Cineworld shares are advancing for the third day in a row today after accumulating a 24% gain as traders eye a short-squeeze, as seen in the shares of rival company AMC Entertainment.

Shares of the European movie theatre operator are up an eye-popping 12% during today’s stock trading activity in London, following the approval of a controversial compensation package for the company’s Chief Executive Officer, Mooky Greidinger, and his brother –currently the firm’s deputy CEO – which received support from 69.25% of voting shareholders.

The scheme entitles each Greidinger brother – whose family trust holds a 20% in Cineworld – to a £32.5 million ($89 million) stock bonus if the price of the shares hit a 190p target, while they will also be entitled to receive a partial bonus of approximately £5.57 million each if the share price surges to 130p per share over the next three years – almost 60% above the current price of 81p per share.

The total compensation package approved for the company’s senior staff reportedly amounted to £208 million. It comes at a time when thousands of employees remain on furlough amid the strong downturn that the business has faced as a result of the pandemic.

The company acknowledged that there were a significant number of voting shareholders who opposed the measure, while it also faced a backlash from advisory group Glass Lewis and corporate governance advocacy group ISS, both of which voiced their concerns in regards to the size and actual necessity of such a large compensation given the current conditions of the company.

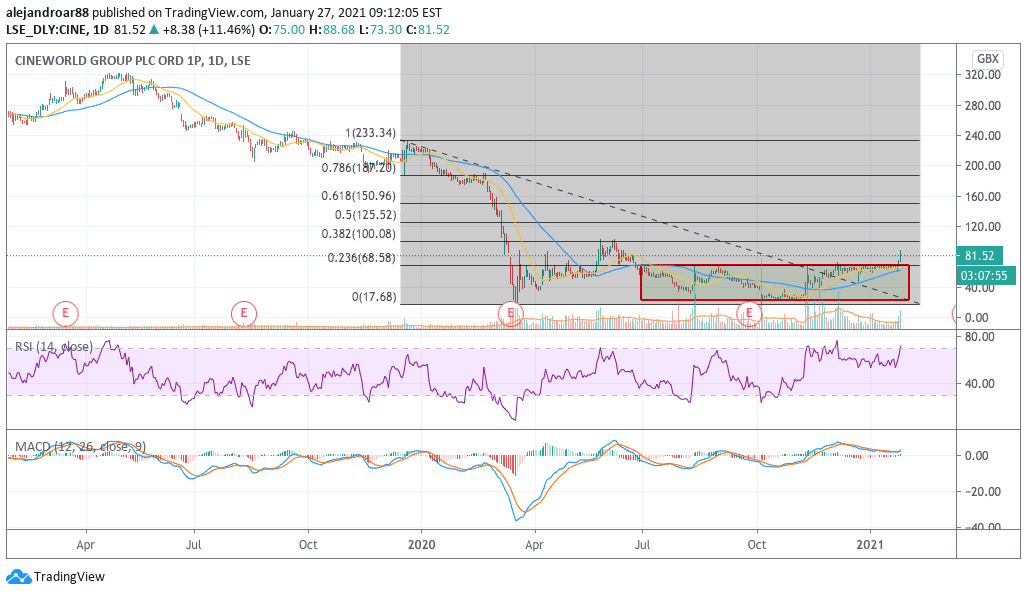

Meanwhile, a major short-squeeze led by retail investors could end up pushing the price of Cineworld shares to new highs, even though the firm’s financial situation is still remain severely affected by the pandemic.

In this regard, according to data provider London South East, the short interest for the stock currently stands at almost 9% of its float, with one prominent short position accounting for 2.84% of the firm’s floating shares held by New York-based investment fund New Holland Capital.

The fund, which reportedly oversees $20 billion in assets for its investors according to its official website, could be about to be squeezed from its short position in Cineworld – which appears to have been opened back in late November when the share price was near the 60p level – with the total exposure of the fund possibly amounting to £1 to £1.5 billion based on the size of their position and the stock’s free float.

Based on the stock’s latest upward push, the firm might have lost around 33% of the value of its short position already, while a progressive rollout of the short stake to close the position could further push the share price in the following days if supply dries up in response – a situation that would effectively cause a short-squeeze.

What’s next for Cineworld shares?

Although the short-squeeze thesis is far from being a certain scenario for Cineworld’s stock, this phenomenon is already being seen in other heavily shorted stocks, especially in the United States.

Recently, a coordinated effort from retail traders to squeeze large institutional investors out of their short positions has resulted in the near-collapse of one fund – Melvin Capital – which reportedly received a $3 billion cash injection from Citadel and Point 72 to shore up its finances after booking 100% loss on a short position the fund held in GameStop (GME) – one of the stocks targeted by the retail crowd.

If such a situation were to happen to Cineworld shares, the price of the stock could soar to new highs, as short sellers will need to quickly cover their positions by offloading roughly 60 to 90 million shares on the open market.

Question & Answers (0)