Netflix shares (NYSE: NFLX) are trading sharply higher in US premarket price action today after the company reported better-than-expected earnings for the third quarter of 2022. It added 2.4 million net subscribers in the quarter reversing two quarters of subscriber losses.

Netflix reported revenues of $7.93 billion in the quarter which was 16.3% higher than the corresponding period last year and was ahead of the $7.84 billion that analysts were expecting. Its adjusted EPS came in at $3.10 while analysts were expecting the metric at $2.13.

Importantly, it added just above 2.4 million net subscribers in the quarter. During the previous earnings call, it had forecast net subscriber addition of 1 million for the third quarter. Wall Street analysts were expecting the company to add around 1.09 million subscribers in the quarter.

Netflix added 2.4 million subscribers in the quarter

However, Netflix’s subscriber numbers in the quarter surpassed analysts’ estimates by a wide margin. Notably, the company lost 1.2 million subscribers in the first half of the year. After the third quarter subscriber adds, it has now added a net of 1.2 million subscribers this year.

Most of the subscriber addition came from Asia-Pacific where it added 1.4 million subscribers. It added only about 100,000 subscribers in the US-Canada market. That’s still a welcome break for the company as it lost subscribers in the lucrative market in the first half of the year.

In its shareholder letter, Netflix sounded quite upbeat. It said, “After a challenging first half, we believe we’re on a path to reaccelerate growth. The key is pleasing members. It’s why we’ve always focused on winning the competition for viewing every day.”

Streaming competition

Until last year, Netflix maintained that it does not see much competitive pressure in the streaming market. It saw more players entering the market as a sign of the industry’s long-term outlook. However, during its Q1 2022 earnings call, it talked about competitive pressures and slowing streaming industry growth for possibly the first time.

It took a swipe at streaming peers during the Q3 2022 earnings call and said that it estimates all other streaming companies are losing money. It estimates that the industry’s operating losses in 2022 would be around $10 billion while Netflix would earn an operating income between $5-$6 billion.

There certainly is merit in the argument. Disney, which surpassed Netflix to become the largest streaming company based on the number of subscribers is losing money in the streaming business. It has forecast that it would become profitable only by the fiscal year 2024.

Growth is back albeit at a slower pace

During the earnings call, Spencer Neumann, Netflix CFO said, “We’re still not growing as fast as we’d like. He added, “We are building momentum, we are pleased with our progress, but we know we still have a lot more work to do.”

Netflix provided guidance

Netflix forecasted revenues of $7.8 billion for the fourth quarter. The guidance implies a sequential fall in revenues which the company attributed to the stronger US dollar. The dollar’s strength has been a headwind for almost all US tech companies.

The revenue guidance fell short of what analysts were expecting. Also, it forecast an adjusted EPS of $1.2 for the quarter which is less than a third of what Wall Street was expecting.

It however said that the operating margin would fall from 8% to 4% in the quarter. The fourth quarter is anyways seasonally weak for the company. This year, it would face an additional headwind from adverse currency movements.

The company expects to add 4.5 million net subscribers in the quarter. It added, “Our paid net adds forecast assumes that we experience our usual seasonality as well as the impact of a strong content slate, counterbalanced by macroeconomic weakness which leads to less-than-normal visibility.” It does not expect material subscriber addition from the ad-supported tier which is launching early next month.

Netflix to stop providing subscriber forecast

Netflix said that beginning next quarter, it would stop providing the subscriber growth forecast. It would however continue to report the metric on a quarterly basis. It said that revenues would be its primary topline metric, as it has discussed previously also.

In the shareholder letter, it said, “This will become particularly important heading into 2023 as we develop new revenue streams like advertising and paid sharing, where membership is just one component of our revenue growth.”

Streaming shares rise

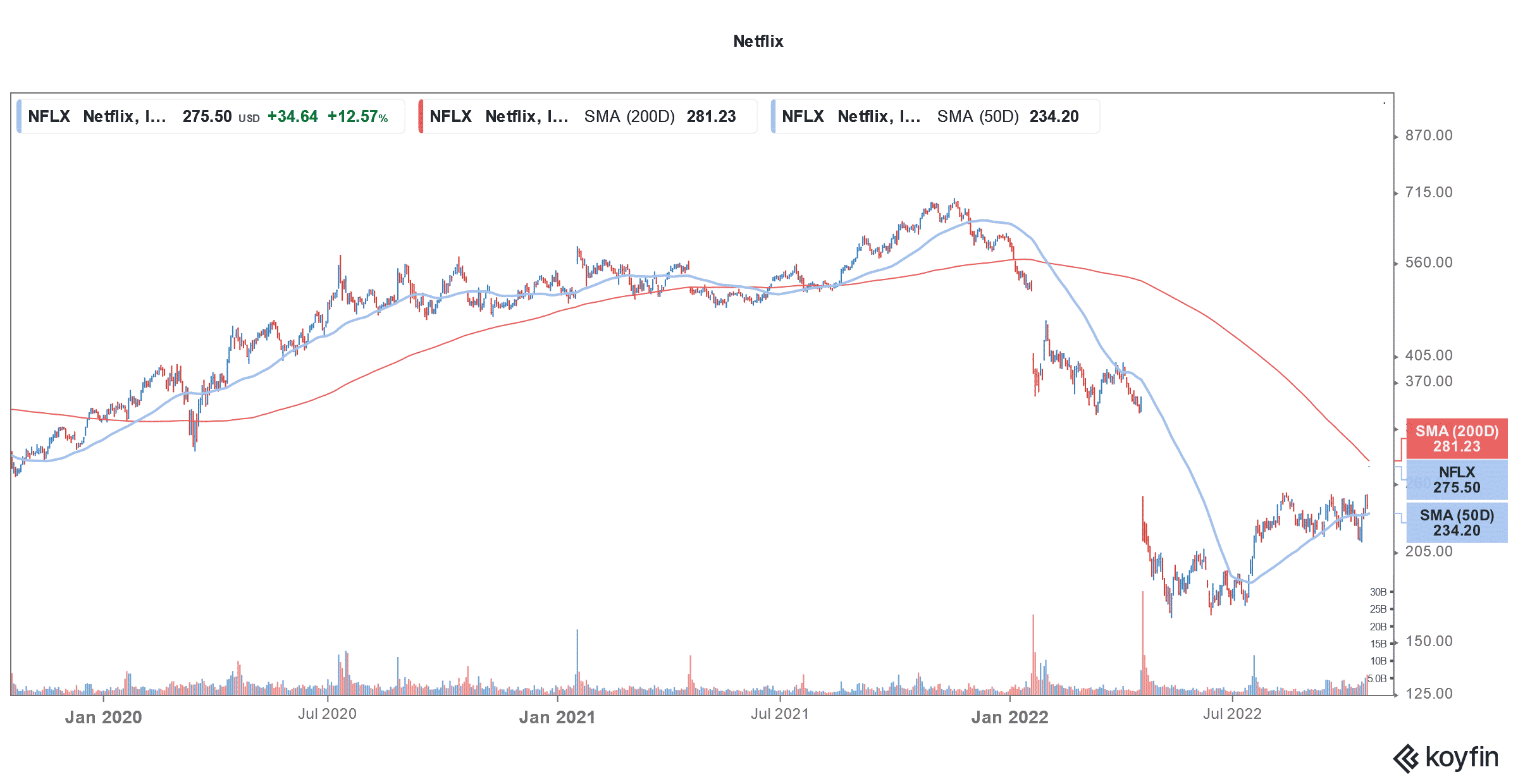

Streaming companies like Disney and Roku are also trading higher today after upbeat commentary from Netflix. Notably, Netflix shares have rebounded from their lows. It had the dubious distinction of being the worst-performing FAANG as well as S&P 500 share in 2022.

Even Bill Ackman, who had bought the dip in Netflix shares after the Q4 2021 earnings release, exited the company after its Q1 2022 earnings, incurring millions of dollars of losses.

However, thanks to the sharp rally, it is no longer the bottom FAANG share. Meta Platforms is now the worst-performing FAANG share of the year. Markets would next look forward to the earnings of FAANG peers to gauge whether the worst of the slowdown is over for US tech companies.

Question & Answers (0)