The first-quarter earnings season is in full swing. Last week, three of the major US steel companies reported their earnings. Here are the key takeaways from their earnings report.

All three companies namely Nucor, Steel Dynamics and Cleveland-Cliffs reported better than expected earnings. US steel stocks were strong last year amid soaring metal prices. While metal prices have since come off their highs, they are still quite high by historical standards which have helped buoy earnings. Let’s begin by looking at Steel Dynamics’ earnings.

Steel Dynamics reported better than expected earnings

Steel Dynamics delivered a record performance in the quarter on multiple metrics. The company’s steel shipments were a record 2.9 million tons in the quarter. The net sales of $5.6 billion were also a new record. Notably, while fellow steel companies reported a yearly fall in shipments, STLD’s shipments rose to a record high led by the incremental shipments from its Sinton Texas Flat Roll Mill. When the plant is fully operational it would add an annual production capacity of 3 million tons for STLD.

After President Trump imposed Section 232 tariffs, US steel companies announced billions of dollars in investment toward new plants. The tariffs have since been greatly toned down both by the Trump as well as the Biden administration. Meanwhile, strong steel prices pushed STLD’s adjusted EBITDA to a record $1.6 billion and operating cash flows of $819 million.

STLD sees strong end-user demand

Despite there being concerns over demand, STLD sounded upbeat. The management was particularly optimistic about demand from the non-residential sector. Notably, domestically produced steel would be used as part of the projects under President Joe Biden’s infrastructure bill.

STLD added, “The automotive sector steel consumption is expected to grow with production through 2024, returning to over 17 million units, supported by an extreme lack of automotive dealer inventory and a strong pent up demand.” The company also sees strong end-user demand from the energy sector as soaring energy prices have led to an increase in rig count.

Steel Dynamics sees high order backlogs

STLD said, “In aggregate, our steel order backlogs and order input strength, coupled with broad optimistic customer commentary and general market momentum drive us to conclude that steel market dynamics will remain strong throughout 2022.” The company has a strong order backlog and expects to post record profits in the second quarter as well.

STLD management also tried to allay fears that rising natural gas prices could dampen its profitability. The company said that natural gas accounts for 2-3% of the total production plants and is therefore not a key cost driver.

Raw material strategy

The Russia-Ukraine crisis has both been an opportunity as well a threat for US steel companies. While both Russia and Ukraine are major steel exporters, together they control almost two-thirds of global pig iron exports. Pig iron is a raw material for steel companies and the Russia-Ukraine war has led to a supply chain crisis. STLD said that it has been able to procure pig iron from India and Brazil and has also reduced the percentage of pig iron in its raw material mix. The company believes that scrap prices, which are running at elevated levels would come down as supply improves.

It said, “At these trading levels, everyone is out there with their pickup trucks picking up old cars and old refrigerators, and so the obsolete stream is considerable today. Flow is very, very, very high and we feel that is going to pressure scrap pricing over the next few months as well.”

Nucor also posted strong earnings

Nucor shipped 6,394,000 tons were shipped to outside customers in the quarter. While shipments were similar to the sequential quarter, they fell 11% as compared to the first quarter of 2021. However, the company’s sales increased 50% YoY led by higher steel prices. Its sales increased 1% sequentially also. Meanwhile, its operating rates fell to 77% in the quarter which is lower than 95% in the corresponding period last year.

Commenting on raw material costs, Nucor said “the average scrap and scrap substitute cost per gross ton used in the first quarter of 2022 was $495, a 3% decrease compared to $508 in the fourth quarter of 2021 and a 22% increase compared to $405 in the first quarter of 2021. The company posted a net profit of $2.1 billion in the quarter which made it its most profitable first quarter ever.

Raw material strategy

Nucor said that pig iron has historically accounted for 10% of its raw material mix and it has procured half of it from Russia and Ukraine. After Russia invaded Ukraine, Nucor stopped buying from Russian suppliers. It hasn’t been able to get supplies from Ukrainian suppliers as well as the war has taken a toll on the country’s industrial activity.

The company has now reduced the pig iron mix to around 6% and has increased DRI (direct reduced iron). Nucor is an integrated steel company and owns two DRI plants. The company said that metallics account for 70% of its input costs. The costs of metallic raw materials closely track steel prices. It has also hedged almost half of its natural gas needs for 2022 so it would be less impacted by the steep rise in prices.

Nucor also pointed to strong steel demand

Nucor also sounded bullish on the outlook. It said, “End use market demand remains strong for steel and steel products, and we remain confident that 2022 will be another year of very strong earnings and cash flow for Nucor.”

The company added, “We expect that the second quarter of 2022 will be the most profitable quarter in Nucor’s history, surpassing the previous record set in the fourth quarter of 2021.”

Nucor has been investing in growth

Nucor has a long history of investing in growth. The company has spent $4.1 billion on 10 projects over the last few years. These would increase the company’s sales as well as profitability and the company forecasts that during normal market conditions it would add $600 million to its annual EBITDA. The company is looking to spend another $3.5 billion on growth projects which can add $700 million to its adjusted EBITDA in normal times.

It said, “in addition to our organic growth opportunities, Nucor continues to engage in strategic and targeted M&A activity.” The company added, “We expect to add more than $1.6 billion to Nucor’s run-rate EBITDA in future years from these already completed and underway investments.”

Automotive can be a key growth area for Nucor. It is a leading metal consumer and is a lucrative market for steel companies. Nucor ships only about 5-6% of its steel to automotive companies. The percentage is much higher for Cleveland-Cliffs and ArcelorMittal. Nucor intends to double its shipments to the industry. If the company can achieve the feat, it would help buoy its profitability.

Cleveland-Cliffs also posted record profits

Cleveland-Cliffs (CLD) reported revenues of $6 billion in the quarter while its net profit of $801 million was a new record. The company’s earnings were better than expected for both the topline as well as the bottomline. The company shipped 3.63 million tons of steel to external customers in the quarter which was below the 4.14 million tons in the first quarter of 2021. The company shipped 31% of its steel to the distributor market while 28% of sales were made to automotive customers.

CLF became an integrated steel company

CLF had acquired AK Steel to transform itself into an integrated steel company. AK Steel had high exposure to automotive customers and we see something similar with CLF also. In the first quarter, CLF shipped 27% of its products to the infrastructure and manufacturing market while 14% of its sales were to other steel companies. CLF raised the full-year average selling price guidance by $220 to $1,445 per ton.

Raw material strategy

CLF also took a dig at fellow steel companies that rely on imported pig iron. It said, “The Russian aggression toward Ukraine has made it absolutely clear to everyone what we at Cleveland-Cliffs have been explaining to our clients for some time: overly extended supply chains are weak and prone to break down, particularly steel supply chains that are dependent on imported feedstock.”

It added, “While other flat-rolled steelmakers scramble and pay high prices for their needed feedstock, we stand out from the crowd due to our preparation for the current geopolitical climate.”

Outlook for steel companies

The outlook for US steel companies looks somewhat mixed. If the US economy heads for a recession as some are predicting, steel prices and by extension steel stocks could come under pressure. We do see some pain in some end markets. While the housing sector has shown signs of cooling off, the automotive industry is battling supply chain issues which are affecting production.

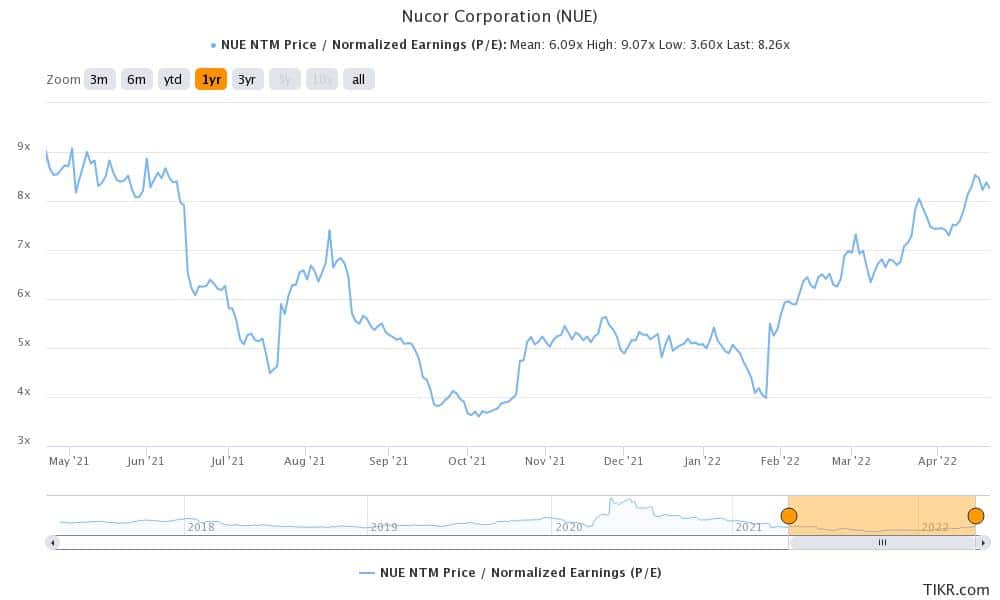

However, given the current environment and tepid valuations, the risk-reward for steel companies looks reasonably balanced.

Question & Answers (0)