The market capitalisation of Coinbase reached $86 billion at the end of the first day of trading, after the long-awaited listing of the cryptocurrency exchange attracted significant interest from both retail and institutional investors.

The price of Coinbase (COIN) was initially referenced at $250 per share by the Nasdaq stock exchange, but quickly jumped to $410 per share only five minutes after the stock hit the trading floor.

Five minutes later, the price had been propelled to a session high of $428.94 to then retreat sharply by 23.5% to close the session at $328.05 per share.

This results in a fully-diluted market capitalisation of $85.8 billion for Coinbase based on the stock’s closing price, making the company the most valuable US exchange with a valuation almost $12 billion higher than that of the CME Group (CME).

Coinbase’s direct listing marked a historic moment for crypto assets, as regulators continue to give their blessing to the introduction of crypto-related companies and instruments to traditional financial markets.

On the other hand, cryptocurrency advocates have been voicing their favouritism for investing in crypto assets directly rather than buying Coinbase as a way to get exposure to the growing environment of digital currencies.

In this regard, the Chief Executive of Coinbase, Brian Armstrong, supported the case for COIN during an interview with CNBC by likening the company to an index fund play on the cryptocurrency market, because the exchange enables traders to make transactions with over 170 different tokens.

Moreover, concerns have been brought up about the sustainability of Coinbase’s fee-based model as decentralised exchanges could threaten to take a portion of the market share, even though the firm headed by Armstrong currently holds at least 11% of the entire market capitalisation of cryptocurrencies based on its latest quarterly report.

Armstrong further stated during the interview that he does not expect to see fee compression in the mid-term for Coinbase, highlighting that there is a custodial component of the fee that is not necessarily too valuable from the perspective of traditional financial assets, but that does play a role when trading an investing in cryptocurrencies due to the virtual nature of their existence.

Meanwhile, the company has already been exploring and engaging in generating other sources of revenues aside from transaction fee revenues in order to diversify its streams. One of these efforts includes a campaign to keep attracting institutional investors as the exchange only had 7,000 institutional clients registered with the platform by the end of 2020 compared to 43 million retail customers according to Coinbase’s S1 SEC filing.

What’s next for Coinbase (COIN)?

Much of Coinbase’s performance at the moment is tied to that of Bitcoin (BTC), as the cryptocurrency remains the most traded asset and the most valuable cryptocurrency with a market capitalisation of over $1 trillion.

“A majority of our net revenue is derived from transactions in Bitcoin and Ethereum. If demand for these crypto assets declines and is not replaced by new crypto asset demand, our business, operating results, and financial condition could be adversely affected”, the company stated as part of its risk factors disclosures.

Meanwhile, Coinbase recognises that most of its revenue growth is pegged to the performance of the cryptocurrency market, as transaction fees would ultimately decline in an environment of plunging crypto prices.

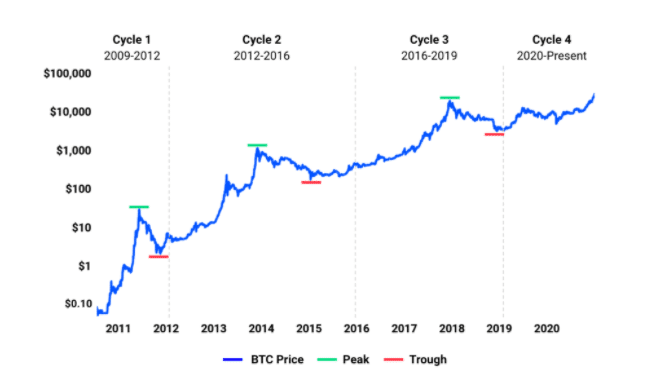

According to Coinbase’s estimates, the crypto market is currently in the middle of its latest four-year cycle. This cyclical perspective of the firm’s revenue and profitability should encourage investors to maintain a long-term perspective on Coinbase rather than viewing the stock as a short-term play.

In this regard, the chart above shows how crypto prices have seen higher highs during each of the previous three cycles, while this long-term uptrend is expected to continue as the adoption of digital currencies accelerates over the coming decades.

Question & Answers (0)