Netflix generates over $2.34 million of revenue per employee

Netflix shares reacted positively to the company’s financial results covering the fourth quarter of 2020, as the firm added more subscribers than the market expected, now boasting more than 200 million paying customers. Meanwhile, the management team also made upbeat comments in regards to the company’s future.

Shares of the Los Gatos-based video-streaming service rose nearly 12% in after-market stock trading action following the release of its quarterly report, trading at $563.20 per share after closing the day with a mild 0.7% gain ahead of the announcement.

According to the report, Netflix (NFLX) revenues grew 21.5% during the period, compared to a year ago, with sales landing at $6.64 billion as the pandemic continues to provide a tailwind for the firm’s top-line, while also in line with Wall Street’s estimates.

Meanwhile, the company’s operating income more than doubled during the quarter, moving from $459 million during the fourth quarter of 2019 to $954 million during the three-month period ended on 31 December.

That said, the firm’s operating margin shrank approximately 600 basis points compared to the previous quarter, although it was 800 basis points higher than the margin reported during the same period in 2019. In this regard, Netflix aims to reach a 25% operating margin during the first quarter of 2021.

As for its earnings, Netflix posted a net income of $542 million, resulting in earnings per share of $1.19. This represents an 8.5% drop compared to the EPS reported by the firm a year ago, while it also falls short of analysts’ estimates of $1.39 per share for the quarter.

Nevertheless, the most notable number in the report was the 8.51 million net paid subscribers added by Netflix during the last three months of the year, as the number exceeds analysts’ estimates of 6.47 million for the period based on data from StreetAccount.

The key metric also beat the firm’s own estimate of 6 million net paid subscribers that should have been added during the fourth quarter, which highlights the persistent impact that lockdowns have had on the demand for video streaming services around the world.

Netflix’s management team also said that the company is “very close” to generating sustainable free cash flows – which means that the firm could soon be internally generated resources to finance its growth.

Moreover, the team highlighted that they believed the firm no longer needed external financing, adding that the company has plans to repay a bond issue that will be maturing on 1 February, while they are also contemplating a scenario in which some money can be returned to shareholders, possibly through buybacks.

Netflix positive momentum goes beyond just its financials

This year has been quite positive for the company co-headed by Ted Sarandos and Reed Hastings and not just from a financial perspective, but also from a content standpoint.

In this regard, Netflix’s management stated that they were already prepared to compete with other media giants such as Disney (DIS) prior to their arrival, which is the reason why the firm invested heavily in producing in-house content to establish a strong and long-lasting connection with its viewers.

Among Netflix’s biggest hits we find the fourth season of The Crown, which managed to attract many more households than any of the prior seasons, while pushing the total number of households who watched the series since it was launched on the platform to 100 million.

Meanwhile, The Midnight Sky, directed and starred by George Clooney, had more than 72 million households glued to their screens within the first 28 days after its release while Over the Moon attracted another 43 million.

Moreover, The Queen’s Gambit, a limited fiction series that portrays the life of a female chess prodigy, was among the platform’s biggest hits for the year, with a total of 62 million households watching the series during the first 28 days of its release.

Although competition remains strong for Netflix, its defensive moat seems to be widening through the continued launch of top-notch original content that keeps luring new subscribers and recurring viewership.

What’s next for Netflix shares?

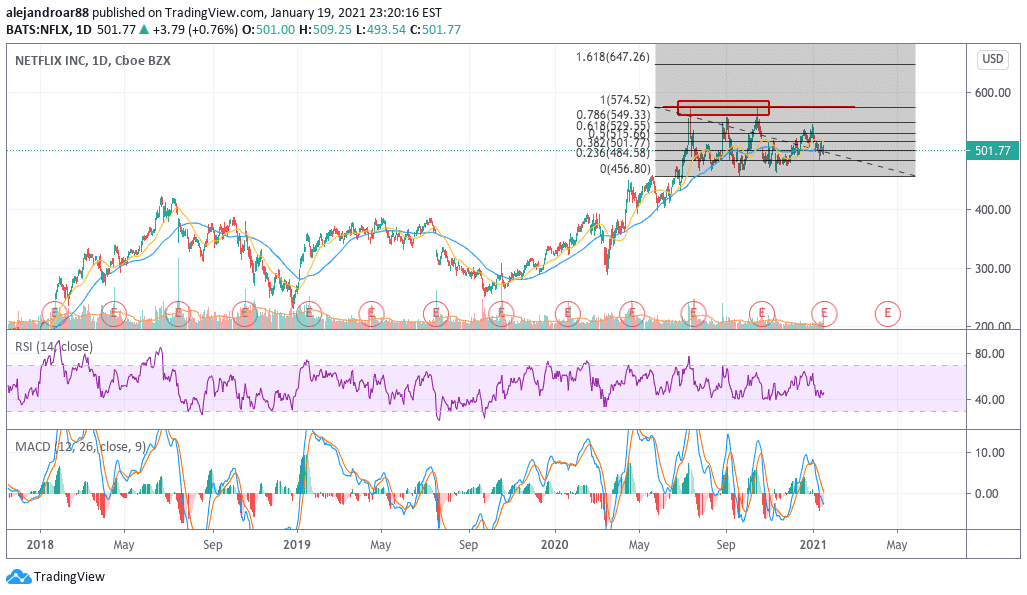

Netflix shares have struggled to clear the $575 threshold two times now and Wednesday’s session could end up determining if this after-market price action will be the tip of the spear for a strong rally above that mark.

If this uptick comes to fruition and the price ends up surging to its current after-market level of $563, Netflix shares would effectively enter bullish Fibonacci territory, possibly eyeing the $575 level in short-order, while aiming to reach higher ground if this positive momentum accelerates.

Such a remarkable beat in the number of net added subscribers is perhaps the strongest catalyst for Netflix’s share price at the moment, as it means that the firm will keep growing its revenues over the coming months through this enlarged user base. It also underlines a strong competitive position, despite the addition of new players to the video streaming landscape.

Question & Answers (0)