DraftKings shares are bouncing today in early stock trading activity following yesterday’s sharp drop as supporters have stepped up to buy the dip after a report from a short-selling firm pointed to alleged black-market dealings from the sports betting platform.

According to a report from Reuters, Cathie Wood’s Ark Invest flagship fund has been one of the institutional players that have taken advantage of the sell-off to buy some 870,000 shares of the Boston-based betting operator at around $42.2 million.

At some point in yesterday’s session, the price of DraftKing (DKNG) had slipped as much as 12% at $44.65 per share but then settled higher at $48.5 to end the session only 4% lower. Meanwhile, the price of DKNG is opening the day with gains of 1.8% at $49.4 per share.

Yesterday’s trading volumes seen by DraftKings shares were the highest since the company went public, with a total of 88 million shares or so exchanging hands throughout the day – around 4 times the stock’s average daily trading volume.

The sell-off was prompted by a lengthy report released by the well-known short-seller Hindenburg Research that claimed alleged black-market dealings made by one of DraftKings subsidiaries – a Bulgaria-based company SBTech.

SBTech merged with DraftKings earlier this year as part of the firm’s SPAC-supported IPO. According to Hindenburg, SBTech is involved in “black-market gaming, money laundering, and organized crime”.

The firm cited statements from former employees and information contained in DraftKing’s SEC filings, while also mentioning the background of SBTech’s Chief Executive, Amir Vaknin, who allegedly ran a binary options scam called SpotOption. This company was accused by the SEC of defrauding millions from investors in the United States back in 2017.

In response to these allegations, a DraftKings spokesperson told FOX Business: “Our business combination with SBTech was completed in 2020. We conducted a thorough review of their business practices and we were comfortable with the findings”.

The company added that it will “not comment on speculation or allegations made by former SBTech employees”.

The rise of sports betting and DraftKing’s SPAC-backed deal

DraftKings (DKNG), a poster child of the SPAC era that went public in April 2020 in the midst of the global pandemic, has seen its shares rise by 156% since inception as sports betting in the United States is expected to explode on the back of the potential federal-level legalization of this activity.

Meanwhile, the company has been backed by multiple titans of the exchange-traded funds (ETF) industry including sector-specific funds such as the VanEck Vectors Gaming ETF (BJK) and the Roundhill Sports Betting & iGaming ETF (BETZ), both of which have 7% and 4.5% exposures to the stock respectively according to data from ETF.com.

Moreover, Cathie Wood’s ARK funds have also piled into the sports betting stock, as DKNG accounts for 0.95% of Ark’s Next Generation Internet ETF (ARKW) while it is also part of other funds managed by ARK including the ARK Fintech Innovation ETF (ARKF).

For now, the market seems to be ignoring the implications and accuracy of Hindenburg’s report on DKNG. However, as it has happened on other occasions, these reports may lead to investigations from regulatory agencies in case some of the claims presented by Hindenburg turn out to be true.

Notably, Hindenburg was one of the most prominent actors in the latest demise of the Nikola Corporation (NKLA), as a report from the short-seller highlighted multiple inconsistencies in the firm’s claims and promises that pointed to efforts to mislead investors during the tenure of its now-deposed Chief Executive, Trevor Milton.

Since their report came out, shares of Nikola have dived almost 29.5% even though the firm retains a market capitalization of $6.5 billion despite not having reported a dime in revenues in its history.

What’s next for DraftKings shares?

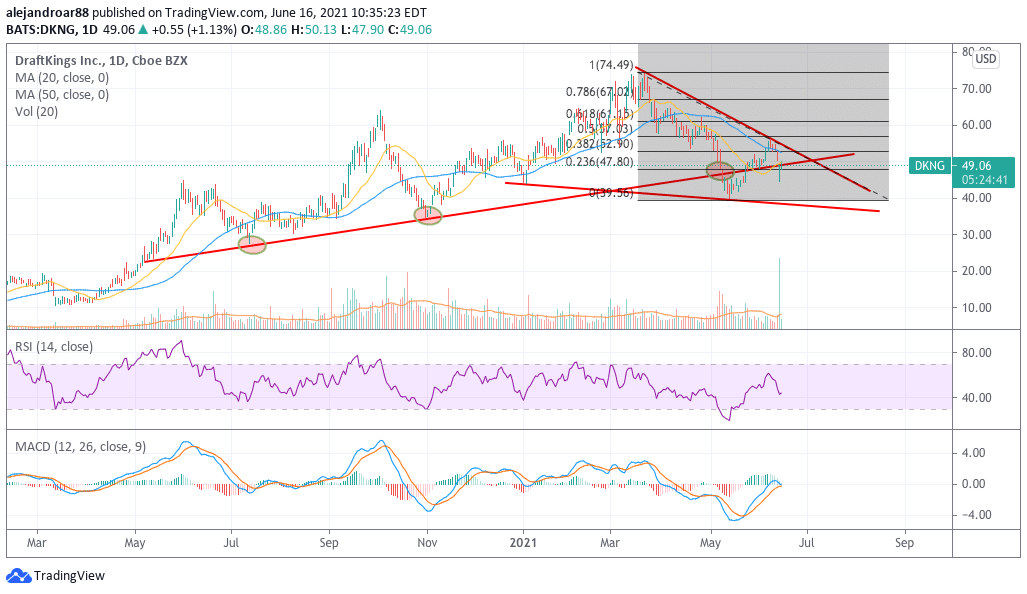

The outlook for DraftKings shares remains bearish as the price action has broken below a long-dated trend line support that seems to be acting as resistance during this morning’s mild bounce.

Momentum oscillators could support this bearish thesis if the MACD makes a turn and crosses below the signal line while the price of DKNG is still trading below its short-term moving averages – a situation that is commonly interpreted as a sign of short-term weakness in the price.

For now, if the stock continues to decline, a first target for a short-seller could be set at $40 for an 18.4% upside potential. This level coincides with both the stock’s trend line support and its latest 2021 lows.

Question & Answers (0)