comes after competing Chinese electric vehicle maker Xpeng posted higher delivery volumes during the third quarter of the year.

These positive results from NIO’s rival means that the demand for electric vehicles in the country keeps growing – which benefits Nio (NYSE: NIO) as the market remains big enough for all players, at least for now.

Xpeng’s quarterly report showed a 266% jump in vehicle deliveries, with the Chinese company delivering a total of 8,578 units during the three-month period, while revenues increased 342% to $293.1 million. The firm also expects to deliver at least 10,000 vehicles during the fourth quarter of the year.

Xpeng shares reacted positively to the report, advancing 33.4% yesterday to $44.73, in addition to also gaining 5% in pre-market action. Moreover, shares of Li Auto – another Chinese EV vehicle maker – are up almost 24% so far today, following the 27% surge the stock saw yesterday on the same news.

The good news from Xpeng is lifting all boats – NIO included, while recent developments on the technical front points to further upside ahead for the firm’s earnings.

How have NIO shares performed so far this year?

NIO shares have moved from $4 per share to as much as $48 in just 11 months, posting a remarkable 1,100% gain for investors since the year started.

EV vehicle maker shares have seen significant upside during the pandemic as investors expect the shift towards electric-powered vehicles to accelerate as the technology underpinning the industry continues to solidify.

Meanwhile, the success of American electric vehicle maker Tesla (TSLA) in posting a series of profitable quarters has also helped lift the shares of other vehicle makers as delivery volumes continue to surge.

Recently, NIO announced that its vehicle deliveries doubled during the third quarter of the year, with the Chinese manufacturer handing over 5,055 vehicles during that period, compared to roughly 2,526 it delivered a year ago.

Moreover, the firm has received multiple price target hikes from investment banks around the world including JP Morgan, with analyst Rebecca Wen recently lifting her 12-month target for the firm to $46, up from a previous $40 forecast. She reckons that NIO will be a “long-term winner” in the race to become China’s largest EV vehicle producer.

What’s next for Nio shares?

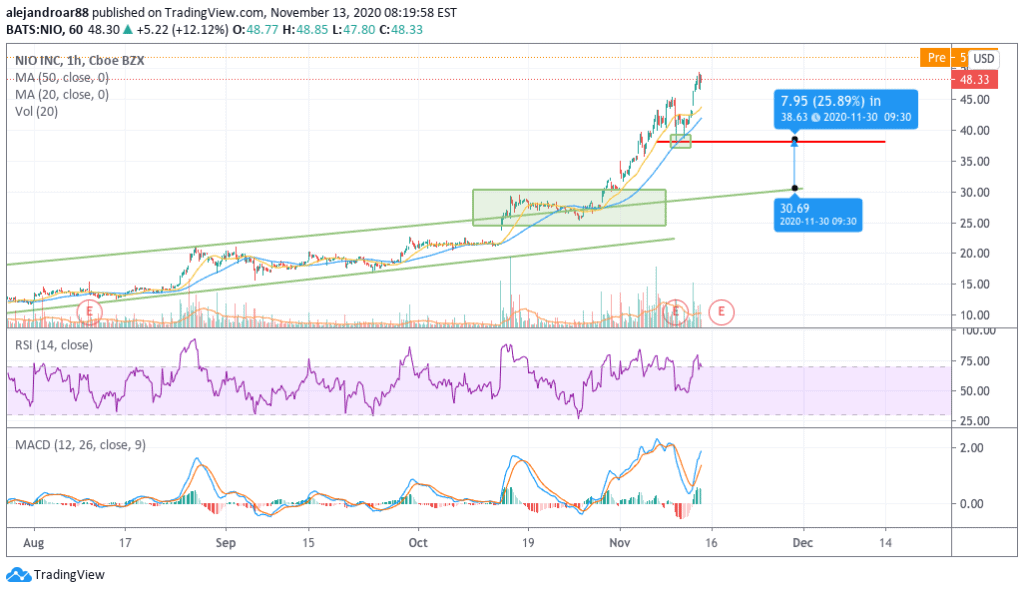

NIO shares recently moved above an upward price channel that emerged since early May after a series of price target hikes that came ahead of the company’s Q3 earnings report.

Meanwhile, NIO’s positive numbers reported in early November contributed to lifting the stock to its current levels – with the price nearly doubling since the month started.

NIO stock price has already surpassed the initial forecast that was drafted by using the height of this former price channel, with the price action finding support at this very level in the past few days.

The potential double floor shown in the hourly chart above could serve as the backbone of further upward movements, although the current bull run could take a breather at any point as multiple indicators are flashing oversold signals.

If traders were to take profits in the following sessions, this $38 floor could be a key level to watch as a swift rebound off it could be the starting point of another –possibly stronger – bull run.

Question & Answers (0)