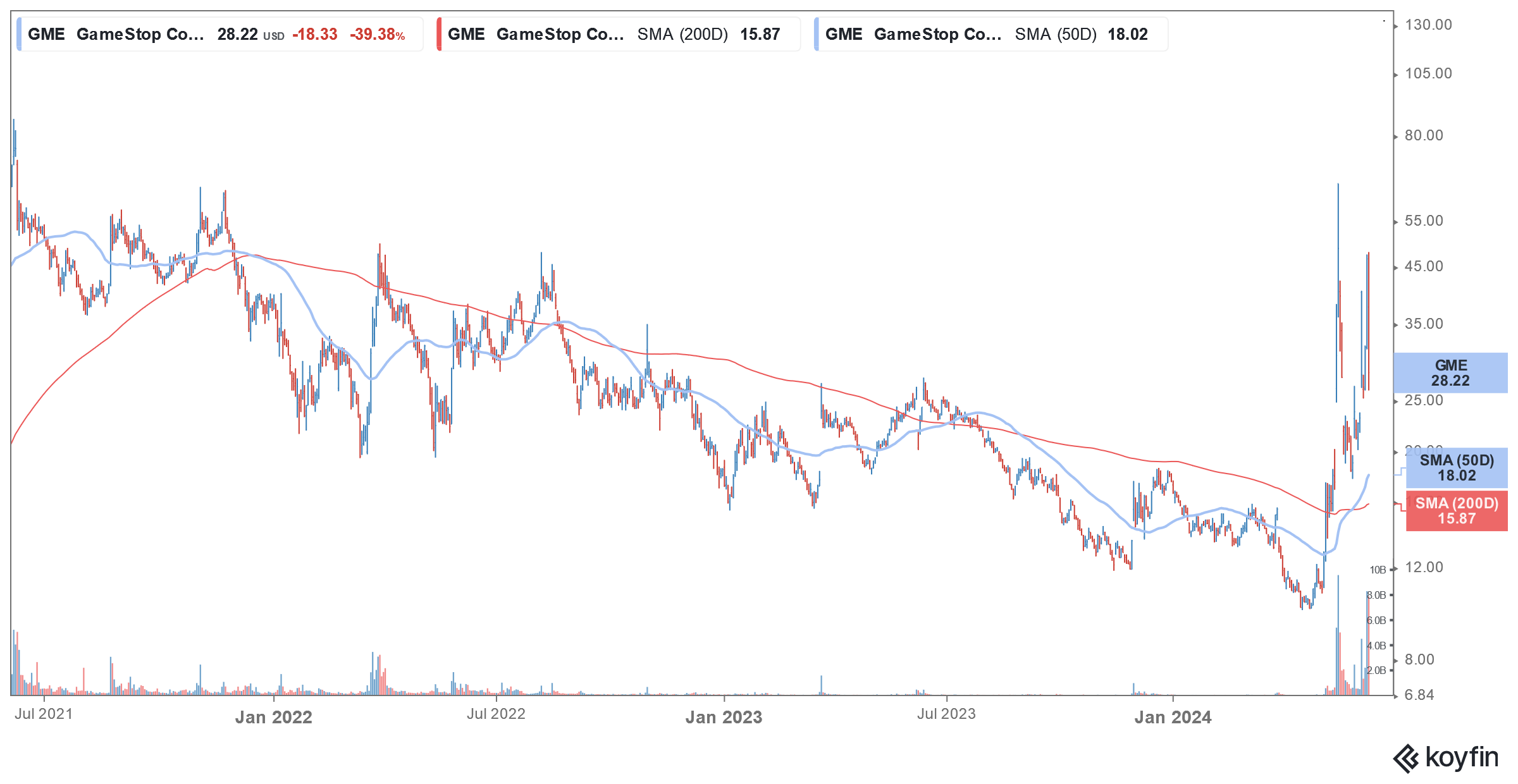

GameStop shares crashed on Friday and are lower in the US post-market price action. The meme darling has seen quite a bit of volatility over the last month after “Roaring Kitty” whose real name is Keith Gill became active online and started tweeting about the company.

He shared a cryptic tweet on May 13 which added fuel to GameStop’s meme rally. However, the shares crashed last week after his livestream which did not offer any new insight into the investing theme for the gaming retailer.

Gill holds 20,000 GME call options with a strike price of $20 that expires June 21. During the stream, he said that he does not have any institutional backers. “Those are my positions. I’m not working with anybody else, with hedge funds. … I gotta hop on the stream and just remind people you know … I’m not an institutional investor,” said Gill.

Meanwhile, GameStop shares crashed a whopping 40% on Friday. Not only did Gill’s livestream turn out to be a damp squib but GameStop’s earnings also played a dampener.

GameStop preponed its earnings

GameStop preponed its earnings and released its in premarkets on Friday, It reported revenues of $881.8 million in the quarter which was down 29% YoY and below Wall Street expectations. However, the company’s net low narrowed to $32.3 million in the quarter as compared to $50.5 million in the corresponding quarter last year.

The company did not hold an earnings call and has anyways stopped taking analyst questions during the earnings.

GameStop to issue more shares

Just last month GameStop sold 45 million shares to raise upwards of $900 million. Now it has unveiled yet another stock sale plan and intends to sell 75 million shares.

AMC Entertainment that is saddled with billions of dollars of debt, issued shares worth $250 million amid the meme stock mania.

In the 2021 meme stock rally also, companies capitalised on the short squeeze and went on a capital raising spree. Zomedica, Sundial Growers, and Naked Brands issued new shares in a frenzy with almost complete disregard for dilution.

Meme share rallies

The capital raise was a lifesaver for meme companies and some wouldn’t have survived if not for the cash they raised during that period. But then, even the massive capital raise wasn’t any surety of long-term survival.

Naked Brands for instance eventually announced a reverse merger with Cenntro Electric Group while Zomedica’s current market cap is just about similar to the $173.5 million that it raised through share sales in 2021.

Sundial Growers is an exception here as the company, which was predominantly a cannabis company turned into an investment company and the marketable securities and investments on its balance sheet are just about similar to its market cap.

Analysts don’t see a revival in GameStop

GameStop has taken several actions to revive the business. For instance, it doubled down on online sales, shut many of its stores, reshuffled its top management and hired several tech executives, and expanded its target market. It even experimented with NFTs but these measures haven’t been able to mask the near-terminal decline in its core gaming retailing business.

Analysts continue to be bearish on GameStop and Wedbush analyst Michael Pachter who has a $7 target price on the shares believes the company is not in a position to move to profitability, citing its $6 million loss last year.

“We expect them to lose $100 million a year going forward. It’s a race to see if they can close stores fast enough to limit losses, but they have no plan that would suggest they can grow revenues or profits, and their core business is in decline,” said Pachter.

Is Gill manipulating GameStop shares?

Former SEC chief Jay Clayton believes that Gill could have possibly committed market manipulation with his tweets that “triggered…euphoric and speculative buying among the retail community.” However, he said that “facts and circumstances around the publication of the tweet,” would need to be considered while determining whether Gill’s activity was illegal.

According to Clayton, “There is nothing illegal about saying I like a stock” He however added, “There are things illegal about saying I like a stock and taking activity in the marketplace that’s designed to drive behavior, indicate that prices are rising.”

E*Trade was reportedly considering banning Gill from its platform

The Wall Street Journal reported that E*Trade was considering banning Gill from its platform. According to Pillsbury partner David Oliwenstein “What the government would need to show to pursue a market manipulation theory is manipulative intent.”

He added, “It’s safe to assume that the SEC will at least take a hard look at the trading.”

Meanwhile, while GameStop shares have come off their 2024 highs they are still much higher than what they were before the meme rally began. GameStop seems to be making up the most from the rally as is evident in its second share sales announcement.

Question & Answers (0)