If you’re on the hunt for some high-octane excitement down with the penny shares, then look no further than Eurasia Mining (EUA).

The shares of this Russian mining company – listed on the Alternative Investment Market (Aim) junior market – have been suspended since 11 February, but have recently started trading again.

Eurasia Mining (not be confused with Eurasia Group) is sometimes described as a gold miner but that is only a small part of the business. It also digs up some palladium, rhodium and iridium, but most revenues are from platinum.

In line with stock market rules on acquisitions, the lack of clarity around the firm’s relationship with Chinese group CITIC led to the suspension of the shares. It transpires that CITIC’s merchant bank subsidiary is trying to sell the company’s assets.

Per an announcement on 1 July, UBS is advising on the sale and the related “review of its strategic options”.

Discussions regarding the disposal have taken place with a number of interested parties.

In April the firm confirmed that it had held discussions during and after the PDAC and Indaba mining industry conferences.

South Africa shutdown spurs interest in Eurasia assets

An announcement by the South African government at the end of March that platinum group metal mining would undergo shutdown for 21 days may have helped to spur interest in the Eurasia assets.

South African output accounts for around 70% of global platinum supply.

Problems for the South African miners were compounded by the downgrading of South African sovereign debt to junk, with the knock-on effect of making it more difficult for miners based there to raise funds.

South African miners such as Pan African Resources and others were quick to state that they could draw down on borrowing facilities.

Mining in the country fully resumed on 1 June. Hard evidence of how that is impacting CITIC’s attempts to find suitors for Eurasia has yet to emerge.

Certainly there has been a firming or palladium prices, where South Africa is estimated to supply 38% of the metal, but as noted above, it is platinum that matters more for Eurasia and the shares of that metal have been in the doldrums all year, although have start to recover of late.

How easy to sell?

So how easy will it be to dispose of Eurasia’s asset?

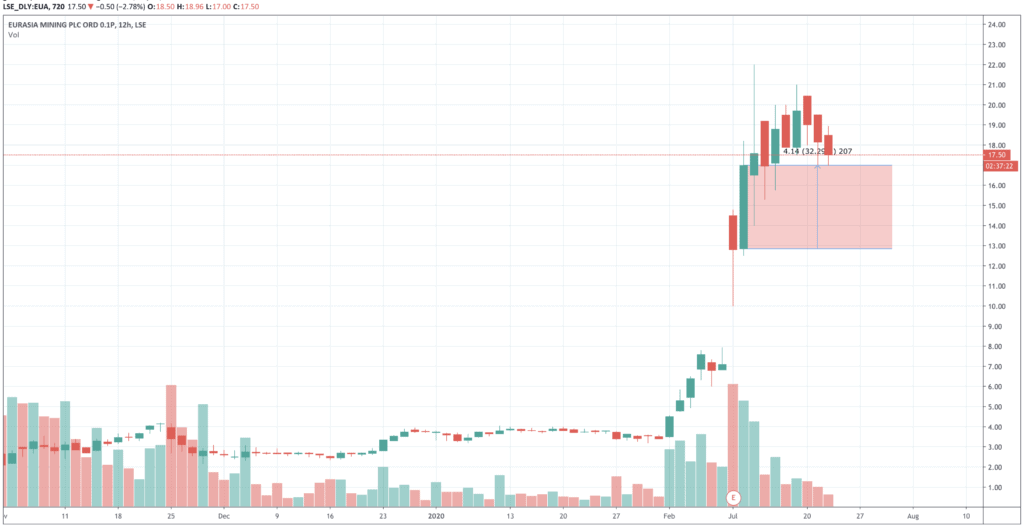

When the suspension was lifted on the news of the sale plans, the shares spiked, but the longer the search for a buyer goes on, the greater the likelihood will be that the froth gets blown off, and shareholders start to look to take profits.

The mining minnow’s shares jumped 32% (intraday high saw an 80% advance) when it resumed trading and after touching a high 22p is currently priced at 17.74, with selling pressure building this week (see chart below).

So what exactly is up for sale?

Eurasia’s two main operations are at West Kytlim in the Urals, where the platinum is mined, and two palladium open pit deposits at the Monchetundra Project on the Kola, closely situated to the processing facilities in the town of Monchegorsk.

The firm had to invest in new wash facilities last year plus outlays for new mining equipment late last year and earlier this, and that has seen its cash pile dwindle.

In April the company said it had cash in the bank amounting to $600,000 with a further $1 million available through an untapped credit line.

In a statement released announcing the restoration of Aim trading on 9 July, Eurasia executive chairman Christian Schaffalitzky, said: “The Board remains focused on maximising shareholder value, and, after receiving approaches from multiple parties interested in acquiring the company’s assets, has decided that launching a formal sale process under the Takeover Code is in the best interests of shareholders, which could result in a sale of assets or the company.”

Should you buy Eurasia Mining shares now?

But with the platinum price remaining decidedly soft, having fallen from $1,023 and ounce on 17 January to $882 today, it makes Eurasia’s assets look less attractive.

The company probably correctly expects demand for industrial metals to continue to strengthen for the rest of the year as industries start up again in China. Platinum these days is also considered a precious metal.

Plus the fact that it didn’t have to shutdown production like competitors in South Africa did, has helped strengthen the companies position in the market.

Nevertheless, buying the shares now is a risky gamble without greater visibility on who its suitors might be.

That said, Eurasia has no debt. However, with the shares delivering a year-to-date return of 380% for a market capitalisation of £490 million as of 21 July, its valuation is rich, to say the least.

Traders tempted by the prospect of a buyer emerging from among the mining giants such as Rio Tinto (RIO) or Anglo-American (AAL), might be best to wait out for the current pullback in the price to play out.

If the price falls back precipitously, to nearer the February pre-suspension price at around 7p before a buyer swoops, then that might be an entry point to consider.

Question & Answers (0)