US discount retailer Costco (COST) released its fiscal third-quarter 2021 earnings yesterday after the close of markets. However, the shares were trading lower despite the earnings beat.

It’s been a stellar earnings season for US retail companies. Best Buy, which also released its earnings yesterday also reported strong earnings which came in ahead of analysts’ estimates. Before Costco and Best Buy, Home Depot, Target, and Walmart also posted better than expected earnings.

However, markets’ response to Costco shares is lukewarm unlike some of the other retail names which had rallied after the earnings beat. Let’s drill into the earnings report to see why markets have a thumbs down to Costco shares despite the earnings beat.

Costco fiscal third-quarter earnings smashed estimates

Costco reported net sales of $44.38 billion in the quarter which were 21.7% higher than the corresponding period in 2020. Analysts were expecting the sales to rise less than 18% in the quarter and reach $43.8 billion.

Looking at the breakup, Costco’s comparable sales in the US increased 18.2% while the growth in international markets was 22.9%. Canada was the best segment for the discount retailer in the quarter and its sales in the region increased 32.3% year over year. Here it is worth noting that these are aggregate numbers and don’t take into account the currency movement and gas sales, which can be volatile depending on gasoline prices.

Gasoline prices were higher in the quarter

US gasoline prices were at elevated levels in the quarter amid the rise in crude oil prices. The ransomware attack on Colonial Pipelines also led to a spike in gasoline prices earlier this month but the event did not impact Costco’s earnings in the quarter as the attack occurred earlier this month only.

Costco’s online sales increased 41.2% in the quarter. The growth rates have come down from the previous quarters. In the first nine months of the fiscal year, Costco’s online sales have increased 65.1% before the currency impact.

Costco profits surge despite COVID-19 related costs

Costco reported a net income of $1.22 billion in the quarter which means an EPS of $2.75 in the quarter—a year-over-year increase of almost 45%. The fiscal third-quarter 2021 earnings were negatively impacted by a $57 million pre-tax costs related to the COVID-19 pandemic. Costco was paying a $2 per hour additional pay to frontline workers to compensate against the higher risks. In the third quarter of the fiscal year 2020, the company had incurred $283 million as COVID-19 related expenses.

Meanwhile, as a large part of the US population is already inoculated against the coronavirus and daily cases have fallen sharply from the highs, Costco has discontinued the premium wage. However, the company has announced a permanent wage hike for its US hourly workers.

Costco had a total of 109.8 cardholders at the end of the quarter as compared to 108.3 million in the previous quarter.

Inflationary pressures could impact gross margins

During the earnings call, Costco also talked about inflationary pressures from several quarters including higher wage costs, higher commodity prices, and higher transportation costs. In response to an analyst question on how the inflationary pressure could impact the company’s gross margins going forwards, CFO Richard Galanti said “we’ll have to wait and see.”

While he admitted that inflation has impacted the company’s gross margins slightly, he said that it is not a major impact so far. He commented, “while historically, we want to mitigate those increases and work with our vendors and try to be as efficient as possible to lower those pressure points, some of it will pass through, and some of it has passed through.”

Costco ended the quarter with over $10 billion as cash

Costco ended the quarter with over $10.2 billion as cash and cash equivalents which while healthy is lower than the $12.2 billion that the company held at the end of the corresponding period last year. The decline in cash is largely due to the $10 per share special dividend that the company announced in November.

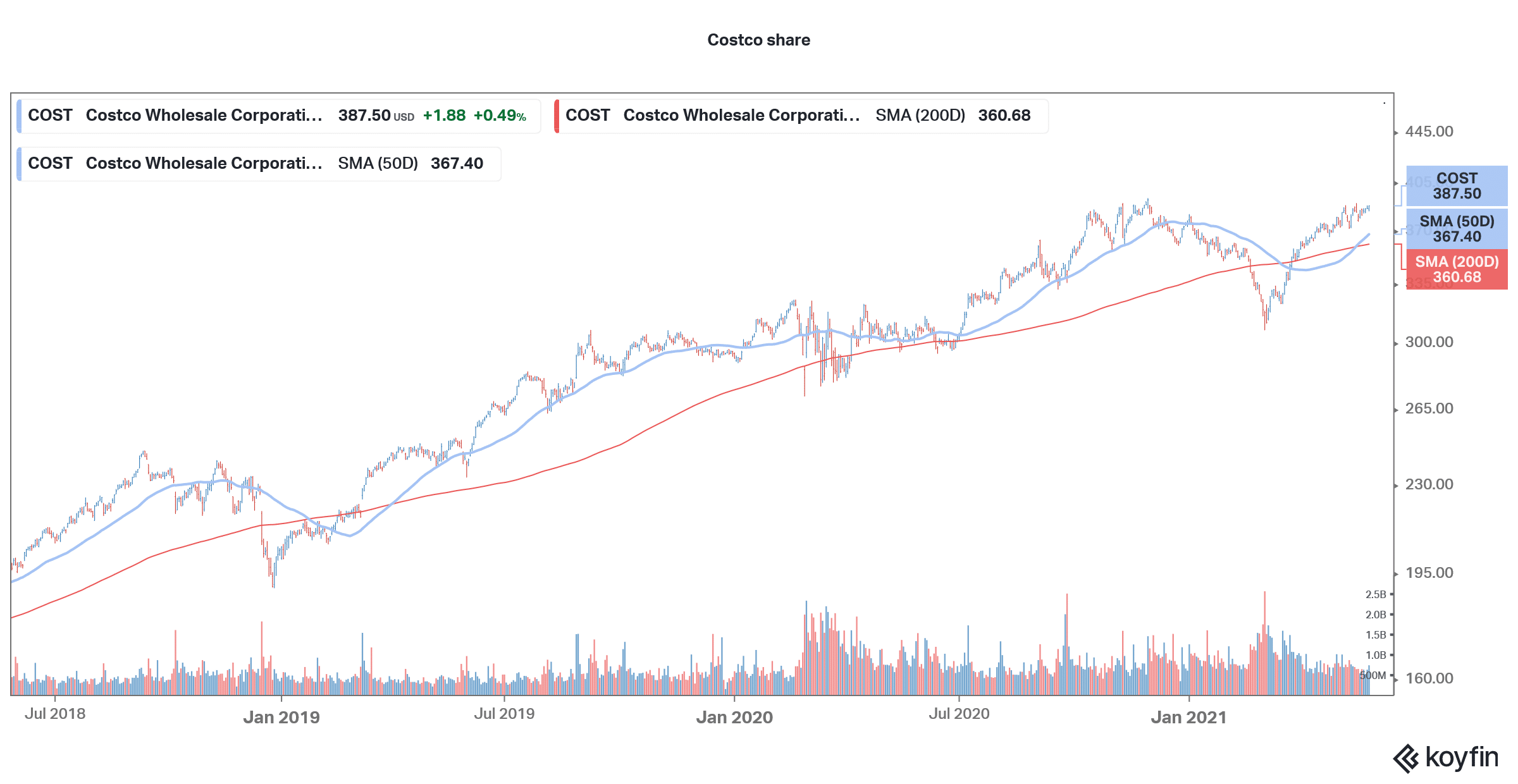

Costco shares have sagged in 2021

Costco shares have sagged in 2021 and are up only about 3% for the year while the S&P 500 is up in double digits. One of the reasons the shares did not raise despite stellar earnings is because they are anyways trading near their 52-week highs and a lot of positives seem to be baked in. Also, fears of a slowdown in US retail sales as consumers spend their money on other avenues as the economy reopens are also taking a toll on retail shares including Costco.

Analysts on Costco earnings

Meanwhile, Wall Street analysts seem impressed with Costco earnings and many of them raised their target prices. Cowen raised the discount retailer’s target price from $410 to $440. Last year, it had raised the stock’s target price from $370 to $410.

RBC, JPMorgan Chase and CFRA also raised their target price after the stellar earnings report. Morgan Stanley, which has a $410 target price on the stock in the base case and $520 in the bull case also seems impressed with the earnings.

“COST’s results have consistently been among the best in Retail. Over the past decade, COST has delivered ~6% comps and ~10% EBIT growth on average. It is rare to find a business with COST’s solid comp/membership growth, while relative e-commerce insulation differentiates its value proposition from other retailers,” said Morgan Stanley analyst Simeon Gutman.

Costco shares were trading 0.6% lower in US premarket price action today even as the stock futures point to a positive opening for the S&P 500.

Question & Answers (0)