The market capitalisation of Facebook hit a milestone yesterday after the value of the social media company surged to $1 trillion for the first time in its history following the dismissal of an antitrust lawsuit from the Federal Trade Commission (FTC) that sought to unwind the tech company’s acquisition of Instagram and Whatsapp.

Shares of the company founded by Mark Zuckerberg were up 4.2% after the favorable ruling was published, surging to $355.64 per share while they are moving 0.3% higher in pre-market stock trading action this morning as well.

The performance of the stock had been suffering for a while amid worries that an increasingly hostile attitude from regulators regarding alleged monopolistic behaviors from large tech companies including Facebook (FB) could result in a forced break-up of the firm’s triumvirate of successful platforms.

The lawsuit brought up by the FTC accused the Menlo Park-based social media company of displaying monopolistic behavior back when it purchased its rival Instagram at a valuation of $1 billion in 2012 while that view was reinforced by the Whatsapp deal in 2014.

The proceeding demanded a forced divestiture that would result in Instagram and Whatsapp once again becoming standalone businesses. Instagram alone reportedly generated $20 billion in revenue for Facebook in 2020, accounting for at least 28.5% of the firm’s top-line results.

James E. Boasberg, the appointed judge for Facebook’s case, stated: “The FTC has failed to plead enough facts to plausibly establish a necessary element of all of its Section 2 claims —namely, that Facebook has monopoly power in the market for Personal Social Networking (PSN) Services”.

This favorable ruling is a clear win for Zuckerberg’s firm and the market has acknowledged it as it could put an end, at least for a while, to a growing number of threats in the United States including the Senate hearings that started in November last year amid similar concerns.

However, the company continues to face similar proceedings in Europe as multiple investigations have been launched by regulators to scrutinize the company’s practices.

The judge gave the FTC 30 days to refile its complaint against Facebook. Meanwhile, a spokesperson for the company stated: “We are pleased that today’s decisions recognize the defects in the government complaints filed against Facebook”.

How have Facebook shares performed so far this year?

Including yesterday’s uptick, Facebook shares have surged 30% this year as the company’s growth accelerated during the pandemic, with lockdowns prompting businesses to increasingly rely on the firm’s advertising platform to reach customers while they remained confined within their homes.

Moreover, the value of Facebook shares went up 33% last year after quickly recouping the losses they experienced during the February-March market crash.

Yesterday’s ruling could become a strong positive catalyst for the price of FB stock as investor’s concerns about a negative outcome resulting from antitrust proceedings in the US will probably be put to sleep for a while.

What’s next for Facebook shares?

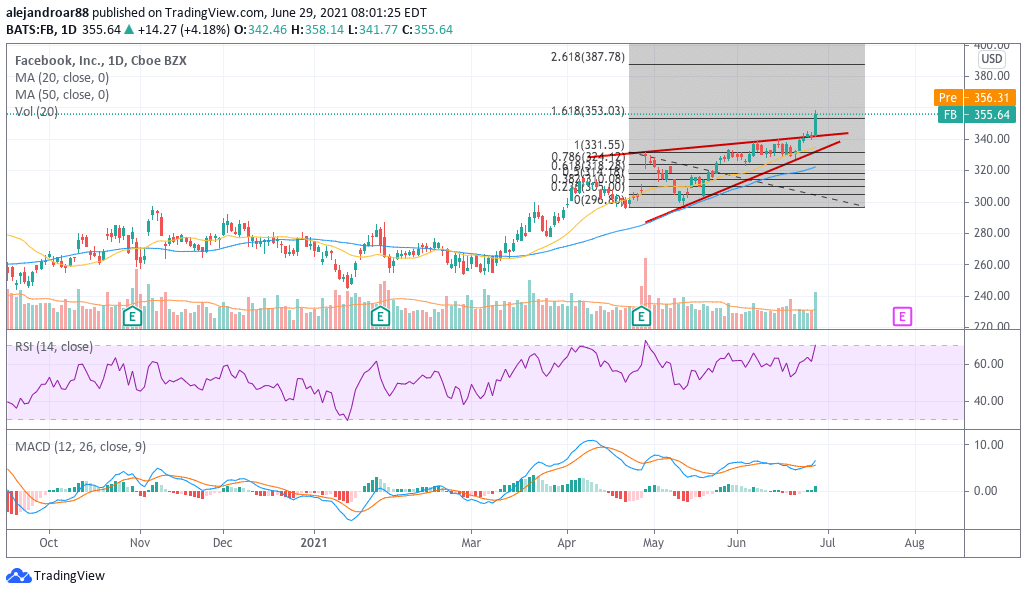

Yesterday’s price action seen by Facebook shares seems to have accelerated the stock’s latest uptrend as reflected in the chart above, with the share price breaking above its upper trend line while surging past the 1.618 Fibonacci extension.

The stock’s trading volumes reinforce this view as buyers rushed to get their hands on almost 30 million shares of the social media platform, a figure that represents roughly two times the stock’s average daily volumes. Meanwhile, the RSI is approaching oversold levels while the MACD just sent a buy signal.

Based on these readings, the stock’s outlook appears to be bullish while analysts’ consensus recommendation for Facebook currently stands at buy according to data compiled by Seeking Alpha with the 12-month consensus price target for FB currently standing at $385 per share.

Question & Answers (0)