Air Liquide is a multinational French company that specialises in providing a wide range of gases such as oxygen, nitrogen, and hydrogen to multiple industries around the world. It has a presence in 80 countries and currently has nearly four million customers.

The COVID-19 pandemic seems to have created a window of opportunity for Air Liquide, as vaccine logistics remain challenging given that both the Pfizer (PFE) and Moderna’s (MRNA) vaccines require a storing temperature of -70°C and -20°C, respectively, which demands a cold supply chain – a specialised form of transportation that aims to maintain these temperatures without disruption at each step of the journey.

For Air Liquide, a firm that offers advanced freezing and chilling solutions to multiple industries, this challenge can be turned into an opportunity and may lead to a spike in this line of business, as different vaccines start to be rolled out around the world.

A closer look at Air Liquide’s fundamentals

Air Liquide earns most of its revenues from its Gas & Services segment – which includes gases for cold storing and other similar solutions. Although the firm is not a pure-play dry ice stock, that product is a part of its portfolio along with other more advanced solutions that could also see a demand uptick amid the need for storing and transporting millions of vaccine doses around the world.

By the end of the third quarter of 2020, Air Liquide sales ended at € 4.98 billion, down 8.7% compared to a year ago, although on an adjusted basis – leaving out the effect of fluctuations in forex exchanges and energy costs – sales remained nearly unchanged compared to the same period in 2019, dropping by just 0.9% by the end of this three-month period.

Interestingly, the Health Care segment saw an 8.4% surge in sales, as Air Liquide provides medical liquid oxygen – a vital element to support patients who have been severely affected by the virus – with revenues in the United States seeing the strongest growth amid a higher number of hospitalisations in America.

Given that the pandemic has persisted during the fourth quarter and with experts expecting an even worst outbreak during the winter in the US, the positive contribution of the Health Care segment to Air Liquide’s revenues – which currently accounts for 20% of its revenues – could be even higher than expected while the need for dry ice and other gases required to store the vaccine starts to surge.

Based on today’s closing price of €135.10 per share, Air Liquide shares are trading at roughly 28.5 times its earnings during 2019 while the firm’s long-term debt accounts for 30% of its assets only.

The technical and fundamental case for Air Liquide

Air Liquide shines among other dry ice stocks as the firm has a presence in the Americas, Europe, Asia-Pacific, and the Middle East, which gives it the exposure needed to meet the requirements of healthcare facilities around the world as their demand for cold-storing increases.

Meanwhile, as the pandemic situation subsides, most of the other segments of Air Liquide’s business should progressively recover to their pre-pandemic levels, while this new revenue stream should give the company’s sales a boost over the next few quarters.

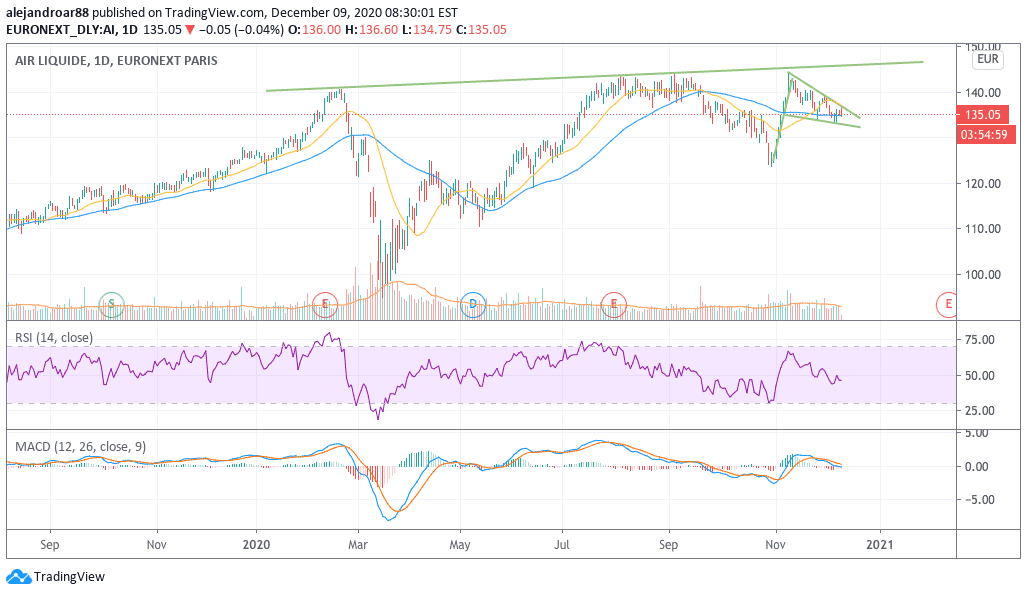

On the other hand, from a technical standpoint, Air Liquide shares seem to be in a falling wedge pattern that could also be interpreted as a bullish pennant (traditionally a continuation pattern) that may end up in a strong reversal if the price moves above the €136 level over the next few sessions. If that were to happen, bulls could possibly aim to resume the strong uptick seen from 29 October until 9 November.

The chart above shows how the stock has been consistently posting higher highs in the last nine months, although the price has reversed quite sharply after failing to climb above those levels.

Given the positive backdrop that this particular industry could be seeing over the next few months and the positive technical setup highlighted above, a reversal at this point could push the stock to the €145 level in short order – which represents a 7% upside based on today’s price.

Meanwhile, the trend line shown in the chart is tough resistance to overcome. However, if the price action manages to climb above it, a new wave of positive momentum could be unleashed given the business’ exposure to what could be a huge market in 2021.

Question & Answers (0)