The UK’s FTSE 100 index is dropping 3% today at 5,830 – its largest daily drop since 24 July – as coronavirus cases continue to rise in the country and following the release of leaked documents that pointed to British banks allowing billions from criminal organizations to flow through their systems.

Shares of virus sensitive companies are leading today’s meltdown including those of IAG Group and Rolls Royce, which are dropping by 10.8% and 8.2% respectively due to the impact that renewed travel restrictions could have on their businesses if European countries were to impose strict lockdowns again.

Meanwhile, bank stocks are seeing heavy trading volumes and sharp losses as well as a result of the FinCEN leaks, a series of documents from the Financial Crimes Enforcement Network that expose how large banks around the world have helped criminal organizations in moving at least $2 trillion through the global financial system.

UK-based banks including Barclays, HSBC, and Standard Chartered were among the top movers along with US-based banks JP Morgan & Chase and the Bank of New York Mellon, although the Deutsche Bank emerges as the most heavily involved in these operations, accounting for roughly $1.2 trillion of the $2 trillion total the report mentions.

Barclays shares are dropping 5.5% today at 0.92p per share following these allegations while HSBC, Lloyd’s Banking Group, and Standard Chartered shares are also down 5.4%, 7.8%, and 4.9% respectively. The financial sector – including banks and financial services companies – accounts for roughly 18% of the index.

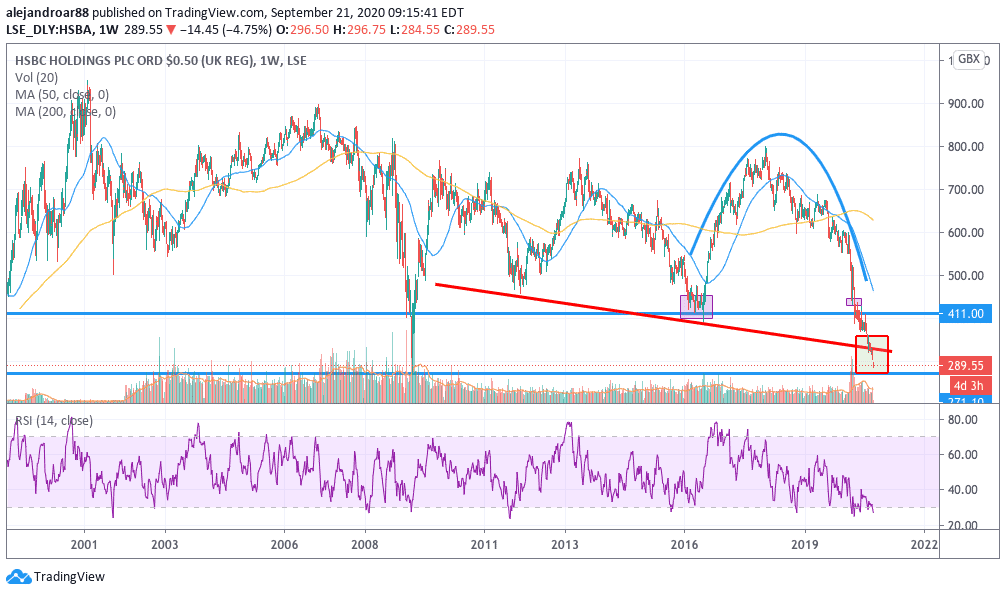

HSBC (HSBA) shares are facing increased pressure as the bank has already been involved in operations that supported criminal activities in the past, while the situation in Hong Kong continues to play against the bank’s stability.

Based on today’s stock trading activity, HSBC shares seem to be dropping from a long-dated lower trend line that dates back to November 2011, while the price is also at its lowest level since 1998 and approaching a historical support line at 270p per share, which could serve as either a floor for the bank or – if crossed – it could mean HSBC shares could be in serious trouble.

How is the virus situation affecting the FTSE 100 index?

A resurgence of the virus in the United Kingdom is also a major factor weighing on the performance of the FTSE 100 index today, as the country has been recording more than 4,000 infections per day – the highest daily tally since February – May.

This situation is endangering the prospects of a swift economic recovery for the country as another wave of lockdowns and travel restrictions could derail the fragile rebound seen in the last few months after the economy progressively reopened.

The World Health Organization (WHO) has already qualified the situation in Europe as a whole as “very serious” while vaccine hopes have also taken a hit this weekend after a report from AstraZeneca – one of the world’s front-runners in the race to find a cure for the virus – revealed that a second patient fell ill, showing similar symptoms to the first one who experienced a rare neurological syndrome.

Moreover, a second wave of lockdowns could also add to the pressures that the country’s public finances are facing after its recently-approved multi-billion fiscal aid package. Plus, the economy is bracing for a potential 10% contraction according to UBS’s most recent forecast. The UK economy shrunk a historical 20% between April and June.

What’s next for the FTSE 100 index?

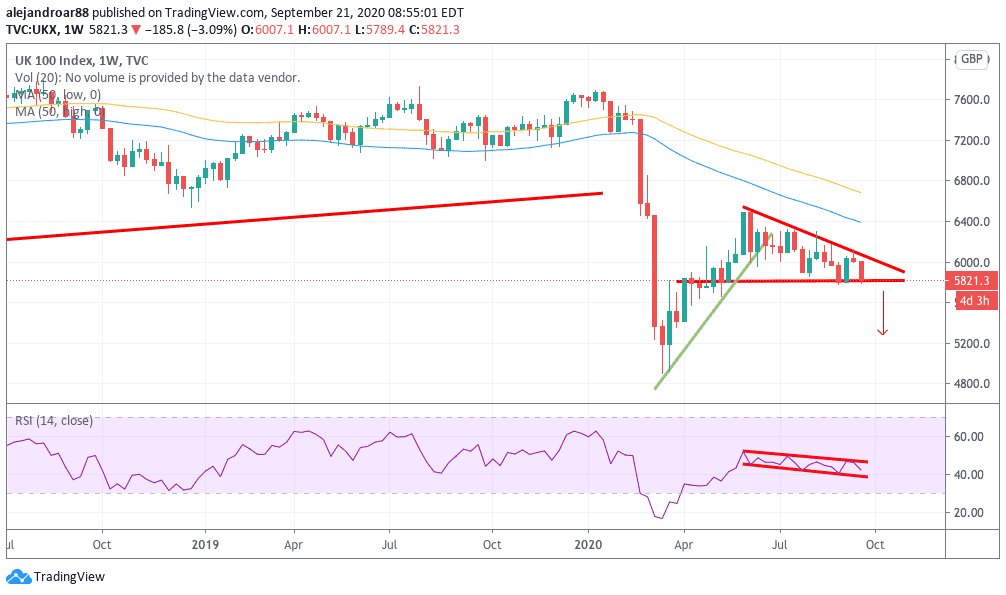

The weekly chart of the FTSE 100 index shows that the benchmark broke its lower trend line back in June as virus infections in the United States threatened to derail the global economic recovery.

Since then, the price action seems to be forming a descending triangle, a bearish formation that consists of subsequent lower highs supported by a key level – in this case 5,800.

At this point, the index is finding support at that exact level but the pressure that banks are facing along with the negative momentum triggered by a spike in virus cases could plunge the FTSE 100 index into a more severe correction.

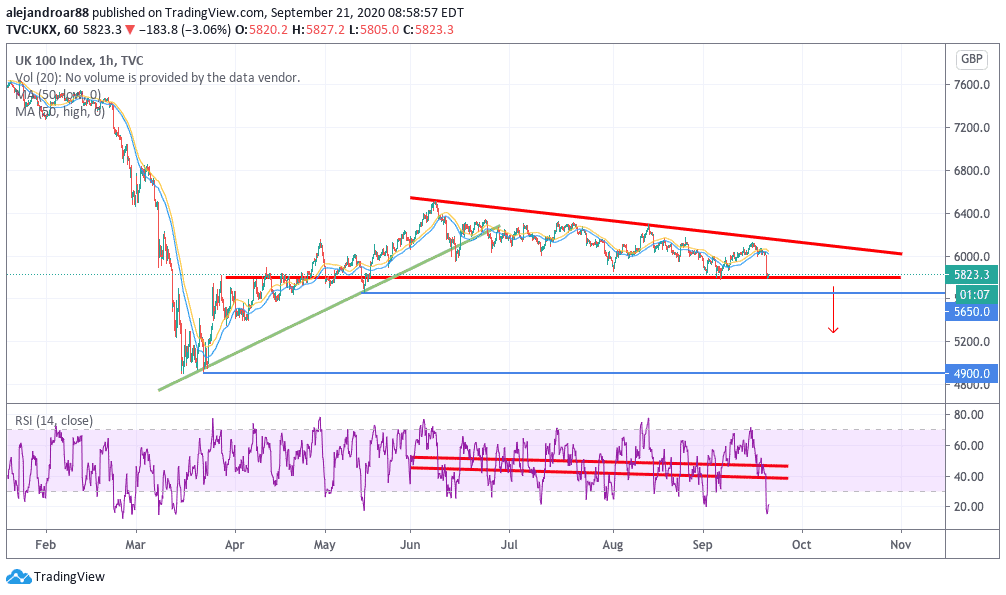

In this regard, the hourly chart shows that the next support level would be found at 5,650, which is only 3% down from the index’s current value.

A move below that level could retest other supports at 5,550 and 5,400 while a full retest of the 4,900 is not completely off the table, especially if virus cases spike out of control and reach levels higher than those seen in February – May.

A catalyst that could plunge the index to those levels would be a set of nationwide lockdowns in the country along with strict travel restrictions all over the Eurozone.

Question & Answers (0)