IAG shares are down 2% during today’s stock trading activity in London at 93.68p as negative momentum accelerates for airlines on the back of rising virus cases on the European continent.

This would be the fifth red session for IAG shares in the past six days, with the stock dropping nearly 80% so far this year, while one of the firm’s subsidiaries – British Airways – is facing a £20 million pound fine from the British Information Commissioner Office for failing to prevent the leak of sensitive information of more than 400,000 passengers.

The leak is traced back to a cybersecurity incident from 2018 with both personal and financial information from the affected passengers being exposed to unauthorized third parties.

The UK regulator, however, went soft on British Airways in regard to the size of the fine – although it is still the largest it has ever imposed to date – in consideration of the strained financial situation the airline is in amid the pandemic.

IAG receives a pat on the back by one of UK0’s largest hedge fund

Marshall Wace – a £35 billion UK-based hedge fund – recently disclosed that it invested £140 million in the battered airline holding company, an amount that represents a 3% stake in the firm.

The British investment fund will join Qatar Airways as one of the largest stakeholders in IAG at the moment, with the Middle East air carrier currently retaining 25% of the ownership.

An investment in IAG would be an interesting turn in Marshall Wace’s perception of the commercial aviation industry, as the firm has taken short positions throughout the year in multiple other European airlines including Lufthansa and Air France.

This investment is potentially providing a pat on the back for IAG, and for the continent’s airline industry for that matter, as it could signal that investors are becoming more optimistic about the future of the sector despite this temporary pandemic headwind.

What’s next for IAG?

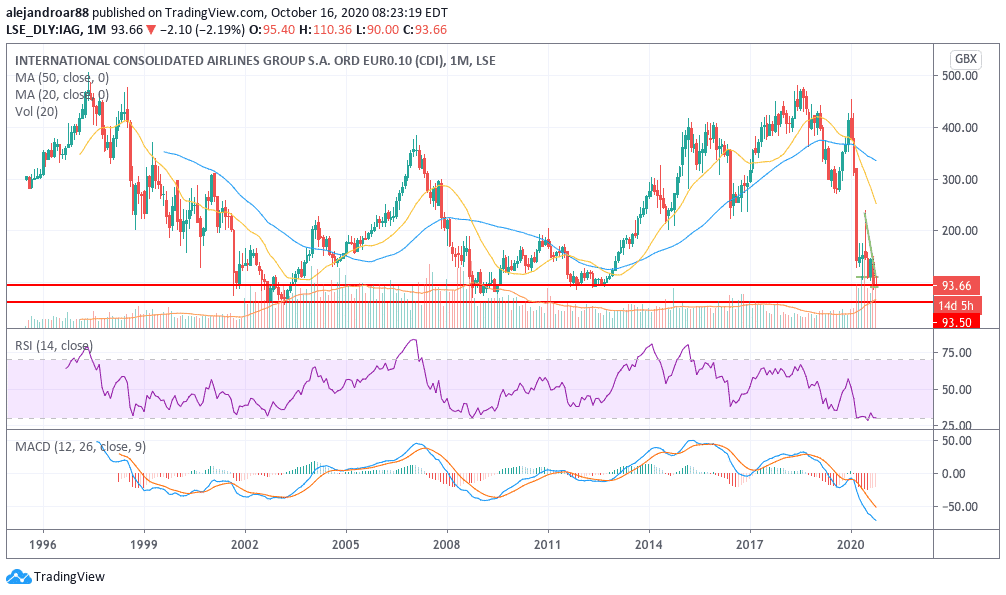

From a long-term perspective, IAG shares remain submerged in a sharp negative momentum, although the long-term indicators are signaling that the shares may be poised for a technical rebound over the next few months.

In fact, the chart above shows that the monthly RSI is currently sitting at its lowest levels in history, which is perhaps a contrarian indication as shares could swiftly rebound from there if market players feel the price of the stock is too cheap to miss out on.

Moreover, the stock is finding support at a historical threshold of 93.5p and a rebound off these lows could confirm that the stock could be due for a trend reversal – although the backdrop remains unfavorable and could cap the extent of such a move.

The daily chart, on the other hand, shows that IAG shares have now dropped below a descending triangle pattern driven by a strong resurgence of the virus in the Eurozone.

The price action has found a floor at the 88p – 90p level with a potential double bottom pattern in play if the stock were to fall to those levels to then successfully rebound off of them.

A move of that nature would confirm what the monthly chart is also indicating – that the stock is poised to move higher on the back of a technical rebound. This could present a short-term buying opportunity although the mid-term outlook for IAG remains bearish given the significant pressure its financial situation is facing amid the pandemic downturn.

Question & Answers (0)