Johnson & Johnson shares are moving higher today in pre-market stock trading action as the company’s COVID-19 vaccine could be poised to get approved by the US Food and Drug Administration (FDA) before the week ends.

The American firm’s vaccine has already proven safe by a panel of independent experts, with clinical trials showing efficacy in preventing moderate to severe COVID infections in 66% of the cases while the percentage increases to 88% in preventing asymptomatic cases.

Perhaps the most encouraging aspect of the Johnson & Johnson (JNJ) vaccine is the fact that it only requires one jab to reach these levels of efficacy while the treatment has to be stored at temperatures between 2-8°C for at least three months, meaning that it needs to be transported through a cold chain.

Although the FDA has not yet made an official announcement in regards to the approval of J&J’s vaccines, market participants expect that the treatment should be approved before the end of the week, as it will probably be treated similarly to the Pfizer (PFE) and Moderna (MRNA) vaccines.

Johnson & Johnson shares climbed 1.34% yesterday and are posting a 1.2% gain so far today at $164.60 in pre-market trading with multiple countries already placing big orders for the firm’s treatment including 100 million doses ordered by the United States and 30 million purchased by the United Kingdom.

Can this vaccine provide a boost to Johnson & Johnson’s bottom line?

According to J&J’s initial announcement regarding the efficacy of the treatment, the firm emphasized that it plans to produce an affordable vaccine on a “not-for-profit basis” for emergency pandemic use.

That said, Johnson & Johnson could ultimately benefit from the revenues resulting from the treatment if COVID-19 becomes a seasonal virus – which would require periodical vaccinations after the pandemic is over.

The fact that the treatment’s effectiveness is 85% for severe symptoms and 100% for preventing hospitalisations and deaths with a single jab is perhaps the most appealing and marketable aspect of the J&J vaccine compared to the treatments developed by other companies, which could give J&J a long-term edge if periodical shots are required.

What’s next for Johnson & Johnson shares?

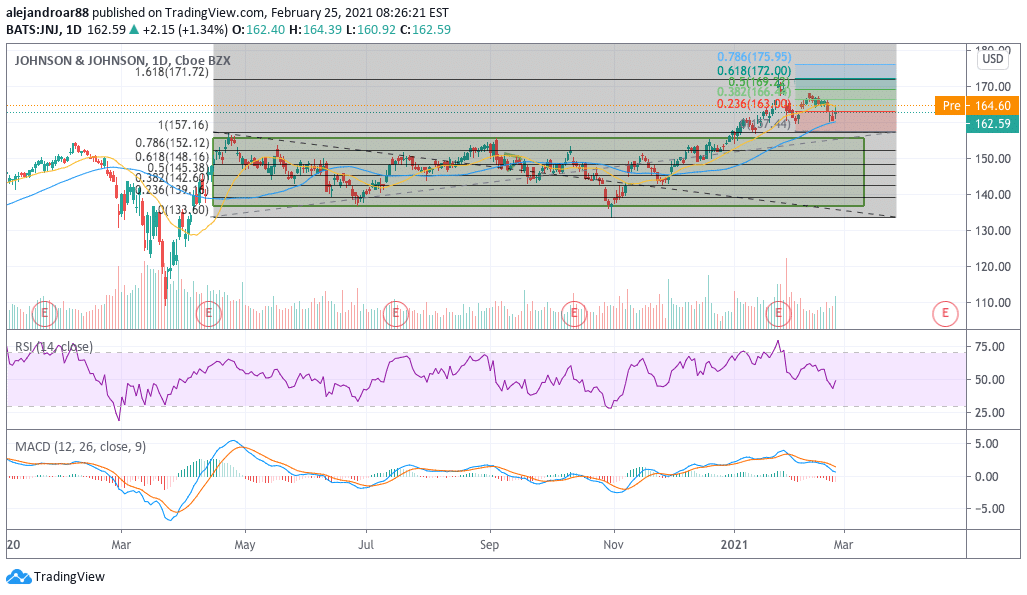

After months of trading range-bound, Johnson & Johnson shares appear to be emerging off the consolidation rectangle shown in the chart, although they have recently gone down awfully close to the upper end of this formation.

Last year, the stock delivered an 11% gain for investors while JNJ’s share price has advanced another 4% this year, currently offering a 2.5% dividend yield.

At this point, the short-term moving averages remain the most important resistances to overcome to possibly confirm the continuation of this bull run, although the MACD oscillator is still heading down while approaching negative territory.

The approval of the vaccine in the US and other latitudes seems to have already been priced in, which means that the official announcement will probably fail in moving the needle for market participants.

On the other hand, if studies continue to reinforce the view that vaccines will be required periodically to inoculate individuals around the world against the virus over the coming years, chances are that the stock might receive a boost as the one-dose vaccine will open up a huge new profitable revenue stream for J&J for the next 2 to 5 years at least.

Question & Answers (0)