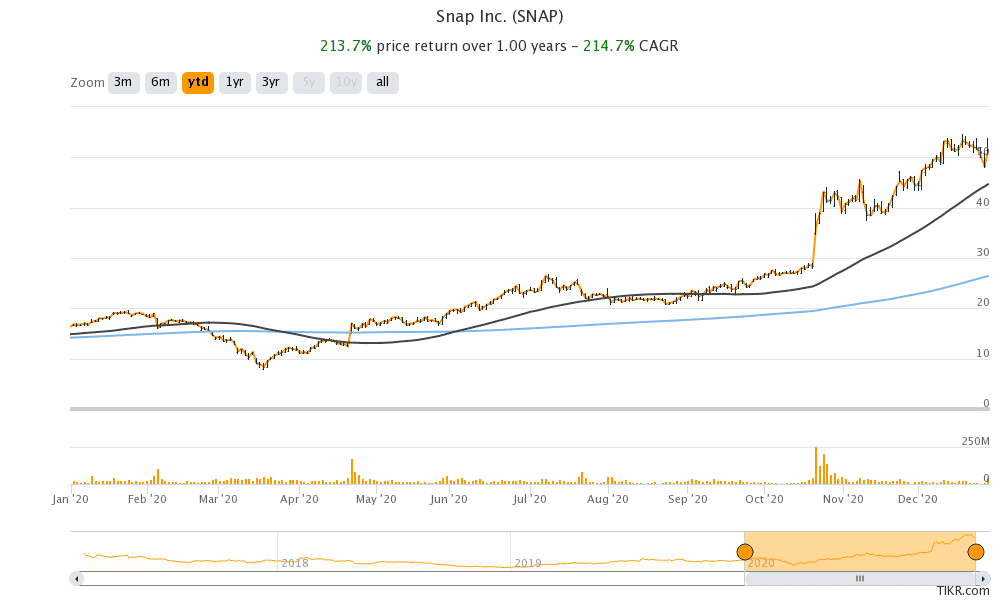

Snap share has more than tripled in 2020 and outperformed its bigger rival Facebook. Goldman Sachs expects the rally to continue in 2021 also and has raised its target price.

Goldman Sachs raised its target price on Snap from $47 to $70 which is the street high price target. According to the estimates compiled by TipRanks, Snap’s average price target is $42.54 which is a discount of 17% over its Tuesday closing prices. The share’s lowest price target is $24 which is less than half of its current price levels.

Goldman Sachs turns bullish on Snap

Goldman Sachs expects Snap share to rally further in 2021. “Snap’s Spotlight product, new ad campaign objectives and bid types, and the Unity partnership, particularly Unity Ads’ inclusion into the Snap Audience Network (SAN), have the potential to drive further momentum in engagement growth as well as provide valuable scale to advertisers,” said Goldman Sachs analysts led by Heath Terry.

Snap’s third quarter earnings

Snap, that owns Snapchat and Bitmoji had reported stellar results in the third quarter. The company reported revenues of $679 million in the third quarter which was higher than the $556 million that analysts polled by Refinitiv were expecting. Snap’s revenues increased 52% year over year which Snap’s CEO Evan Spiegel said reflects “the substantial value we drive to both direct response and brand advertisers during this continued period of uncertainty.”

The company also posted a surprise profit of $0.01 per share in the quarter while analysts were expecting it to post a loss per share of $0.05. Snap’s daily active users in the third quarter rose 4% as compared to the second quarter to 249 million. Its average revenue per user (or ARPU) was $2.73 in the third quarter which was higher than the $2.27 that analysts were expecting.

Fourth quarter guidance

During the third quarter earnings call, Snap said that it expects its fourth quarter revenues to increase between 47% and 50% and expects its daily active users to rise to 257 million in the quarter. Goldman Sachs analysts expect the company to beat its fourth quarter guidance.

“In addition, our recent ad checks as well as 3rd party data suggest outperformance relative to the company’s initial guidance for 4Q, acceleration we believe is sustainable beyond the current quarter,” said Goldman Sachs analysts.

Some advertisers are shifting to Snap

Earlier this year, many advertisers stopped advertising on Facebook over the company’s inability to prevent hate speech. Some of these advertisers shifted to Snap. “We saw many brands look to align their marketing efforts with platforms who share their corporate values,” said Snap’s Chief Business Officer Jeremi Gorman during the third quarter earnings call.

Notably, many users have been getting apprehensive of Facebook’s data collection and privacy policies. Users that are not comfortable with Facebook’s policies or the way it treats user data have been moving to platforms like MeWe that do not sell the user data to the highest bidder.

Snap’s views on free speech

In an interview with BBC, Snapchat’s founder Evan Spiegel expressed his views on the debate between free speech and the need to moderate content on social media platforms. While he opined that social media platforms should not be held responsible for moderating content, he said that the company is taking a “proactive approach” towards the content on its platform.

Free speech versus content moderation

Drawing an example to illustrate why social media companies should not be held responsible for the content he said: “For example, for telephone calls, I would say no – if you pick up the phone, and you say something really, really inappropriate and outrageous to your friends, the telephone company isn’t responsible for what your friend said, your friend is responsible.”

However, he added, “We do want to make sure that our platform is the place where people can express themselves and even though they say inappropriate things sometimes, our government actually has a whole legal framework to protect that sort of self expression and free speech,”

Snap share: Valuation and technical analysis

Coming back to Snap shares, it looks in a technical uptrend and is trading above both its 50-day SMA (simple moving average) and the 200-day SMA. Looking at the valuations, it trades at an NTM (next-12 months) enterprise value to revenue multiple of 23.5x while its NTM PE multiple is 415x.

The valuation multiples might look high on a standalone basis but should be seen in the context of the high growth. For instance, analysts expect Snap’s revenues to rise over 41% in 2021 while its earnings are expected to surge over 300% over the period.

Should you buy Snap share

Snap is in the process of monetising the platforms that should lead to higher revenues and earnings. The company has also been coming up with innovative features. For instance, it has partnered with several companies including Levi’s Straus where the users can virtually try their apparel and shoes on its apps.

Growth shares have seen a rerating this year and that’s reflected in Snap’s valuations. On a relative basis, the share does not look expensive. Looking at the company’s strong growth rates and innovations, it could be a long-term winner.

Question & Answers (0)