The European Union (EU) has imposed definitive tariffs on electric vehicle (EV) imports from China after a split vote where some members opposed the tariffs with Germany cautioning against starting a trade war with China which happens to be the country’s biggest trading partner.

For context, in June the EU imposed tariffs of upto 38.1% on EV imports from China. The duties would be on top of the 10% tariff these imports already attract. However, in August it somewhat slashed the tariffs to between 9%-35.3% – with the top end of the range reserves for names like SAIC that did not cooperate with the EU’s probe. The region imposed a 7.8% tariff on Tesla cars made in China.

The tariffs have been contentious and the EU and China were negotiating for a mutual solution. However, eventually, the bloc voted to adopt these tariffs.

EU imposes definitive tariffs on EV imports from China

Overall, five members, namely Germany, Malta, Hungary, Slovakia, and Slovenia voted against the tariffs. 12 countries including Greece, Spain, Belgium, and Portugal abstained from the voting. However, the proposal went through as 10 members including Italy, France, Denmark, and Ireland voted in favor of the tariffs.

The voting choices of EU members are not hard to comprehend. The automotive industry in China and Europe is quite interconnected with German giant Volkswagen among the major players in China. The country has extensive trade ties with China and has historically been soft on the communist country as compared to some of the other members.

China’s EV giant BYD is setting up a plant in Hungary and the country unsurprisingly voted against the tariffs. Hungarian Prime Minister Viktor Orban warned that the EU was headed for an “economic cold war” with China.

Similarly, Cherry is looking to set up a plant in Spain in partnership with Ebro EV Motors and the country abstained from voting.

Germany warns of a Cold War with China after the tariffs

German Finance Minister Christian Lindner cautioned the EU against entering into a trade war with China. “Despite the vote for potential punitive tariffs against China, Ursula von der Leyen’s EU Commission should not trigger a trade war. We need a negotiated solution,” he said on X.

Notably, there has been a trade war between the US and China even as the two countries are the biggest trading partners for each other. The trade war escalated in former US president Donald Trump’s presidency where he imposed a 25% tariff on most imports from China.

The Biden administration has taken a more targeted approach and targeted specific imports from the world’s second-largest economy. In June, President Biden imposed tariffs on $18 billion of imports from China under Section 301 of the Trade Act of 1974.

Biden increased tariffs on EV imports from China

Specifically, tariffs on Chinese EVs were increased from 25% to 100%. “With extensive subsidies and non-market practices leading to substantial risks of overcapacity, China’s exports of EVs grew by 70% from 2022 to 2023—jeopardizing productive investments elsewhere. A 100% tariff rate on EVs will protect American manufacturers from China’s unfair trade practices,” said the White House in its statement.

Notably, the Biden administration took several steps to boost EV adoption in the country. It has linked the EV tax credit to the localization of production – including that of critical battery metals. After the targeted policies, companies like Toyota announced new investments in the US in an apparent bid to make its EVs eligible for the $7,500 EV tax credit.

According to the White House statement, “The increase in the tariff rate on electric vehicles will protect these investments and jobs from unfairly priced Chinese imports.”

Later, Canada also followed the lead and increased the tariffs on Chinese EVs to 100%. China has filed an appeal to the WTO against the tariffs on EV and metal products imposed by China.

Chinese EV companies reported stellar deliveries in September

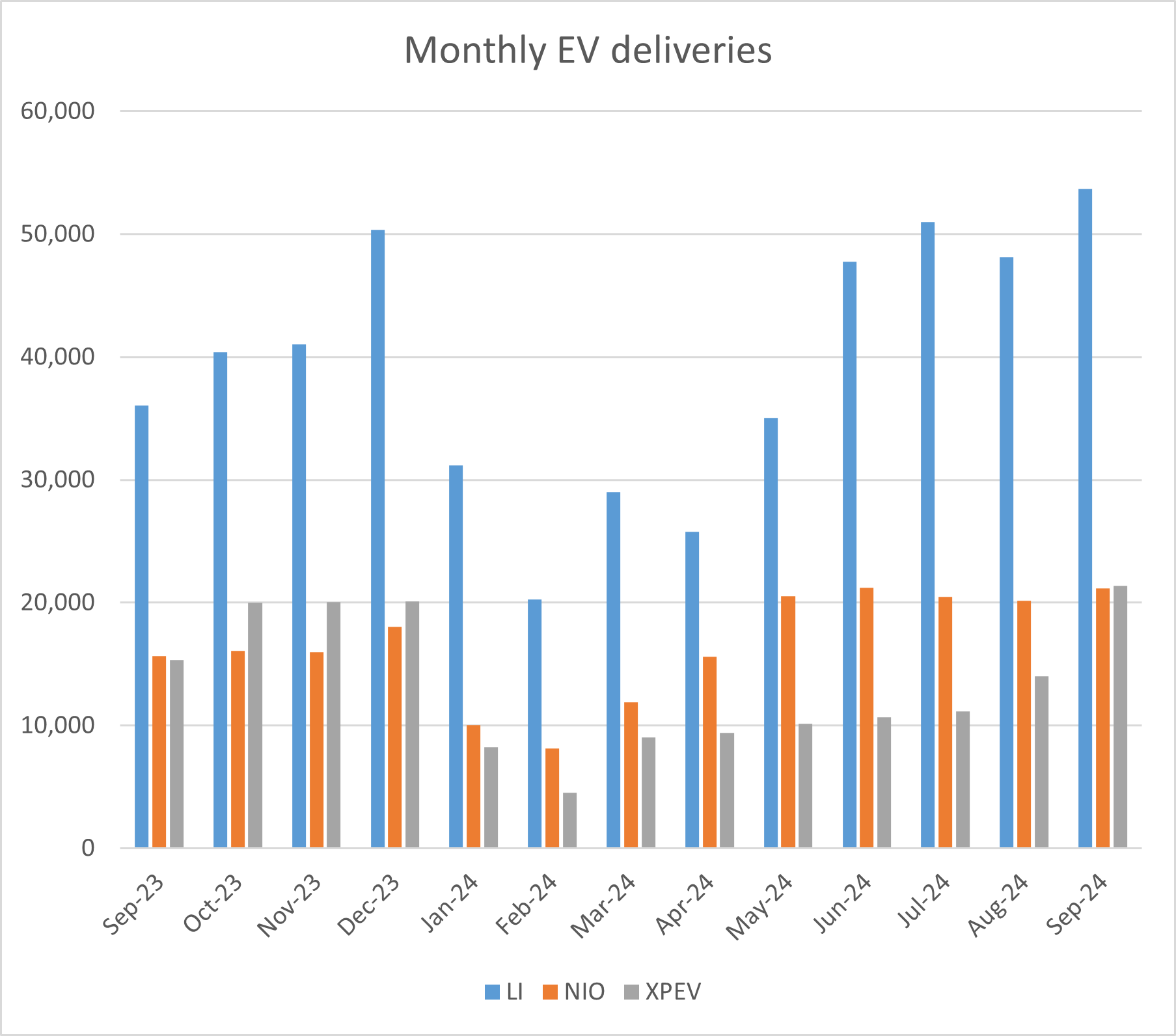

Meanwhile, away from the tariff noise, Chinese companies reported impressive EV deliveries in September. For instance, NIO delivered 21,181 vehicles in September which was 35.4% higher YoY. The company delivered 61,855 vehicles in the third quarter which was up 11.6% YoY and within the company’s guidance of 61,000 and 63,000.

Xpeng Motors, Li Auto, and Zeekr reported record deliveries in September. BYD, which sells both hybrids and EVs reported total deliveries of 419,426 in September which was not only a record high but the first time since the company’s monthly deliveries topped 400,000. As has been the case for the last many months, the growth was mostly led by sales of plug-in hybrids (PHEVs) whose deliveries soared to a new record high of 252,657. EV sales also rose 9.1% YoY to 164,956.

Chinese shares have surged over the last two weeks

Chinese shares have surged over the last two weeks amid optimism over the stimulus. The Chinese central bank lowered its 7-day reverse repurchase rate by 20 basis points to 1.5%. It also lowered the reserve requirement ratio for banks by 50 basis points which would make more funds available for lending.

The People’s Bank of China said that the reserve ratio cut will “create a good monetary and financial environment for China’s stable economic growth and high-quality development.” Governor Pan Gongsheng said that the PBOC would cut the RRR by between 25 basis points to 50 basis points by the end of 2024.

As China struggles to meet its 2024 GDP growth target of 5%, the country is looking at fiscal measures to revive the economy.

Chinese EV shares have also spiked as foreign investors piled up both the Hong Kong and mainland listed shares. That said, Chinese EV shares trade well below their all-time highs amid the overcapacity situation at home. With more countries imposing tariffs on Chinese electric cars, Chinese companies might need to consider manufacturing them overseas to evade the tariffs.

Question & Answers (0)