Greggs shares are soaring today in mid-day stock trading activity after the company revealed that its sales are recovering towards pre-pandemic levels.

Shares of the British bakery are advancing as much as 10% at 1,960p per share as Greggs reported that its like-for-like sales – a measure that reflects the performance of individual stores against past results – stood at 85.7% of their 2019 level during the five weeks ended on 2 January.

Meanwhile, the same indicator stood at 81.1% during the fourth quarter of 2020, while sales were down 15% compared to the same period a year ago, ending the three-month period at £293 million.

The company’s CEO, Roger Whiteside, highlighted that despite the “enormous” impact that the pandemic has had on the business, the firm managed to demonstrate its resilience by taking advantage of its geographical spread to limit the extent of the downturn.

That said, the head of the bakery store chain acknowledged that the recent restrictions announced by the British government – referring to the countrywide lockdown imposed by Prime Minister Boris Johnson – have increased the level of near-term uncertainty for Greggs, while they also affect its growth prospects.

In this regard, the company believes that its pre-COVID profitability levels won’t come back until 2022 at least, as higher levels of unemployment and persisting social restrictions might continue to cap the company’s ability to deliver stronger results.

The firm now anticipates that total sales for the 2020 financial year will land at £811 million, down 30.5% from the £1.17 billion the firm brought in a year ago. Meanwhile, full-year losses before taxes are expected to end the year at £15 million.

How did Gregg shares perform during 2020?

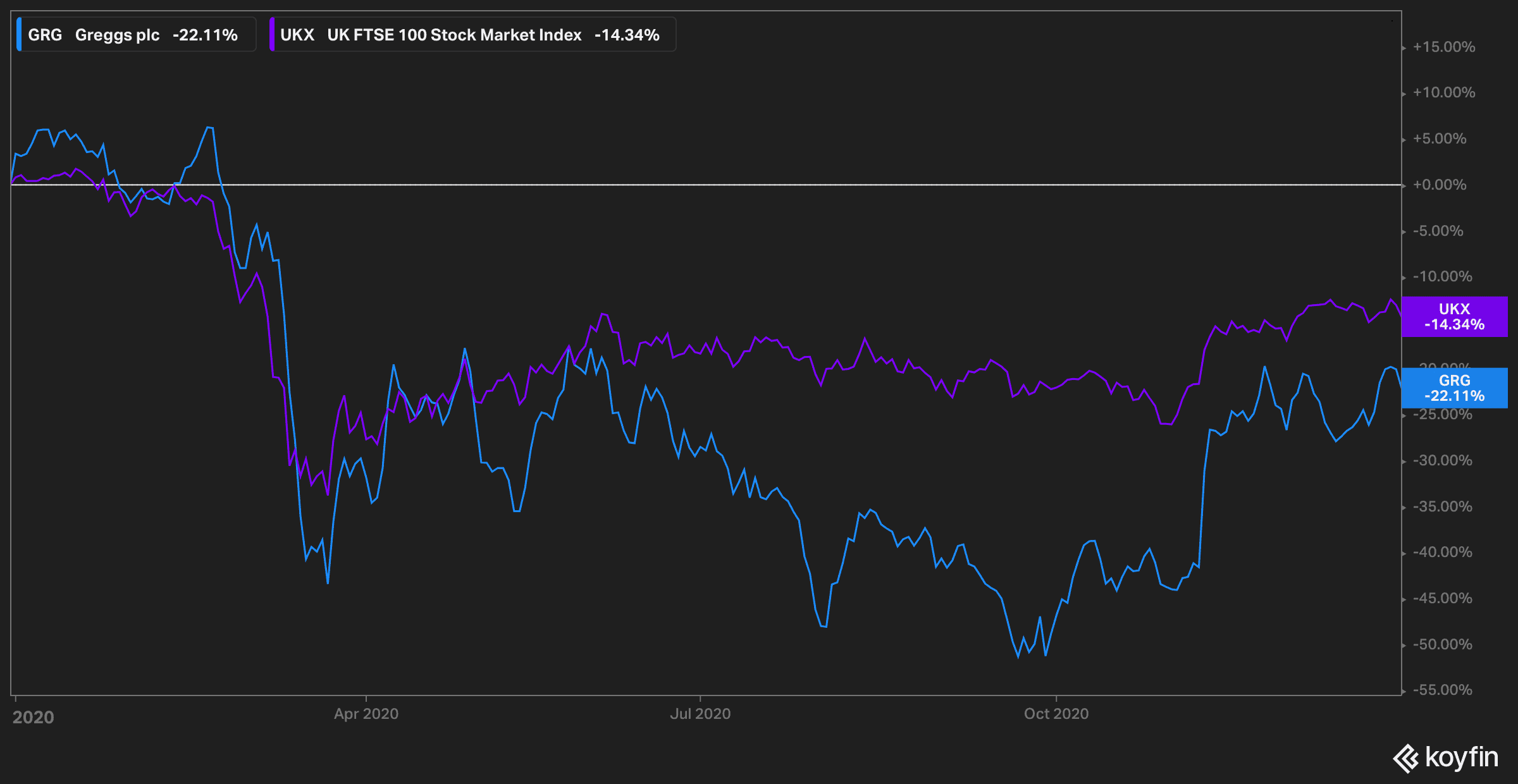

Gregg shares underperformed the British stock market as a whole during 2020, as the company was dramatically affected by the introduction of lockdowns and other social restrictions amid the pandemic.

The firm, which relies heavily on foot traffic to attract customers to its stores, saw its stock plunge by 22% during the year, while the FTSE 100 index ended up losing 14% during the same period.

To respond to the challenges flowing from the health emergency, the company partnered with delivery firm Just Eat to serve customers while they remain confined at their homes, with 600 stores currently providing deliveries and another 200 in line to start doing so in 2021.

During the year, the number of Greggs stores stood at 2,078, with the firm added 28 net new shops. Meanwhile, Greggs plans to open 100 new stores this year, although that target is subject to market conditions.

What’s next for Greggs shares?

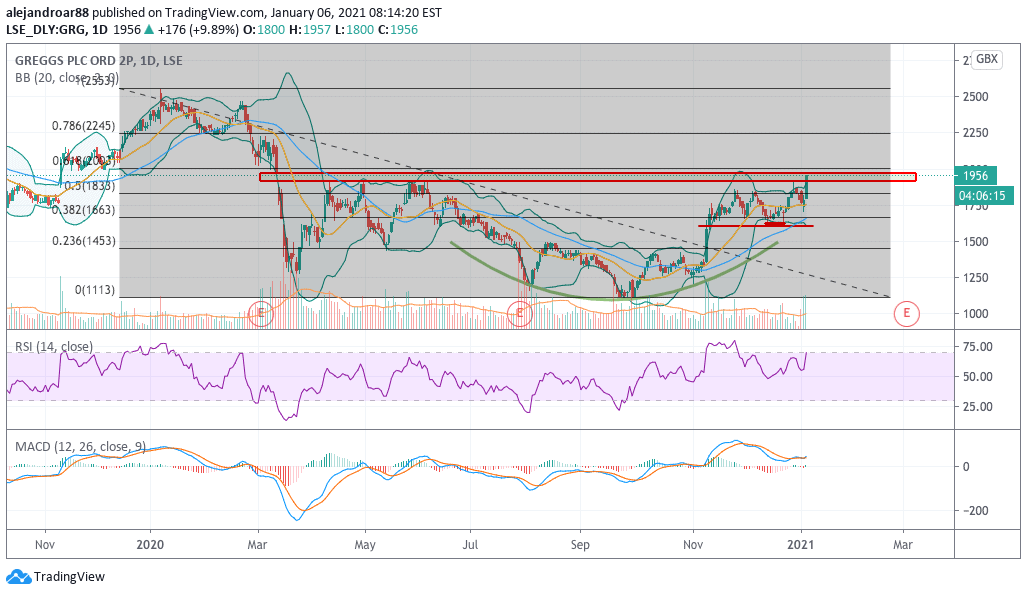

Today’s price action seen by Greggs shares is effectively filling the bearish gap left behind during the February-March pandemic sell-off as market players could be looking forward to a full-blown recovery by the end of 2021, amid the progressive rollout of multiple vaccines in the UK.

Filling this gap is perhaps the most difficult task for the stock and it could end up marking the beginning of a new bullish phase.

If this move were to gain traction in the following days, a first target could be set at 2,250p per share – the 0.786 Fibonacci shown in the chart – which would represent a 15% short-term upside if reached.

That said, the following days remain important for Greggs shares as the price is making a new high on a lower RSI reading. This could end up creating a bearish divergence that might end up sidetracking the bull run.

With that in mind, if today’s uptick were to be followed by a breather, the 1,800p level would be an area of support to watch as buyers should respond strongly to the selling amid the prospect of a sustained recovery in the business.

Question & Answers (0)