Electric vehicle companies have been on a capital raising spree over the last year. Nikola is the latest to join the ranks and is reportedly considering a share offering to raise $100 million.

Electric vehicle shares jumped sharply over the last year, which prompted companies to capitalise on the opportunity and raise cash by selling shares. Tesla, the most popular electric car maker led from the front and raised $13 billion by issuing shares thrice in 2020. NIO has also issued shares thrice since the beginning of 2020.

Tesla has also been on a capital raising spree

Tesla’s capital raise came despite the company saying in January 2020 that it does not intend to raise capital and would cover its capex with internal accruals. Tesla generated positive free cash flows in 2020 despite spending a lot of cash on new plants.

Meanwhile, after raising $13 billion last year, Tesla is now a net debt negative company holding more cash than debt on its balance sheet. It now has “spare cash” to invest $1.5 billion in bitcoins. Meanwhile, Tesla seems to be making more money on its investment in bitcoins than its core automotive operations where its net profit margins are in the vicinity of 1% and even that has come through sales of carbon credits.

Nikola announces share issuance

Now, Nikola has announced plans to raise $100 million by issuing shares. It intends to use the funds for its Arizona factory. Nikola share was trading lower in US premarket trading today which looks surprising. The capital raise represents only about 1.5% of Nikola’s current market capitalisation so there won’t be much dilution.

Interestingly, the markets’ response to Nikola’s capital raise is different to how they reacted to Tesla. Tesla share actually jumped after it announced a share sale, as investors were buoyed by the high growth that Tesla is witnessing and willing to ignore the earnings dilution that comes with the share issuance.

XPeng Motors

Chinese electric vehicle maker XPeng Motors is also on a capital raising spree. After its $1.5 billion IPO in the US, it raised another $2.5 billion towards the end of 2020 by way of share issuance. The investment arm of the Guangdong provincial government has invested $76.9 million or 500 yuan into XPeng. It had invested another 2 billion yuan into XPeng in 2020.

While Chinese electric vehicle makers like XPeng and NIO have the support of the Chinese government as the fall-back option, US electric car makers such as Nikola have to rely on capital market transactions to raise money.

Nikola’s troubles with Hindenburg Research

Short-seller Hindenburg Research accused Nikola of fraud in its report in September 2020. “We believe Nikola is an intricate fraud built on dozens of lies over the course of its Founder and Executive Chairman Trevor Milton’s career,” said Hindenburg in its report.

Hindenburg added, “We have gathered extensive evidence—including recorded phone calls, text messages, private emails and behind-the-scenes photographs—detailing dozens of false statements by Nikola Founder Trevor Milton. We have never seen this level of deception at a public company, especially of this size.”

As a repercussion of Hindenburg’s allegations, the SEC started an investigation into Nikola while Milton had to quit the company. General Motors also scaled down its partnership with Nikola.

Hindenburg Research also accused Workhorse of fraud

More recently, Hindenburg Research has targeted electric vehicle company Workhorse in its short-seller report. It accused Workhorse of inflating its pre orders. “Our research has revealed that Lordstown’s order book consists of fake or entirely non-binding orders, from customers that generally do not even have fleets of vehicles,” said Hindenburg in its report.

Notably, in the absence of any current revenues, markets have been valuing electric vehicle shares like Nikola based on their pre orders.

JP Morgan on Nikola

Meanwhile, JP Morgan sees 2021 to be a less dramatic year for Nikola. JP Morgan analyst Paul Coster expects 2021 “to be less drama-filled and to turn generally positive” for Nikola.

He expects a “steady flow of updates for the truck in 2021, as test milestones are met, as production ramps in Ulm, and as customers submit orders in midyear.” Coster expects Nikola to have “at least nine trucks for testing by end of the 1Q21.”

Are electric vehicle shares in a bubble?

The kind of valuations that electric vehicle startups are commanding despite not having delivered their first car is astonishing. The valuation premium might smell like a bubble especially to those who are bearish on the sector.

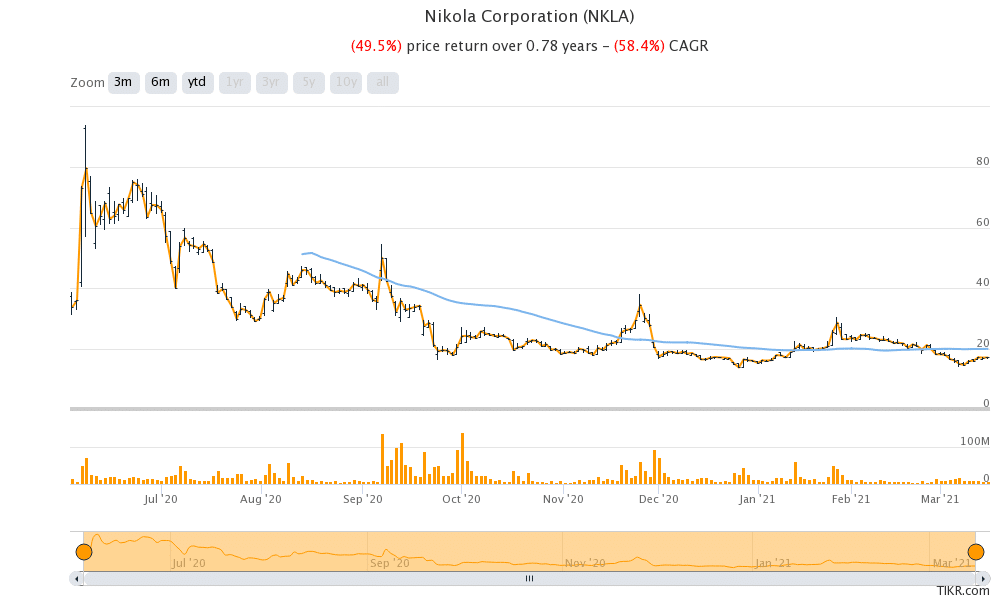

Nikola for instance has a market capitalisation of a little under $7 billion. The company’s valuations now look much more reasonable looking at the peaks in 2020 where its market capitalisation was more than that of Ford. Lucid Motors, which is set to merge with SPAC (special purpose acquisition company) Churchill Capital IV (CCIV) commands a pro forma market capitalisation of over $45 billion. Lucid Motors is also yet to deliver its first car.

Should you buy Nikola share?

Nikola could be among the electric vehicle shares to watch in 2021 as the company is expected to start delivering its vehicles in 2021. This year would be crucial for Nikola as it tries to prove that it really is the “Tesla of trucking.” 2021 would be the year of execution for Nikola as the race for electric vehicle heats up. Looking at Nikola’s market capitalisation as compared to other electric vehicle makers like Tesla, NIO, and XPeng Motors, it seems to offer good value at current prices.

Nikola shares were trading almost 3% lower in US premarket trading at $16.55 today. The shares have a 52-week trading range of $10.42-$93.99.

Question & Answers (0)