Tech sector weakness in the US stock market is dragging the FTSE 100 index below the 7,000 level this morning, only a few days after the index managed to climb above this major psychological threshold for a second time since the pandemic started.

So far today, the ‘footsie’ is dropping 2.4% at 6,955, with bulls struggling to keep the price above the 7,000 mark to avoid losing a major area of support.

Only one of the 108 companies that comprise the FTSE 100 is reporting a positive performance today, while certain individual issues including Next (NXT), Prudential (PRU), IAG Group (IAG), and Ocado Group (OCDO) are posting sharp single-day drops during mid-day stock trading action.

The consistent climb in US Treasury yields since last week is contributing to the deterioration of stock market valuations across the world, with other European markets suffering a similar faith including the German DAX and the French CAC 40 index, both of which are dropping 2.3% and 2% respectively.

Meanwhile, a rise in inflation expectations is also affecting the market’s overall sentiment, as a consistent climb in price indexes could prompt central banks to raise interest rates abruptly – a situation that would depress valuations across the board.

Sophie Griffith, a market analyst for OANDA, commented: “The overriding fear is that pandemic stimulus combined with reopening economies will spark a sharp drive high in inflation, forcing central banks to take action, tightening policy and potentially slowing down economic recovery”.

On Wednesday, consumer price index (CPI) data will be released by the US Bureau of Labor Statistics, with the consensus estimate for annualised inflation rates currently standing at 3.6% while annualised core inflation is expected to land at 2.6% according to data from Koyfin.

Three variables support a bullish outlook for the FTSE 100

Despite today’s downtick in the footsie, three variables continue to support a bullish thesis for the British stock index. These are en-masse vaccinations, an improving economy, and no more Brexit worries.

On the vaccine front, data from the British government indicates that a total of 35.47 million people have received one dose of the vaccine in the country so far, which is more than half of the population while the most sensitive age groups should now be out of harm’s way.

Meanwhile, the country’s economy is expected to grow at a faster rate than expected, as indicated by forecasts from the EY ITEM Club, a group comprised of top economists who track the performance of the British economy and who are now anticipating a 6.8% jump in the nation’s gross domestic product (GDP) for 2021 – up from a previous forecast of 5%.

Finally, with Brexit concerns now taking the back seat, most of the hurdles that were keeping a lid on the advance of the British stock index appear to be off the table, providing investors with an upside potential similar to that seen by other European benchmarks.

What’s next for the FTSE 100 index?

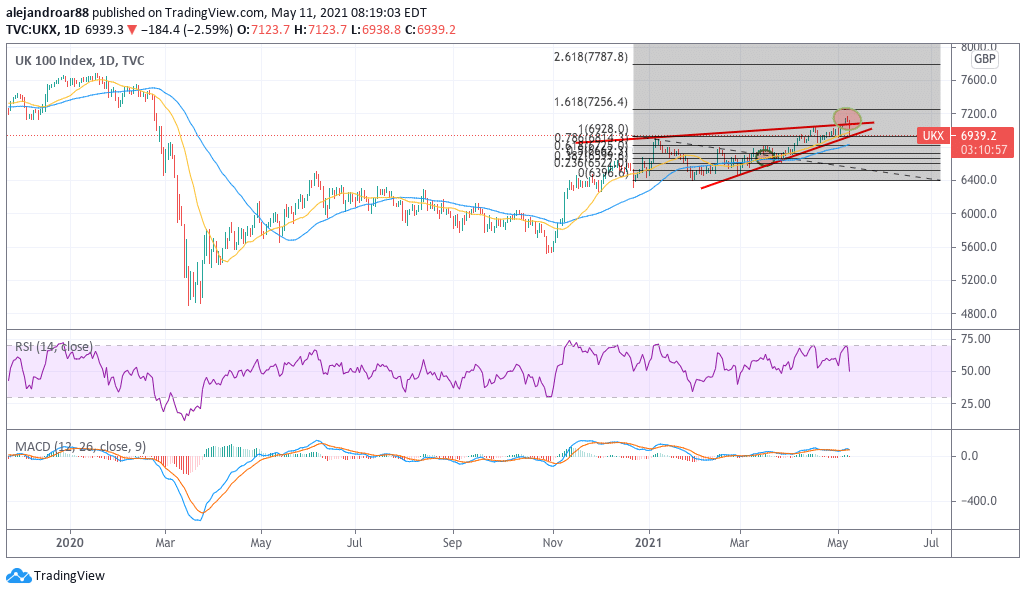

The price action today is not necessarily invalidating a short-term bullish thesis for the footsie, as the index is finding support at the lower trend line highlighted in the chart as bulls fight to hold the line above the 7,000 mark.

A series of lower highs and higher lows is reinforcing a bullish outlook as well, with the resulting formation being a rising wedge that should lead to a break above the 7,200 on short notice.

That said, there is strong downside risk if the price breaks below the 50-day moving average – currently standing at 6,800 – and that would be a good place to set a stop-loss for swing traders.

All things considered, a strong push below the 7,000 level could present itself as a buying opportunity since the backdrop is particularly favorable for the index while there is no material evidence that suggests that a full-blown reversal is in place.

Question & Answers (0)