Bunzl shares dived yesterday in mid-day stock trading activity in London after the company announced the acquisition of Canadian cleaning and hygiene distributor Snelling for a total of £28 million along with confirming the completion of a Brazilian deal.

The British multi-market distributor also announced in the same press release that it expects to see its revenues jump by approximately 9% by the end of its fiscal year amid higher sales in COVID-related products including hand sanitiser, gloves, masks, and other similar items.

Meanwhile, this latest acquisition from Bunzl comes to join a long list of other recent purchases including the completion of a deal to buy Brazilian personal protection equipment distributor SP Equipamentos in a deal valued at £22 million, accumulating a total of £410 million in similar investments made during the year.

Other recent acquisitions made by the firm include US-based Joshen Paper & Packaging, a company that distributes packaging and other similar goods across 11 states of America, along with Bodyguard Workwear, a UK-based safety workwear distributor, MCR Safety, Medcorp, and ICM.

All of these purchases have been made as part of the firm’s strategy of “focused acquisitions”, which aims to grow the Group’s revenues and profitability over the coming years by buying companies with a strong competitive position in their respective markets.

However, despite the recent good news, Bunzl shares dived yesterday, losing 4% at 2,385p by the end of the session as the markets struggled to digest these latest developments.

How have Bunzl shares performed so far this year?

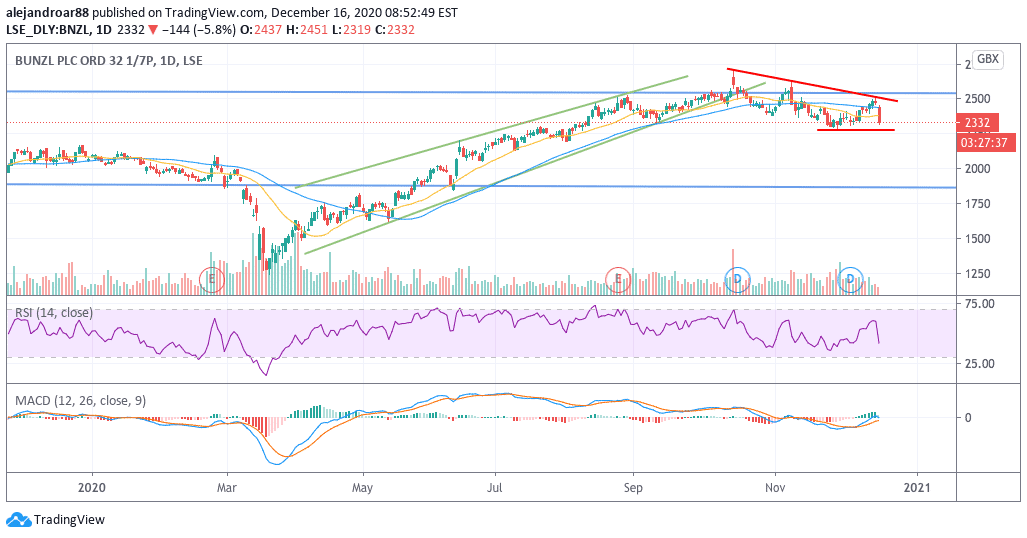

Bunzl shares have delivered a remarkable 22% gain since the year started, with the performance of the stock peaking at 26% in recent months while the price has taken a breather after a furious rebound off its March lows.

The stock’s performance has outpaced that of the FTSE 100 index during the period by nearly 35% as the company has benefitted from a spike in the demand for its hygiene and cleaning products, especially from the Continental Europe region, which has helped offset the slowdown seen in other categories.

Meanwhile, the company has resumed its acquisition activity after taking a brief pause in March to assess the impact of the pandemic, a situation that should help boost Bunzl’s revenues over the coming quarters as the recent deals are finalized.

What’s next for Bunzl shares?

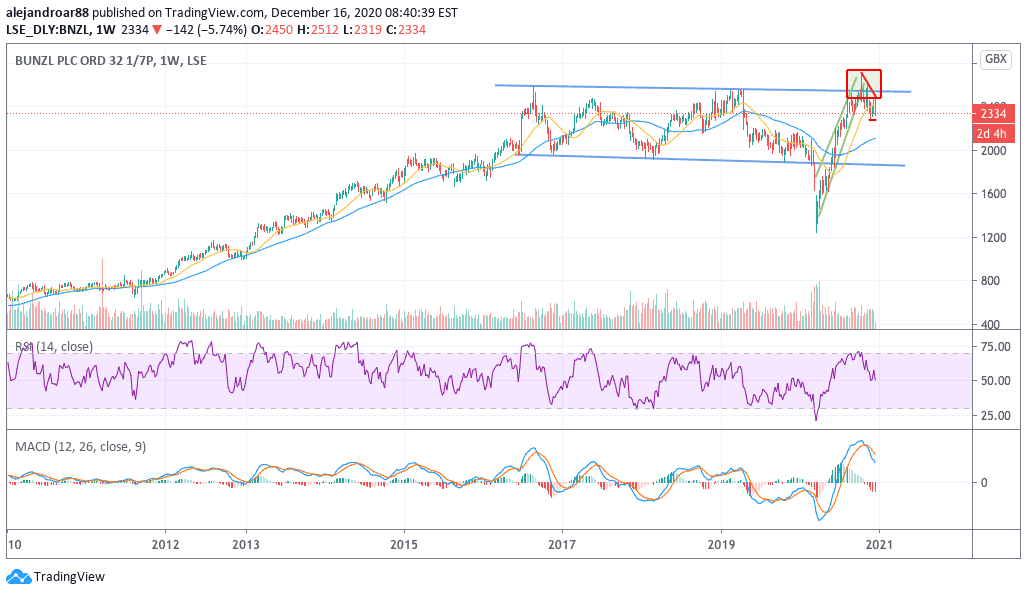

Bunzl shares appear to have topped on 14 October after a failed break above a long-dated consolidation pattern that ended up pushing the stock down to 2,333p today, losing almost 12% of its value amid the rejection.

This peak has been accompanied by a series of lower highs in November and December, while the decline has recently found support at the 2,300 level.

Yesterday’s downtick has pushed the stock near those late November lows, which could present an opportunity if the price action were to bounce off this support over the coming days. In this regard, the MACD has already sent a buy signal in early December while the oscillator has already moved to positive territory.

With that in mind, traders should keep an eye on how the price behaves around this 2,300 threshold as a pronounced bounce could result in a bullish double bottom formation that is usually accompanied by a big rally.

That said, the 2,500 – 2,600 level is a tough resistance to overcome, which means that the upside is somehow capped to around 11% unless bulls manage to break that barrier over the coming weeks.

Question & Answers (0)