Shares of online pet retailer Chewy were trading sharply lower in US premarket price action today after its second-quarter earnings and forecast failed to please markets. Should you buy the dip in the shares?

Even before the earnings release, Chewy was having a dismal 2021. The shares are down almost 2% for the year while the S&P 500 is up over 20% for the year. While 2020 was a good year for growth names like Chewy, they have been out of favour with investors in 2021. While fears of a rate hike have been weighing heavy on growth names, a lot of them are also witnessing a slowdown in growth.

Zoom Video Communications earnings

Zoom Video Communications shares tumbled after the company released its fiscal second-quarter earnings. While the company managed to post better than expected earnings in the quarter, its guidance fell short. Nothing scares away investors in growth companies than signs of a growth slowdown. Talking of Chewy, its earnings also raised concerns about slowing growth. Also, unlike Zoom, its earnings also missed estimates that are further adding to the gloom.

Chewy second-quarter earnings

Chewy reported revenues of $2.16 billion in the second quarter. While the topline increased 26.7% as compared to the corresponding period last year, it fell short of the $2.2 billion that analysts polled by Refinitiv were expecting. It posted a loss per share of 4 cents which was also wider than the 2 cents that analysts were expecting.

“We have now crossed the halfway point of 2021, and our results once again demonstrate the strength of our business model and the incredible bond between pets and pet parents,” said Sumit Singh, Chewy CEO.

Meanwhile, while the company’s growth is higher than what it saw before the pandemic, it has slowed down considerably from last year’s highs. It said that its fiscal third quarter revenues would be between $2.20-$2.22 billion which was slightly below what analysts were expecting.

Key metrics from Chewy’s earnings

Chewy ended the quarter with 20.1 million customers which was 21% higher than what it had last year. It’s net sales per active customer increased to $404 in the quarter which was 14% higher than the corresponding period last year. Singh sounded bullish on the operating metrics.

Commenting on the operating performance he said “So what does that tell you? More customers. They’re spending more. They’re staying with us longer, and we continue to deliver very strong comps.” Sign added, “Overall, we’re very pleased with the performance of the business and the way that the teams are operating amidst this difficult environment.”

The company also posted positive free cash flows of $60.3 million in the quarter as compared to a cash burn of $56 million in the corresponding quarter last year. Favourable working capital helped it buoy cash flows and it ended the quarter with cash and cash equivalents of $725 million.

Chewy share price forecast

Meanwhile, Wall Street analysts have a mixed forecast for Chewy shares. Of the 20 analysts polled by MarketBeat, 13 have given it a buy rating while six rate it as a hold. One analyst has a sell rating. Its average target price of $100.67 implies an upside potential of 15.1% over the next 12 months.

Baird is bullish

In July, Baird analyst Justin Kleber had initiated coverage on Chewy with a buy rating and $105 target price. “CHWY is the online leader in an attractive, defensive growth sector, with favorable customer unit economics and a large sticky base of recurring revenue,” it said in its note. While the brokerage acknowledged concerns over the pace of new customer acquisition, it said “we believe embedded growth from existing cohort maturation is meaningful/ supportive of FY21 revenue upside.”

It added, “With a high-touch service model and proven customer acquisition strategy, we believe CHWY is well positioned for continued outsized share gains as incremental industry volume shifts online.”

Chewy valuation and technical analysis

With an NTM (next-12 months) EV (enterprise value)-to-sales multiple of 3.65x, Chewy shares still not look any cheap. While the multiples have come down from the peaks last year, they are still higher than what they have averaged since the company was listed.

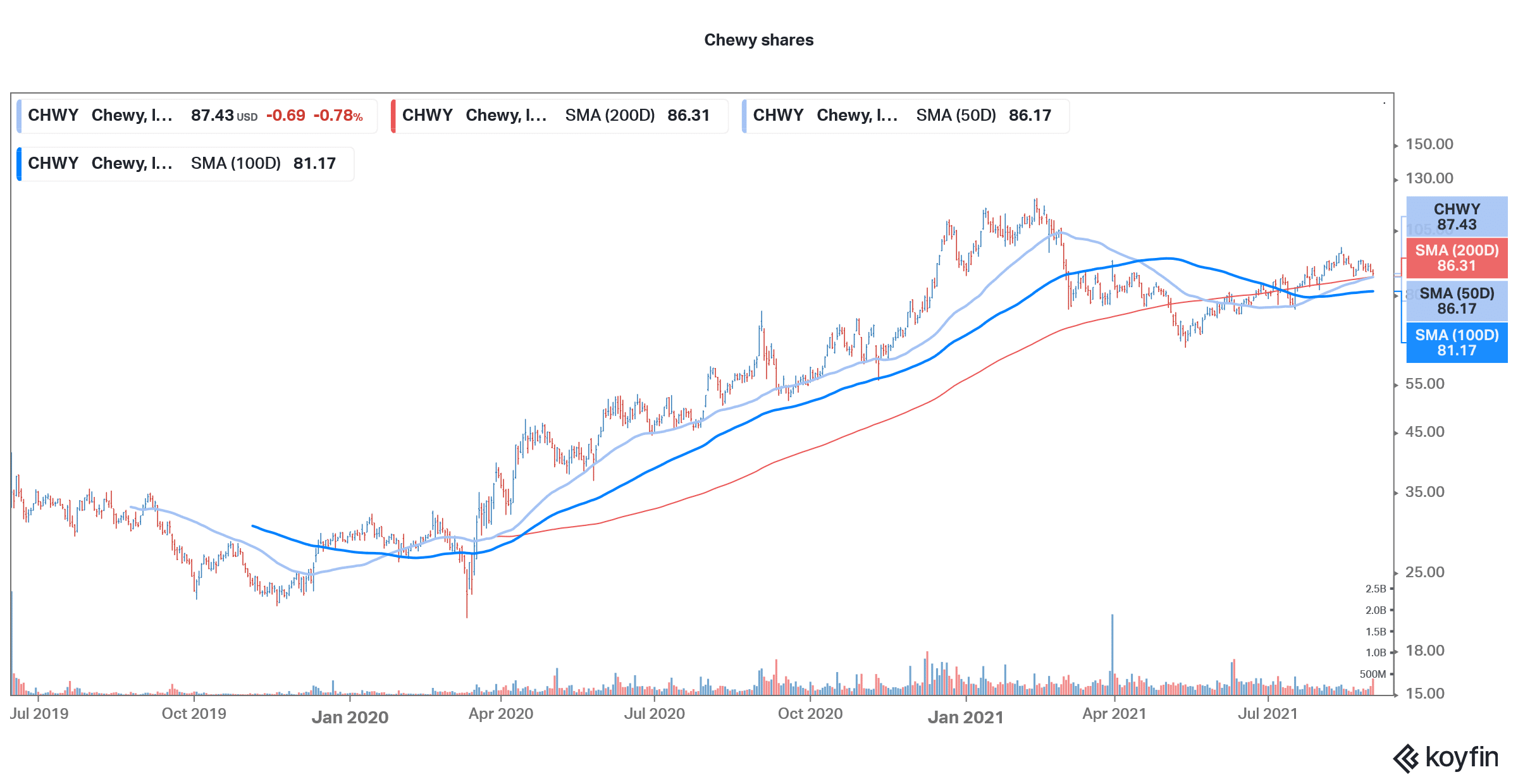

Looking at the technicals, while the stock trades above the 50-day, 100-day, and 200-day SMA (simple moving averages), it could fall below these levels in today’s price action. The 50-day SMA has been strong support for the shares but it looks set to be breached today looking at the premarket carnage.

The MACD (moving average convergence divergence) also gives a sell signal for Chewy while the 14-day RSI (relative strength index) is a neutral indicator.

While Chewy is still growing the growth has come down significantly. The fall in the shares today is an acknowledgement of the slowing growth. The valuation multiples still look a bit on the higher side, and it might be prudent to wait on the sidelines for some more time before buying the shares.

Chewy shares were trading almost 10% lower in US premarket trading at $78.75 and have a 52-week trading range of $51.25-$120.

Question & Answers (0)